By Carlos Guillen

Equity markets are taking off during today's trading session, with the Dow Jones Industrial average making triple digit gains and a bit over 100 points from reaching its all time intraday high of 15,542.40 reached back on May 22 of this year. Today's session is getting a boost from favorable comments that Fed Chairman Ben Bernanke made yesterday after the close of the trading session, which implied that the Federal Reserve will maintain its easy-money policies for the long run.

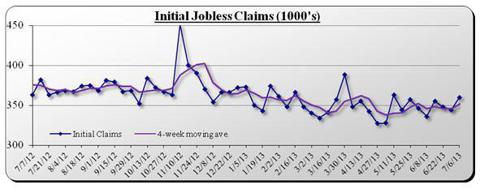

Initial claims data posted earlier today was not very encouraging, but did not derail the overall positive mood that was fueled by the interpretation of continuing the path of Fed easing. According to the Department of Labor, initial claims during the week ended July 6 totaled 360,000, increasing from the 344,000 revised figure reported for the prior week and landing above the Street's estimate of 348,000. The level of new claims continues to bounce around the 350,000 level, which economists say is consistent with moderate labor market growth of about 150,000 net new jobs a month. The initial claims' four-week moving average was 351,750, increasing from the prior week's average of 345,750. The overall tone coming from the public at large has continued to be quite positive, with increasing numbers of people now expecting the employment conditions to improve. However, recent trends show rather flat job creation. Nonetheless the overall perception is still encouraging.

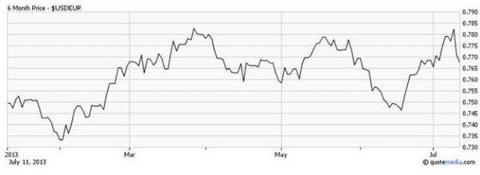

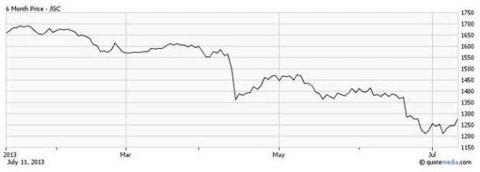

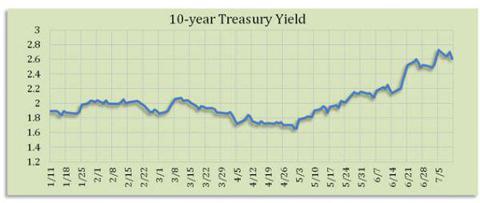

And the phrase from Ben Bernanke that is resonating in Wall Street at the moment is that "the economy still needs highly accommodative monetary policy for the foreseeable future." Mr. Bernanke's comments had U.S. markets trending higher in aftermarket trading yesterday and triggered overnight advances in Asia and Europe; oh and let's not forget the selloff in the dollar, the decline in Treasury yields, and the rise to gold prices.

Fed Fever

By David Urani

The big story of the day is Bernanke's change of tone (or rather the market's perception of it). For me, the market is overly-fixated on what the Fed is up to and to be honest I don't sense a huge change of view from the latest communications. But let's take a look at some of the after-effects in today's session:

The dollar is taking a dive, down 1.2% (versus a basket of international currencies) on the prospect of the Fed printing money for longer:

Gold, which has been down approximately 20% in the last three months, is seeing some reprieve; it's up 2.6% today. More easy central bank money means less faith in fiat currency:

The prospect of lower rates for longer means 10-year Treasury yields are back down to 2.6% from 2.7%:

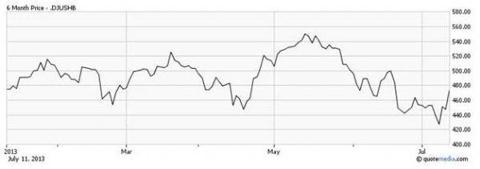

Consequentially, the prospect of rates being held down is a big relief for the housing sector which is the highlight segment of the market today. The Dow Jones US Home Construction Index is up a full 6.2% on the day: