Introduction

Shree Cement is a cement and electricity producer based in India. It trades on the BSE (Bombay Stock Exchange) under the ticker 500387. This write-up lists firm-specific operational advantages as well as challenges in its competitive landscape, and makes the case that an investment in the company looks attractive at current prices.

Superior Margins

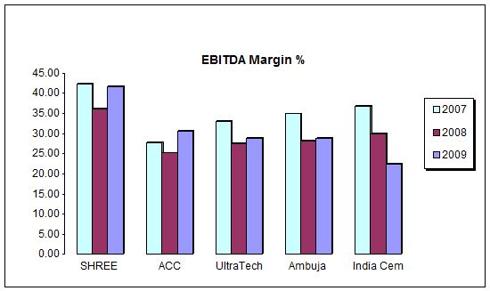

The company has a history of being among the more operationally efficient cement producers in India. For one, it is self-reliant in its electricity consumption needs, and exports surplus electricity to the national grid. Proximity to the National Capital Territory of Delhi region and its neighboring high-population states helped keep freight charges under control, a significant factor given that freight was the top cost driver in the past year, a metric that holds true for many cement companies. In addition, the firm also had the lowest raw materials cost as a percentage of revenues among its competitors over the past three years. These factors result in the firm obtaining the highest EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) margins by far among India's leading cement producers, as indicated in the graphic below.

Emerging Power Player

One of the reasons for Shree Cement's superior operating margins is its reliance on 100% captive generation of electricity. The company has been exporting about 50 megawatts of surplus power until now, but has much larger plans for the coming months; In March 2010, the company significantly boosted its power generation capacity with the commissioning of two plants producing a combined 96 megawatts, the entire capacity earmarked solely for sale to the national grid. This brings the total electricity surplus currently available for export to about 150 megawatts.

At the now prevailing price of Rs. 6.5 per Kilo-Watt-Hour for merchant power, a quick back-of-the-envelope calculation for 150 megawatts implies an annual revenue number of Rs. 8 billion, a full 25% of cement revenues going forward. An additional capacity of 300 MW, scheduled to come on-line around September 2011, should take power revenues to about 75% of cement revenues. The contribution to the bottom line could be higher, as the operating margin of the power segment is a good 4-5 percentage points above that of the cement business. With the acute power shortage that India is witnessing at the moment, the demand for electricity should be robust for at least 7-8 years into the foreseeable future, and margins will likely remain high.

Risks

Risks

1. The Indian cement industry is likely to see 70 million tonnes of additional capacity coming into effect in 2010, representing a 30% rise in installed capacity. Despite robust GDP growth, the current supply scenario could lead to pricing pressures that may last into mid-2011. As a result, a 20% drop in revenue over the next twelve months looks very likely at this point. On the plus side, valuations of certain mid-cap cement manufacturers seem to be trading at lower multiples than their historic levels, so revenue declines in 2010 may have been priced in to some extent.

2. The Indian government has, in the past, resorted to imposing price ceilings on cement companies in a bid to fight inflation, and the party currently in power is especially wont to giving in to such populist measures. While this may not be an issue in the near-run with inflation in the cement space unlikely to rise, said government policies remain a long-term concern.

Valuation and Conclusion

At a closing price of Rs. 2011.10 per share on June 2, 2010, the stock trades at a trailing 12-month Price/Earnings ratio of 10.4, and a Price/Operating cash flow ratio of 5.5, making the shares attractively priced. Ultimately, it is management's oft-stated commitment to remain the most efficient cement producer in India that makes the firm viable over the long run. A foray into the electricity business over the next year should mitigate any revenue declines from the cement arena, and is a timely move given India's perennial electricity shortage. In conclusion, this company looks well set to ride the wave of rapid infrastructure growth that India is likely to witness over the coming decade.

Disclosure: The author owns shares of Shree Cement.