Carlos Guillen

Stocks are having an overall up day ... barely, but this comes after a rather erratic start to the trading session, which had the Dow Jones Industrial Average down over 50 points. Perhaps part of the volatility was fueled by rather mixed same-store-sales from some major retailers, coupled with jobs data that was also mixed.

Now that the holiday shopping season is over, retailers are coming out with their sales results for December, and the numbers left many desiring for more. Among the gainers were Ross Stores releasing same store sales of 6.0 percent; Steinmart, with same-store-sales coming in at 5.9 percent, well above the anticipated 2.8 percent; The Gap same store-sales-came in at 5.0 percent, above the projected 3.6 percent; and Macy's reported same-store-sales at 4.1 percent, beating the projected 3.7 percent.

Among the losers were Fred's, which reported its December same-store-sales at -4.2 percent; Barnes & Noble's same-store-sales came in at -8.2 percent; and Target had flat sales, below the expected 1.3 percent. Overall, however, it is apparent that investors were encouraged with the results as indicated by the Spyder retail EFT XRT, trading up over 1 percent.

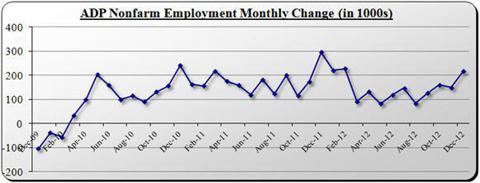

Quite encouraging this morning was the ADP report, which showed more than expected private jobs added to the economy and gave hope for a stronger than expected result this Friday when the government's numbers are delivered. According to ADP, 225,000 private sector jobs were gained during December, above the Street's consensus estimate calling for a gain of 140,000 jobs and significantly above the 148,000 added jobs in the prior month, which itself was revised higher from 118,000. The data showed that payroll gains were predominantly driven by medium sized businesses, which added 102,000 jobs. Small and large business payrolls increased by 25,000 and 87,000, respectively. As usual, most of the added jobs came from the services sector, which ADP said added 187,000 jobs, while the goods-producing sector experienced a gain of 28,000 positions. Also a bit encouraging was that December represented the 34th consecutive month in which jobs were added to the economy, and for the year, the average monthly employment gain was 145,000. At the moment, economists are predicting for this Friday that private sector businesses will have added 165,000 jobs in December, and that the unemployment rate will likely remain flat at 7.7 percent.

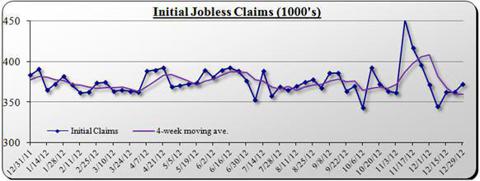

On the other hand, initial claims data for the week continued to tick higher, worse than expected. According to the Department of Labor, initial claims during the week ended December 29 totaled 372,000, increasing from the 362,000 revised figure reported for the prior week and landing above the Street's estimate of 365,000. While the initial claims' four-week moving average had been trending lower, it now ticked higher as well to 360,000, from the prior week's average of 359,750.

Despite the mixed results, the Dow continues to hold on to its slight gains for the session, but tomorrow's jobs data will make or break this rather flat trend.

For Housing Health, the Magic Number is 7

David Urani

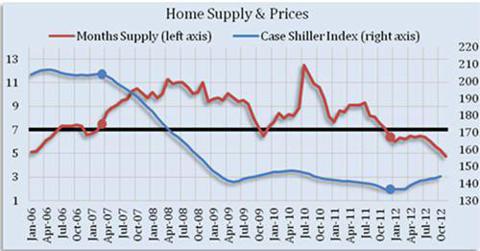

So you're wondering if housing is going to continue its impressive rebound in 2013, after that housing stock you picked up had a huge 2012, right? Certainly the uptrend in sales looks to have continued through the end of the year and the outlook remains strong, but who knows what surprises 2013 will bring upon us. The market surely won't improve in a straight line, so at what point does a normal bump in the road become a reason to worry? For investors looking at the health of the housing market this year, a quick look at supply is a good test with regards to whether you should hang in there or if you should get ready to bail.

It's all about supply and demand, and for me the magic number is 7, as in 7-months supply of existing homes (based on National Association of Realtors' data that divides outstanding inventory by that month's sales tally). I'm sure I don't have to tell you that it was a glut of foreclosures that sent home prices plunging in 2007 and 2008, and as I've pointed out in the chart below, it was when supply broke past 7 months in mid-2006 and early-2007 that prices (based on the Case-Shiller index) topped out and eventually broke south.

Things got a little funky in 2009 and 2010 when the Federal government offered tax credits for homebuyers, artificially spurring demand and prices. In a way I tend to overlook that period as being "unnatural." Yet even so, the resulting influx of sales was enough to briefly drag supply back below that 7 month level.

After the tax credits expired in mid-2010, prices were free to continue their downtrend naturally through 2011, hitting new lows for the cycle. In December 2011, the month's supply of existing homes dropped to 6.4 from 7.1 which led to the inflection point in prices the following month.

It's not an exact science but if 2013 doesn't quite pan out like you wanted it to this may be your quick, handy litmus test. Heaven forbid, if demand were to suddenly hit a rough patch or banks were to suddenly unload hidden stashes of shadow inventory I would start to get worried around a 6-month supply, and would think about heading for the hills at 7-months. Until then, there's a good chance your housing investment is still on track.