SENTIMENT WEIGHS ON MARKETS

Carlos Guillen

While this morning's employment results were able to move markets higher, University of Michigan Sentiment results took away some of enthusiasm that had built up.

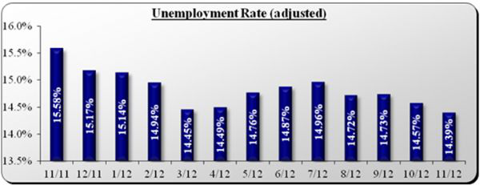

Clearly, the better than expected unemployment result was well received. Yes, the unemployment rate declined to 7.7% from 7.9%, but the jobs market shed a good chunk of people, which led to a lower unemployment rate. And if we include "part time for economic reasons" of 8.2 million and the "marginally attached to the labor force" of 2.5 million to the unemployed number, we calculate an unemployment rate of 14.4%, so it is still indisputable that the unemployment rate is still painfully high

Aside from a better than expected unemployment rate and non-farm employment result, compensation also improved a bit. In November, average hourly earnings for all employees on private non-farm payrolls ticked up by four cents to $24.63. However, over the past 12 months, average hourly earnings have risen by 1.6%, the smallest gain since May of last year.

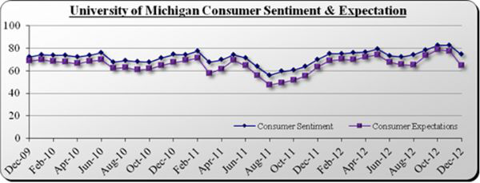

Taking away some of the enthusiasm brought by the government jobs numbers today was that consumer sentiment landed worse than expected. The University of Michigan Consumer Sentiment December preliminary result landed at 74.5, which was much lower than the Street's expectation of 82.4. Moreover, the result significantly declined from the 82.7 level reached in November and represented the lowest reading since August of this year. Consumers are still increasingly worried about the upcoming fiscal cliff dilemma, which is the main reason for the decline in sentiment.

Quite surprisingly, more consumers are finding their current financial positions to be improving, but then again, a bit more than half of consumers still see their finances declining. For perspective, a year ago, close to two-thirds reported worsening financial positions.

Also disappointing was that consumers' outlook for employment, the economy, and their personal finances declined. The expectations index decreased to 64.6 from 77.6, landing at the lowest level since December of last year. At the moment, a positive direction of confidence will be dependent on the promise of no higher taxes, except on the wealthy.

Overall, investors' enthusiasm after the employment data has faded somewhat as the reality still stands that the employment backdrop is not likely to significantly improve into 2013. While consumers have held their heads up high in face of adversity, we believe their confidence will continue taking a hit in the coming months as the employment backdrop continues to drag. This will surely have a negative impact on consumer spending and consequently on gross domestic product growth in the near term.