Shares of Pandora Media (P) dropped 5.67% after hours Thursday, on questions about the company's quarterly report, after trading close to their 52-week high during the day. Here is a way Pandora longs could have hedged there shares against a more significant decline during Thursday's session.

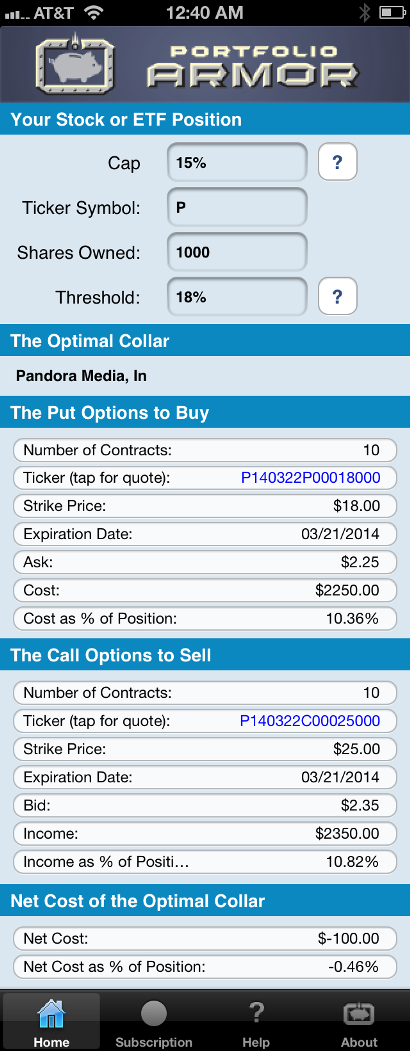

This was the optimal collar, as of Thursday's close, to hedge 1000 shares of P against a >18% drop over the next several months, for an investor willing to cap his potential upside at 15% over the same time frame:

As you can see at the bottom of the screen capture below, the net cost of this optimal collar was negative, meaning you would have gotten paid to hedge in this case.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the optimal collar above would likely have netted more than $100 to do so.

If you wanted to have more potential upside over the next several months, or less potential downside, you could scan for an optimal collar with those parameters, but you would most likely have to pay to hedge in that case.

*Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. Portfolio Armor's algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.