By Carlos Guillen

After taking a step back yesterday, equities are making a strong move to the upside so far into today's trading session as better than expected trade data and positive comments from a Fed President have come together to enthuse investors once again.

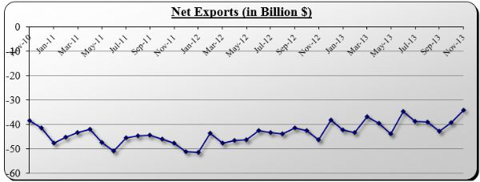

Quite encouraging today was data that showed the U.S. trade deficit shrank in November to the lowest level in over four years, as American exports rose to an all-time high while imports dropped, clearly not the scenario that we have become accustomed to. According to the U.S. Department of Commerce, the trade deficit during November totaled $34.3 billion, decreasing from the $39.3 billion reported for October and landing below the Street's consensus estimate of $40.4 billion. As it stands, the trade deficit is at its lowest level since October 2009 when it stood at $33.95 billion. In terms of the two main components, exports increased 0.89 percent to a record $194.9 billion, as demand for industrial supplies and materials, capital goods, and other goods ramped higher outside the U.S. Imports dropped 1.44 percent to $229.1 billion, as American's demand for industrial supplies and materials and other goods declined. The petroleum deficit shrank to $15.2 billion in November, the lowest since May 2009. Given that net-exports play a direct effect on gross domestic product (GDP), a narrower deficit could lead economists to revise their growth estimates higher for the fourth quarter of this year.

Also encouraging today were comments from Boston Fed President Eric Rosengren who recommended that the central bank should only wind down its bond-buying program gradually. Rosengren believes that despite clearer signs of a U.S. economic recovery, its gradual nature comes with potentially deep-rooted costs that warrant the Federal Reserve to keep its policy highly accommodative. These costs include the potential of having longer-lasting and structural implications for labor markets and the economy; in addition, there may be a reduction in the Fed's ability to reach its inflation targets in a reasonable time frame. As such, Rosengren sees ample justification for the Fed to keep monetary policy highly stimulatory to support growth, which of course has enthused investors today.

In all, equity markets have held nicely in winning territory with the better than expected trade data and Rosengren's comments. In fact, the Dow Jones Industrial Average is up over 110 point and is not far from reaching another all time high. Tomorrow we will get a glimpse at the minutes from the Fed's December 18 meeting, when the central bank decided to slightly taper its bond-buying program. This can shake markets a bit tomorrow, so let us hang tough.