Manitowoc Jumps on Earnings

Shares of The Manitowoc Company, Inc. (MTW), the Wisconsin-based manufacturer of cranes and food service equipment, jumped 5% Friday, closing at $18.48, after the company beat revenue and earnings estimates. Manitowoc has had quite a run since last summer, when it traded near $10 per share, as the chart below shows.

Investors who bought MTW in the $16-range last February suffered a 40% drop in the first half of the year, though.

Advantages of Being Hedged

An MTW investor who was hedged last February could have exited his position during or after the stock's 40% plunge, without suffering losses so large. That's one advantage of being hedged. Another advantage is that it can make it easier to hold a stock, when you know your downside is limited. A third advantage of hedging in the event of a significant drop in your underlying security is that, if you are still bullish on the stock, you have an appreciated asset (your hedge) which you can sell, and use the proceeds to buy more of your stock at a beaten-down price.

Hedging Manitowoc Now

Manitowoc isn't the cheapest stock to hedge now, but for investors considering adding downside protection, after its recent run-up. we'll look at two ways to hedge the stock against greater-than-20% drops from its current price over the next several months.

Why Consider Hedging Against A >20% Drop

A twenty percent decline threshold is worth considering here, because it lowers the cost of hedging somewhat (all things equal, the larger the potential loss you are looking to hedge against, the less expensive it is to hedge), and because a 20% decline is not necessarily an insurmountable one. To recover from a 20% loss, an investor would need a 25% rebound in his stock. But to recover from, say, a 35% drop, would require a rebound of nearly 54%.

Two Ways To Hedge MTW

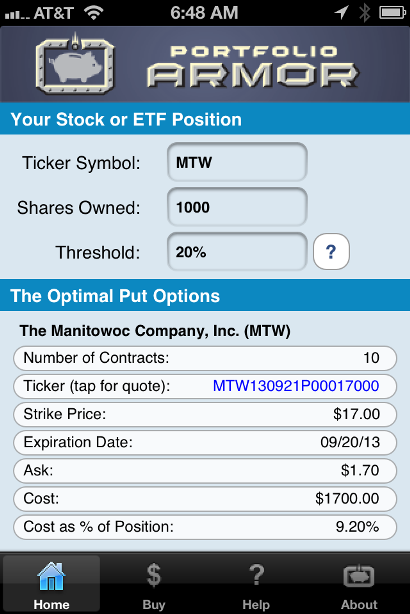

The first way uses optimal puts*; this way is quite expensive, in the case of MTW, but allows uncapped upside. These are the optimal puts, as of Friday's close, for an investor looking to hedge 1,000 shares of MTW against a greater-than-20% drop between now and June 21st:

As you can see in the screen capture above, the cost of those optimal puts, as a percentage of position, is 9.2%. By way of comparison, the current cost of hedging the SPDR S&P 500 ETF (SPY) against the same decline, over the same time frame, is 0.99% of position value.

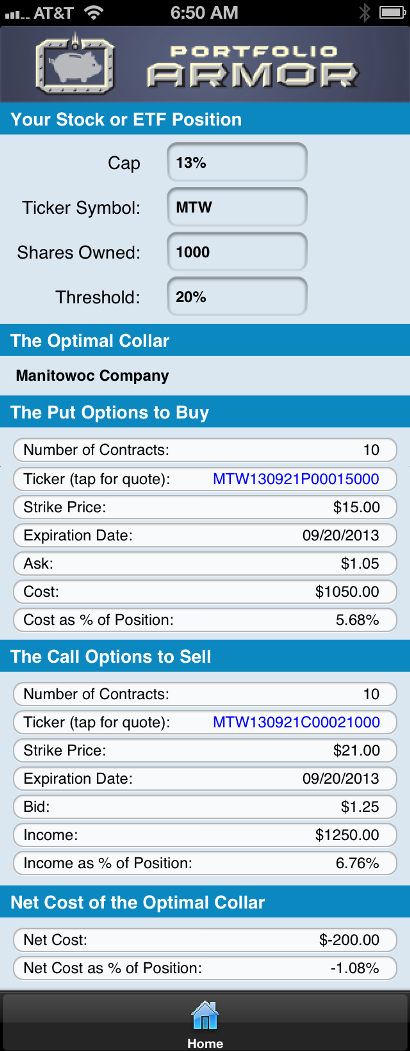

An MTW investor interested in hedging against the same, greater-than-20% decline between now and September 20th, but also willing to cap his potential upside at 13% over that time frame, could use the optimal collar** below to hedge instead.

As you can see at the bottom of the screen capture above, the net cost of this optimal collar is negative -- that means that the MTW investor would be getting paid to hedge in this case.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance Ph.D to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University, and is currently available on the web version of Portfolio Armor.

The screen captures above come from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app. Optimal collar capability will be available as an in-app subscription in the 2.0 version of the app.