A Bearish Take On Sarepta Therapeutics

In a recent Seeking Alpha article, George Rho laid out a bearish case for the Sarepta Therapeutics (SRPT). Those who have owned the stock since last summer are up several hundred percent now, and may want to hedge to lock in most of those gains. In this post, we'll show a way investors can do so.

Of Two Ways To Hedge, One Works Here

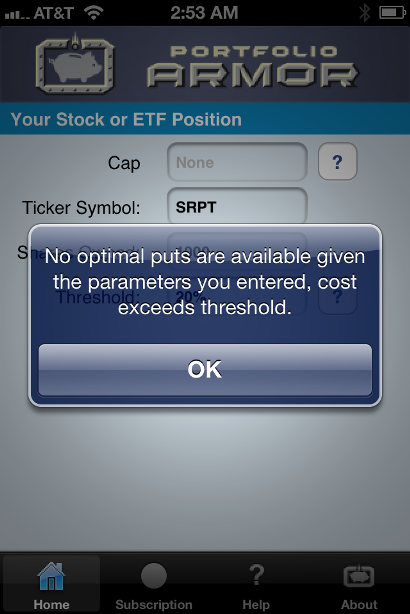

In recent posts, we've looked at two ways to hedge stocks: with optimal puts* and with optimal collars**. Optimal puts are generally more expensive, but allow uncapped upside. We often look at hedging against greater-than-20% drops for equities, because that's a decline threshold that's large enough that it reduces the cost of hedging, but not so large that it's an insurmountable decline to recover from (and, in some cases, e.g., with Affymetrix (OTC:AFFY) here, or with Cliffs Natural Resources (CLF) here, the optimal hedges against >20% drops can provide more protection than promised). In the case of SRPT on Friday, it was too expensive to hedge against a greater-than-20% drop over the next several months using optimal puts, as the screen capture from below explains.

On Friday, the cost of hedging SRPT against a greater-than-20% loss over the next several months was itself higher than 20% of your position value, so Portfolio Armor indicated there were no optimal puts available for it.

Hedging SRPT With An Optimal Collar

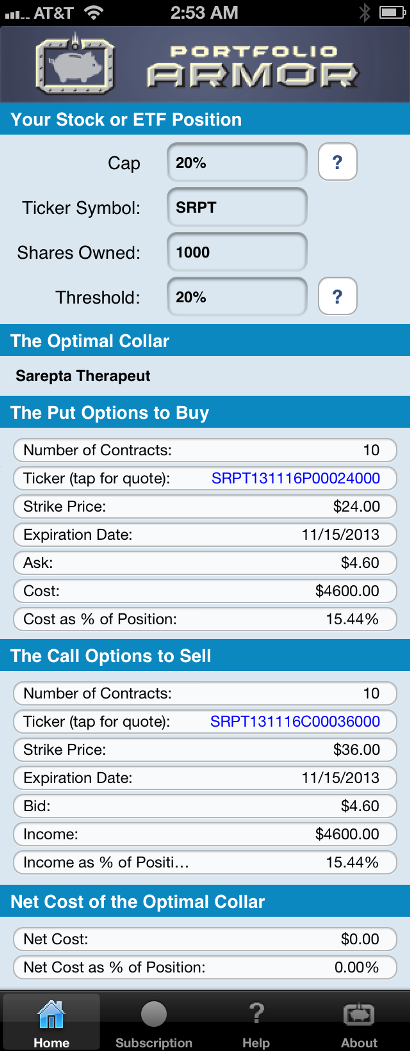

Although it was too expensive to hedge SRPT against a >20% drop over the next several months with optimal puts, it was not too expensive to hedge it against the same drop using an optimal collar, if you were willing to cap your potential upside by the same percentage over the same time frame. The screen capture below shows the optimal collar, as of Friday's close, to hedge 1000 shares of SRPT against a greater-than-20% drop by November 15th, with an upside cap of 20%.

As you can see at the bottom of the screen capture above, the net cost of this optimal collar was zero, meaning that this was a free hedge for an SRPT investor.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.