By Carlos Guillen

After reaching an all-time high closing level yesterday, the Dow Jones Industrial Average has pulled back a bit during this first half of today's trading session as investors appear to be doing some profit taking in light of some stronger than expected economic data.

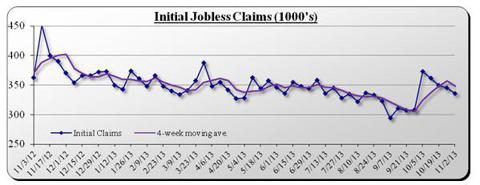

Somewhat mixed today was that the down trend in the number of people filing for unemployment benefits continued but was shy of expectations. According to the Department of Labor, initial claims during the week ended November 2 totaled 336,000, decreasing from the 345,000 revised figure reported for the prior week and landing above the Street's estimate of 335,000 but representing a second week below the 350,000 level that economists say is consistent with moderate labor market growth of about 150,000 net new jobs a month. Also the initial claims' four-week moving average was 348,250, decreasing from the prior week's average of 357,500, representing the first decline in the last five weeks.

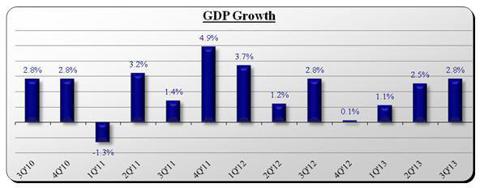

Clearly, the most encouraging economic data presented today was that U.S. output improved better than expected in the September quarter. According to the Bureau of Economic Analysis, real gross domestic product (GDP) during the third quarter of 2013 increased quarter-over-quarter by 2.8 percent (annualized), better than the Street's consensus estimate calling for a 1.9 percent quarter-over-quarter rise, increasing at a faster rate than the 2.5 percent achieved in the second quarter of this year and representing the tenth consecutive quarter of economic growth. It was quite surprising to see that the four main categories of GDP contributed to overall growth; those being consumption, investments, government, and net-exports. In fact, the last time these four components of GDP contributed to growth in the same quarter was back in the second quarter of 2007. On a bit of a negative note, consumption (more precisely Personal Consumption Expenditures) contributed less for a second consecutive quarter, contributing to GDP 1.54 percentage points in the first quarter, 1.24 percentage points in the second quarter, and 1.04 percentage points in the third quarter.

On the inflation side, prices for GDP increased by 1.9 percent (annualized), while economists' average forecast called for a 1.4 percent rise. The higher than expected rise in prices may also serve to motivate the Fed to start tapering when the FOMC meets this upcoming December, and this may not be great news for short term traders.

In all, despite the fact that the European Central Bank cut its benchmark interest rate by quarter of a percentage point to a record low 0.25 percent, which did serve to boost stocks for a short time interval at the open of trading, it is apparent and quite ironic that the better than expected GDP growth from here at home has compelled some investor to take a bit of profits as the good economic news may serve to fuel Fed tapering sooner rather than later.

Twitter Takes Flight

Alright, it's the hottest IPO since Facebook (FB) and it's finally here. Twitter (TWTR) began trading this morning, and with great fanfare as it's popped all the way above $45, more than 70% from the underwritten IPO price of $26. It's going to draw obvious comparisons with Facebook and on the whole you'd have to say this is a much smoother debut. When Facebook made its entrance it plunged but TWTR is having much better success (so far).

It all starts with the underwriters, and in the case of Goldman Sachs and Twitter, they took the more humble road by pricing it at $26 per share, or $14.4 billion. That was below what the market was willing to pay for it, so all the original shareholders of Twitter made out with their windfalls while the public market investors appear to be left with some gains as well, with the stock appreciating all the way above $45 at the open. In contrast Facebook's underwriters set the IPO price too high to start with, as the original Facebook investors milked everything they could get and ran away with some serious profits while the market was left with a brick of a stock that proceeded to tank for the next three months.

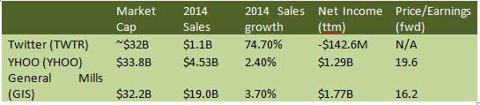

And that's the dilemma we're faced with. TWTR has certainly left a good taste in the mouth of the public market, up 75% from the IPO price but now it has to stay here and that's another story. Like Facebook upon its debut you could stay Twitter is very highly valued right now. It's worth approximately $32 billion at the moment and that's quite a lot for a company that's still running at losses. Of course, Twitter is sure to start making profits one of these days, perhaps in 2015, but even then it will still be a long way from fulfilling the immense promise of riches being priced into the stock here.

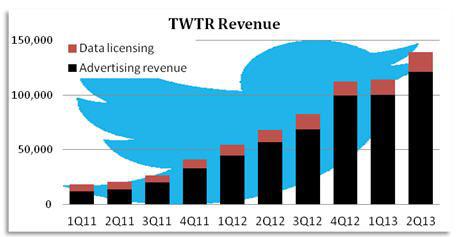

Considering it has negative earnings, price-to-earnings is out the window as far as valuing this stock so perhaps price-to-sales is a better way to look at it. Well, it's running at about 32 times next year's sales (estimated to be $1.1 billion) and that's also pricey. By comparison right now FB is priced at 11 times 2014 sales. That said, Twitter as of the second quarter was growing revenue at more than 100% so the potential for that momentum to continue and yield fantastic revenue growth for years down the road is being priced in. Still, the company is being valued at $32 billion now and as of this year it's still only expected to pull in $638 million of sales, much less convert any of it into profit.

Don't get me wrong, I think Twitter is a fantastic company and I love what it's done to the way we communicate and consume media. And revenue growth has indeed been impressive so far. But a great company and a great stock can be two different things, especially when the price of that stock is looking so far into the future as TWTR is.

For comparison's sake, I've found a couple of other companies you probably know that carry a market cap around $32 billion, Yahoo (YHOO) and General Mills (GIS). Yahoo is perhaps the more comparable of the two given it's also an internet stock and Twitter (when finally profitable) will likely carry profit margins more similar to that. Meanwhile General Mills is a company we all know and come across every day as the maker of Cheerios and other food staples and it gives you the sense of scale we're dealing with here at a $32 billion valuation.

It's clear Twitter doesn't yet bring in near the sales the other two do but at the same time it's in the middle of a massive growth spurt and one day you could see it at least catching up to Yahoo. Income is ultimately the better benchmark for companies' valuations, and unfortunately Twitter still has none which makes the comparison a little more tricky. And as you can see, despite GIS' massive revenue its tight margins rake in a comparable net income to YHOO, thus their similar market caps. So at some point down the road certainly Twitter is not going to have to pull in $19 billion of revenue like General Mills, as it should have a healthy profit margin like other big internet companies along the lines of Yahoo. But you would at least expect it to need to triple or quadruple over its estimated 2014 sales of $1.1 billion and that's going to take years, even when expected to increase by more than 70% next year.

Of course, by the time you see this article TWTR's price could be something entirely different, as I'm not necessarily expecting this one to sit still for a while.

Note: Catch a bit of Charles earlier this morning on The Bill Handel Show KFI-AM 640. Click the link below