About:VNM Includes:OTCPK:VCVOF, OTC:VNMHF, OTC:VTMEF

Summary

- It seems that all the years ending with 6 are "transition years" for Vietnam , such as "Doimoi" in 1986 (decentralized planning economy), ASEAN membership in 1996 and WTO membership.

- On 23/05/2016, Mr. USA President Obama visited Vietnam. In the last 2 USA President's visits, Vnindex soared during 2 months before and after the event (31% in 2000, 49.9% in2006).

- The real story at present in Vietnam is the rapidly improving performance of the private sector, which can be defined as FDIs, domestic private firms and privatized SOE (State owned enterprise)

- Free trade agreement between Vietnam and EU (EVFTA) and the Trans-Pacific Partnership (TPP) make 2016 somehow look a lot like 2006 when Vietnam was about to join WTO.

- Valuation comparing with other regional stock markets makes Vietnam stock market worth a superior site for investment in Asia (both listed stocks and IPO).

A brief introduction

The first thing coming to people's mind about Vietnam is usually a twenty years' war that divided this country and somehow the world until 1975. Vietnam has more to offer than just a war memory or emerging travel destination.

So let's me briefly summarize about Vietnam and its economy. Located in the South East of the continent of Asia, Vietnam covers 310,070 square kilometers of land and 21,140 square kilometers of water, making it the 66th largest nation in the world with a total area of 331,210 square kilometers. Vietnam shares land border with China, Laos and Cambodia; and sea border with China, Taiwan, The Philippines, Malaysia, Indonesia, Thailand and Cambodia. Vietnam's GDP reached USD204 billion last year with a 10-year growth average of 5.7%.

The dynamic behind one of the fastest growing economy is the golden structure of a young and large population (94 million people and 60% under 30 years old). After "Doimoi" 1986 (30 years ago), Vietnam transformed from a centralized economy to a market-oriented economy and joined the lower middle income countries group.

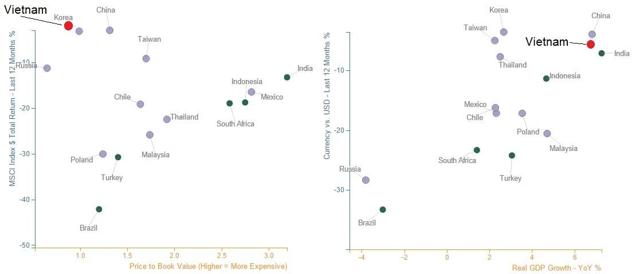

Graph 01: Vietnam Currency, Real GDP Growth, stock return, P/B VS Emerging countries (2015)

Source: BIDV Securities Company BSC

Enough about the big picture, let's take a look at Vietnam stock market which is classified as a frontier market by MSCI. The main Index - Vnindex (Hochiminh Stock Exchange) started from 100 points in 2000 and now stays around 600 points after 16 years. Among the youngest stock markets, the "mid teen" stock market of Vietnam has gone through many ups and downs. On 23/05/2016, Mr. USA President Obama visited Vietnam, putting the country under the spotlight of businessmen and investors. In the last two times USA President visited Vietnam, Vnindex soared during 2 months before and after the event by 31% in 2000 and 49.9% in 2006.

1. The first Wave of Privatization in Vietnam Stock market 2002 - 2006:

What I call the first Wave of Vietnam Stock market (2002 -2006) was the golden time when foreign investors visited and stayed for a few weeks just to open an account to invest in listed stocks and IPO in Vietnam.

VN-Index at Hochiminh Stock Exchange increased by 144% in 2006 while HNX-Index in Hanoi Stock Exchange rose by 152.4%. The total market capitalization was $13.8 billion in late 2006 (22.7% of GDP), in which foreign investors hold approximately USD4 billion, accounting for 16.4% of the capitalization of the entire market.

In 2007, Vietnam market boomed with a new Securities Law. In this period Vietnam stock market witnessed a strong growth in terms of size, volume. By the end of 2007, total stock market capitalization reached nearly VND500,000 billion, about 43.7% of GDP.

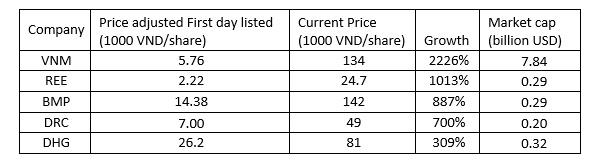

Up to 2007, the stock market helped Vietnam privatize around 3,274 state-owned companies. The first wave of Privatization created a number of popular companies for public and great stocks for investors. Some of those companies now were considered the gems of the country and one even gained as much as 2200%. Vietnam today could be so much under develop without the strong privatization wave of 2006.

Table 01: List of standout Vietnam stocks that transform from SOE

Source: HSX, HNX

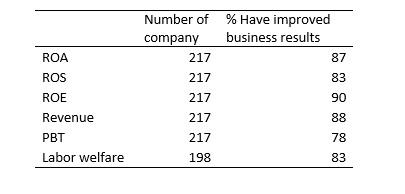

Researchers show that after be privatized, most Vietnam SOE had significant improvement in both business aspects (in terms of growth in sales, profit and ROA, ROE, ROS) and social aspects (job creation, labor welfare).

Table 02: How SOEs improve after privatization

Source: Dr Doan Ngoc Phuc's Doctor Thesis 2012

Vietnam stock market hasn't recovered from the global financial crisis of 2007. Comparing to the peak in 2007 (post-crisis), VN-Index now is about 50% discount while the size of the economy has been tripled from USD75 billion to USD204 billion. The fact that VN-Index still is lagging far behind all Asian market makes Vietnam such an attractive investment opportunity.

Graph 02: Vnindex and Asia main indices (2007 - 2016)

Source: Bloomberg

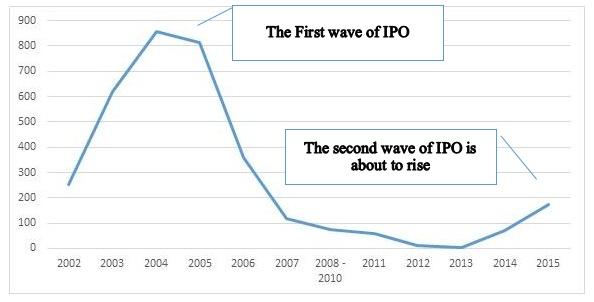

2. Ready for the second wave of privatization

It seems that all the years ending with 6 are "transition years" for Vietnam, such as "Doimoi" in 1986 (decentralized planning economy), ASEAN and AFTA membership in 1996, and WTO membership in 2006. This year 2016, Vietnam will have a new political term cabinet which is expected to make Vietnam more open to the western world, attracting both direct and indirect foreign investment. For foreign investors, it is about time to catch the second wave of IPO and divestment of Vietnamese SOEs.

On 23/05/2016, Mr. USA President Obama visited Vietnam, putting the country under the spotlight of businessmen and investors. In the last two times a USA President visited Vietnam, Vn-Index soared during 2 months before and after the event by respectively 31% in 2000 and 49.9% in 2006. I did not mean that Vietnam will have a super bull this year but surely investors should keep their eyes on Vietnam stock market. There are 3 main investment points:

Mr. Obama have "Buncha" for diner at a traditional shop in Hanoi

Source: Tuoitre online

Firstly, ready to the privatization of the rest of SOEs (The private sector and SOE reforms are the main story of Vietnam).

The real story at present in Vietnam is the rapidly improving performances of the private sector, including FDIs, domestic private firms and especially soon privatized SOEs. The Vietnamese government now realizes that they should reduce the number of SOEs to improve efficiency and to promote a market-oriented economy. In the past, the first wave of IPO has created great companies and equities for investors. This time is the last chance to catch the newly IPO and Divestment in Vietnam. Some popular names that investors have been waiting for:

- Telecommunication: Mobifone (the second biggest telecom company in Vietnam)

- Consumer products: Vinamilk, SJC (the biggest gold bar producer in Vietnam)

- Insurance: BaoMinh, VinaRe (the biggest reinsurance in Vietnam)

- Transportation: VietjetAir, Vinalines, Danang Port, Nhatrang port…

- Oil & Gas: Binhson, Pvoil, PV Power

- Construction and materials: Binh Minh, Tien Phong

- Real estate: Handico, Udic, Rescovn, Benthanh

Graph 03: Number of Company IPO in Vietnam

Source: HSX, HNX

Vietnam are so ready to push the privatization of the SOEs (which local authority called "equalization". Vietnam Government targeted to reduce the number of SOEs by 50% to 200 companies from 2016 to 2020. That is the reason why I think that investors should be in a hurry. Vietnam's Government has new policies to push the process which will be in favor of foreign investor's participation:

Lifting up the Foreign Ownership limitation. The Government issued Decree 60 on June 2016, which will increase the cap for foreign stake holding in a local company. Previously, foreign ownership ratio in listed companies is the same for all companies (49% for non-banks, and 30% for banks). Decree 60 now provides different foreign ownership ratio for each sector and subsector. For some sectors, foreign investors are allowed to own as much as 100% of the stocks.

State-owned enterprises IPO meaning listed stocks. Previously, IPO companies in Vietnam don't need to be listed in the stock market like in other countries. The Ministry of Finance's Circular 01/2015/TT-BTC issued on 5 January 2015 has laid down regulations for unlisted securities operating in the local stock market. State-owned enterprises (SOEs) must trade in the unlisted public-company market (UPCoM) within 90 days of an initial public offering before official listing (in Hochiminh Stock exchange or Hanoi Stock Exchange). This policy is expected to raise the market capitalization of Vietnam which is now only USD 60 billion, equivalent to 34% of GDP, by 17.3%yoy.

Secondly, Vietnam completed negotiations for two major Free trade agreements

The Free trade agreement Vietnam - EU (EVFTA) and the Trans-Pacific Partnership (TPP) are making the year of 2016 somehow looks a lot like 2006 when Vietnam was about to join WTO. The only difference is that this time the economy is much more ready for a global integration than it was 10 years ago.

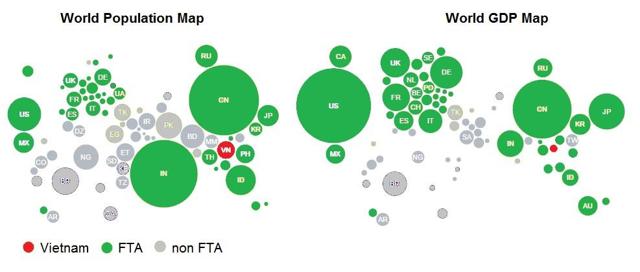

Up to now, Vietnam has signed 17 free trade agreements, which exposes Vietnam d to 62% of the world population and 80% of the world GDP. In the near future, these 17 FTAs will be promoting Vietnam's exportation. They have made significant impacts on medium and long-term growth on both politics and the economy of Vietnam.

- 62.2% of the world population 4.5/7.3 billion people

- 79.6% of the world GDP 61.3/77 thousand billion USD

Graph 04: Countries have FTA with Vietnam

Source: BIDV securities (NYSE:BSC)

Thirdly, valuation comparing with other regional stock markets

Most Asian stock markets excluding Vietnam have reached the previous high of 2007. That lagging makes Vietnam stock market worth a superior site for investment in Asia (both listed stock and IPO).

- Compared to the Southeast Asia (Emerging stock markets), Vietnam's stock market has always been valued at a discount in terms of P/B and P/E. With the EPS annual growth rate around 10%, the low P/E ratio makes Vietnam's market quite attractive.

- The economic growth was strong in the last 5 years. In 2015, Vietnam has become a bright spot when the gross domestic product (GDP) grew by 6.68%yoy and it is the only place in Asia where export grew significantly.

Graph 05: P/E ratio of Vnindex and Asian indices (2007 - 2016)

Source: Bloomberg

3.How to Invest in Vietnam's stock market

Here is how to get a ticket to catch the opportunities in Vietnam Stock market. I will briefly explain how investors can invest in Vietnam stock market, including (1) Listed stocks and (2) IPO.

Firstly how to invest in listed stocks

There are 3 ways for foreigners to invest in Vietnam's listed stock market via (1) ETFs, (2) Vietnam focus funds and (3) open a trading account at a local broker.

ETFs: There are only a few ETFs that have exposure to Vietnam. Two of the biggest are Market Vectors Vietnam ETF (NYSEARCA:VNM) listed in the US and the FTSE Vietnam listed in EU and Asia.

- Vaneck VNM - NAV: USD 338 million invest in 31 stocks

- FTSE Vietnam (FTSE) - NAV: USD 353 million invest in 21 stocks

Vietnam focus funds: There are few listed and unlisted funds which have large expose to Vietnam Stock markets. Good news is some of the close-end funds are trading with huge discount. Here are some of the names:

- Vietnam Holdings, Ltd (Grey Market: OTC:VNMHF): NAV USD 109.5 Million

- Vietnam Enterprise Investments Ltd. (Grey Market: OTC:VTMEF): NAV USD 850 Million

- VinaCapital Vietnam Opportunity Fund Ltd (LONDON:VOF:LN) NAV USD 743 Million

- PYN - Elite (Gray market ELITE:FH): NAV USD 215 Million

- Vietnam Emerging Equity Fund Limited (Grey market PXP) NAV USD 100 Million

Open a trading account: If you want to directly invest by yourself, there are 3 main steps to open an account for foreigners (to directly invest in listed stock market):

- Register for an Indirect Investment Capital Account (IICA) at State Bank of Vietnam (NYSEARCA:SBV). Your custodian bank can do that for you in one or two weeks.

- Apply for a Trading Code at Vietnam Securities Depository (VSD). Your custodian bank or a local broker house can do that for you in one or two weeks.

- Open a Trading Account at a local broker house. When the IICA and TCA are completed, you can instantly open trading account at local broker.

Secondly how to Bid IPO in Vietnam

It is quite a process to bid in Vietnam's IPO hence you will need your local broker's assistance. If you already have a trading account to invest in Vietnam, the process will be much simpler than starting a new one. Anyway, like people always say hidden gem is worth the digging. List of the ongoing IPOs and more information could be found in the website of Hochiminh Stock Exchange, Hanoi Stock Exchange or local stock broker's website. There are some steps to take:

Bidding Registration requires documents as below (in order):

- Bidding register form (with the confirmation of the Bank where investor opens account)

- Indirect investment account (at the state bank of Vietnam) : 01 original copy + 01 copy

- Business license (or equivalent documents): 01 notarized copy.

- Authorization form for authorized executing individual: 01 original copy

- ID or passport of authorized individual: 01 copy

- Deposit paper: 01 copy (Investor has to deposit 10% of value of amount they register to buy, calculated at starting price before the Deadline)

- Account Opening Confirmation of the Bank in Vietnam, where investor opens indirect investment account and will pay through: 01 original copy

Bidding Participation Form Submission:

- After submitting all the required documents, investor will receive the receipt to get Bidding Participation form. Complete and put the Bidding Participation form directly to the ballot box in the Auction Agency

- Or send the Bidding Participation form in the envelope that is sealed with the signature on the edge. Time for receiving is the time when the auction agency receives and signs with the post or the investor.

4. Conclusion

It seems that all the years ending with 6 are "transition years" for Vietnam , such as "Doimoi" in 1986 (decentralized planning economy), ASEAN and AFTA membership in 1996, and WTO membership in 2006. This year 2016, Vietnam will have their new term cabinet which is expected to make Vietnam more open to the western world, attracting foreign investment both direct and indirect.

On 23/05/2016, Mr. USA President Obama visited Vietnam, putting the country under the spotlight of businessmen and investors. In the last two times a USA President visited Vietnam, Vnindex soared during 2 months before and after the event by respectively 31% in 2000 and 49.9% in 2006.

Vietnam stock market has been in a lagging cycle since the 2008 financial crisis which makes it attractive for investors. This year, we expect that it will be the last chance to catch the second wave of IPO, divestment and privatization of big SOE in Vietnam. There will be more and more interesting SOEs going IPO and get listed soon. The stock market and investors will benefit from (1) Privatization (state divestment and IPOs), (2) Lifting up the Foreign ownership limitation and (3) low valuation ratio compared to Asian countries.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: Mr Long Tran Thang proud to work for BIDV Securities Company Vietnam (BSC) as Head of Research and before that as Deputy head of Investment and analyst since 2007. BIDV Securities Company (BSC) is one of the first securities firms in Vietnam. Being a subsidiary of BIDV - the largest commercial Banks in Vietnam, BSC inherit both the 55 years of experience in investment, banking, finance and the nation-wide network of enterprises. Mr Long Tran Thang earned an MBA from Solvay Brussels School (ULB) in 2014. Mr Long graduated with BA in Economics from the ANU Australian National University (ANU) and BA in Finance from The National Economics University (NEU).