Enzymotec Ltd. (ENZY), together with its subsidiaries, develops, manufactures, markets, and sells bio-functional lipid ingredients and final products in North America, Europe, Asia, Australia, New Zealand, and Israel. It has seen its stock sliding continually on the downward trend since the beginning of 2014. In its early days as a public traded company, ENZY had hovered around $16 - $20 per share, before riding on a rally all the way to $33. However, starting in March 2014, ENZY's stock encountered several price corrections, see the graph as follows.

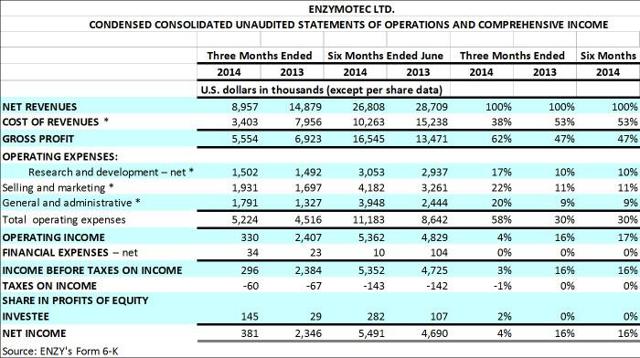

Today, after ENZY released its 2Q results in Form 6-K, its stock price saw another price correction, dropping from $14.98, as closing price on 08/04/2014, to $9.11, as closing price on 08/05/2014. The primary catalyst for this drop is due to weaker net revenue and the operational challenges experienced in the market, as pointed out by Dr. Ariel Katz, Enzymotec Ltd.'s President and CEO in the same Form 6-K. Company offered revenue breakdown based on its operating segments. Nutrition segments of ENZY has contributed only $10 million in net revenue for the three months ended June 30, 2014, as compared to $16.5 million in net revenue a year ago. This is roughly 40% off on the year-to-year basis.

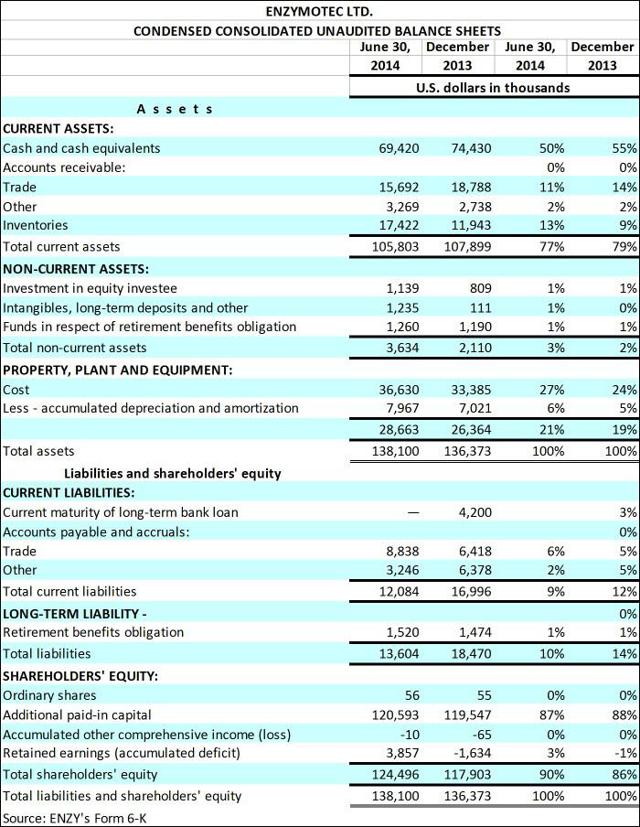

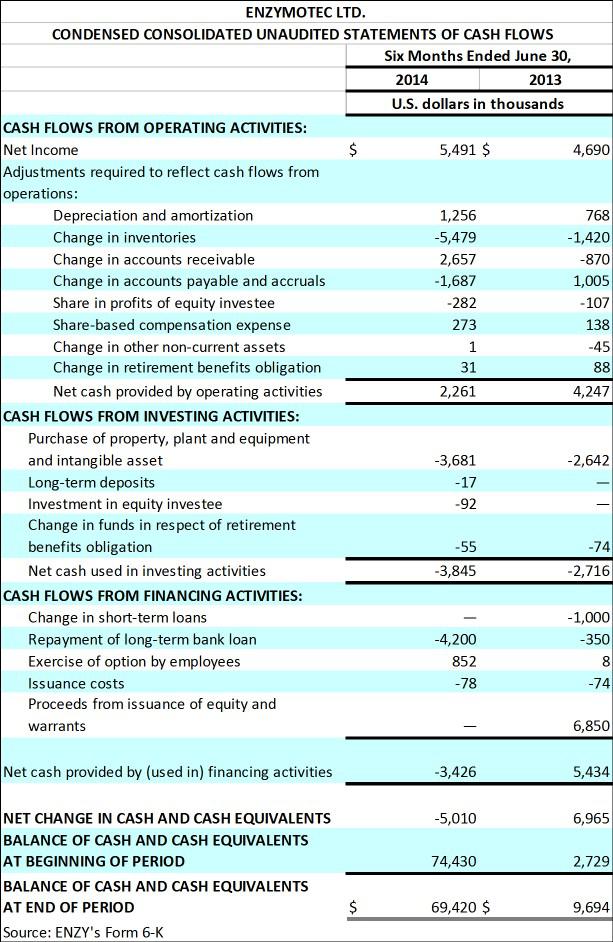

From ENZY's financial statement point of view, it had no major movements. ENZY's cash position, as of June 30th, 2014, was at $69 million, 50% of total assets of ENZY. No major intangible and goodwill assets recorded, coupled with low long-term debt liabilities at 10% of total assets. ENZY has good position in terms of cash and liquidity. On the inventory and manufacturing side, ENZY has put in more dollar in the six months ended June 30, 2014, as compared to the same period a year ago. Management of ENZY has emphasized in the latest Form 6-K that "Second quarter gross margin (equity method) increased over 1,500 basis points to 62.0% from 46.5%", however, would the 60% of gross profit margin continue as a trend throughout the rest of year, this remains an uncertainty, given that ENZY will probably under pressure to increase sales.

Nevertheless, given the stronger than expected headwind facing ENZY, there are still some institutional investors interested in this company. Galam, one of the principal shareholders before ENZY's IPO, probably still has 4.6 million shares on hand, after selling 1.6 million shares in March 2014 at $28 per share. XT Hi-Tech Investments (1992) Ltd. also, one of the principal shareholders before ENZY's IPO, might still have 1.8 million shares on hand, after selling 1 million in March 2014. If these two institutional investors didn't sell any more shares since March 2014, they account for roughly 30% of total outstanding shares. In the meantime, Visium Balanced Master Fund, Ltd had bought 1.1 million shares on March 10, 2014, according to this Schedule 13G. Paulson & Co. Inc. had also increased their stake from 1.7 million shares to 4.1 million shares on March 10, 2014, according to this Schedule 13G.

Bottom Line: ENZY has suffered more than one price correction since the beginning of 2014. Management of ENZY has given a cautious signal in its operating activities going forward, however, some institutional investors still very hold onto this stock. Investors should keep it on the watch list.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.