A 52-Week High For VeriSign

Shares of VeriSign, Inc. (VRSN) climbed to a 52-week high intraday Friday on the strength of a strong Q3 earnings report. For investors looking to lock in some of their gains and add some downside protection, here are two ways to hedge.

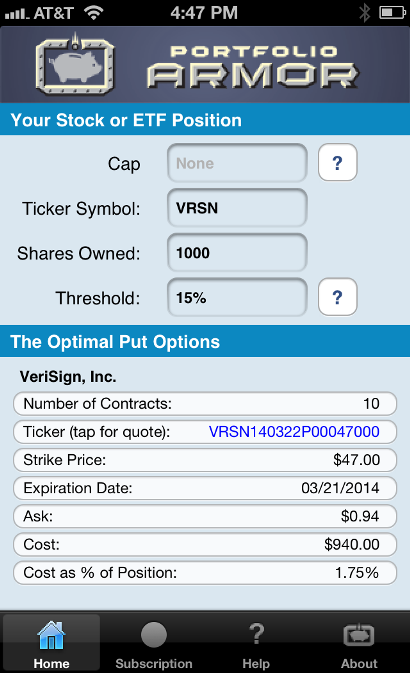

1) Hedging With Optimal Puts

1.75% cost. uncapped upside.

These were the optimal puts*, as of Friday's close, to hedge 1000 shares of VRSN against a greater-than-15% drop between now and March 21st.

As you can see at the bottom of the screen capture below, the cost of this protection, as a percentage of position value, was 1.75%.

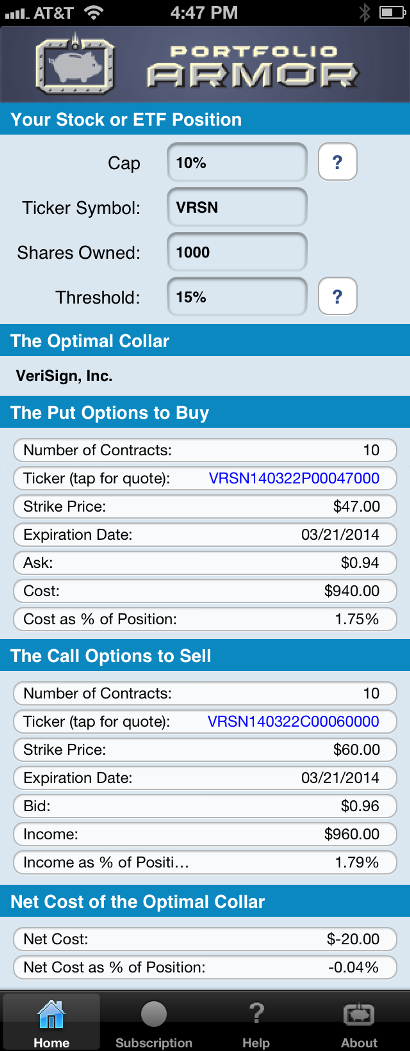

2) Hedging With An Optimal Collar

Pays you to hedge. 10% upside cap.

If you were willing to cap your potential upside at 10% between now and March 21st, this was the optimal collar** to hedge 1000 shares of VRSN against a greater-than-15% drop over the same time frame.

As you can see at the bottom of the screen capture above, the net cost of this collar was negative, meaning you would have gotten paid to hedge in this case.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the optimal collar above would likely have netted more than $20 to do so.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For a recent example of that, see this post about hedging shares of BlackBerry (BBRY).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.