By Carlos Guillen

After experiencing significant volatility last week, which was provoked by a rather negative interpretation of what the Fed said on Wednesday about tapering bond purchases and by China's worse than expected PMI data on the following day, this week is off to a negative start as investors are now becoming more convinced that China will take a hard stance on not providing additional liquidity to its financial system, having repercussions everywhere.

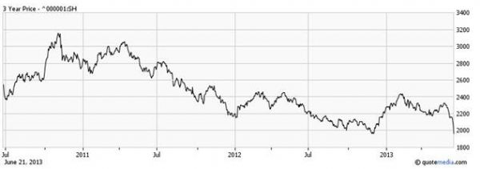

As it stands, U.S. markets are taking a small hit during today's trading session, and the fact that there is no hard economic data for investors to sink their teeth into is not helping either, with the Dow Jones Industrial Average losing over 200 points and experiencing lots of ups and down. Investors are becoming increasingly concerned about China's declining rate of economic growth, but even more worried about the fact that the nation's central bank is no longer willing to stimulate growth by providing more forms of quantitative easing. China's central bank said there is a reasonable amount of liquidity in their financial system and urged banks to control risks from credit expansion, signaling no relief from a current liquidity crunch. Chinese investors were so spooked by the government's reluctance to act that it caused the Shanghai Composite Index to plunge 5.3 percent to 1,963.24, its first close below 2,000 since December and worst percentage drop since a 6.7 percent fall in August 2009.

The recent actions that have been telegraphed by the Central Bank of China have also compelled Goldman Sachs to downgrade its GDP growth forecasts for China. Goldman now sees GDP in china growing at 7.4 and 7.7 percent in 2013 and 2014, respectively, versus its prior expectation of 7.8 and 8.4 percent. Clearly, investors around the world are concerned that in an effort control asset bubbles, China will also inadvertently throw a wrench into the gears of growth of other major economies.

In all, stock markets around the world are having a down day, with the German DAX falling 1.13 percent, the French CAC-40 losing 1.77 percent, and the British FTSE dropping 1.91 percent. As the trading session progresses here at home, indexes continue to oscillate and are now on an upswing again, but we do not expect this to last.

PBoC Gives Tough Love

By David Urani

As we saw last week, there was worry in the Chinese markets, where the overnight lending rate spiked to a record high of 13% on Thursday. That started rumors of a number of Chinese banks defaulting. The overnight rate has come down since Thursday but at 9% remains well above the 4% it was at last month. Consequentially eyes have turned to the central bank, the People's Bank of China (PBoC), and their response to the issue.

Today we got a response from the central bank, and it was anything but reassuring. The PBoC issued a statement that essentially said China's banks are on their own, and that they should manage their risk accordingly. Subsequently, the Shanghai Composite index fell more than 5% today, the worst selloff in over three years.

Not only did the PBoC's statement suggest Chinese banks are seemingly going to have to deal with volatile interest rates, but it also marks a different view from the central bank than previously, when it would mostly add liquidity at will whenever there were signs of trouble in the Chinese economy. Of course, China is under new leadership this year with President Xi Jinping and today's move may be a big statement of intent.

It's no secret that a number of economists and analysts think there's a credit bubble in China, along with an inflated real estate market. Likewise, China's new government seems keen on tightening the financial markets and by the looks of the central bank's stance, they are willing to take some pressure in the near term to make sure the financial system is stable for the long term.

It's an interesting contrast to the US Fed, which of course took center stage last week. Whereas the PBoC is quick to tell Chinese banks they must fend for themselves, it's taken the Federal Reserve a long time to build up the nerve to give even the slightest hint that they could begin taking their foot off the gas.

Here in the US markets we're seeing basic materials underperform the market, down 2.9% mid-day, which is a logical move given that China's credit-fueled infrastructure investments are a big driver of world raw materials usage; we may be seeing less of that for the time being if the PBoC has their way.