By Carlos Guillen

Equity markets are having a phenomenal trading session, as better than expected economic data from here at home and an increase in global growth forecasts are serving to encourage investors back into buying stocks.

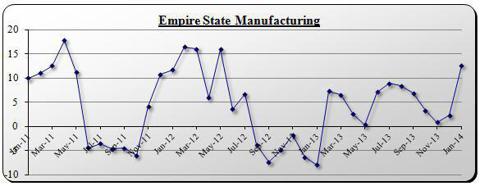

One very encouraging data point today was that manufacturing in the New York region took a rather sharp jump in this month. According to the Federal Reserve Bank of New York, its general business conditions index January result landed at 12.5, higher than the Street's consensus estimate of 3.5, and increasing from the 2.2 reached in December. Given that readings greater than zero signal expansion, this month's result makes the twelfth month of expansion in the region that covers New York, northern New Jersey, and southern Connecticut; however, expansion has been rather volatile. Certainly encouraging was that the index for future new orders climbed nine points to 39.1, and the index for expected number of employees rose 10 points to 20.7.

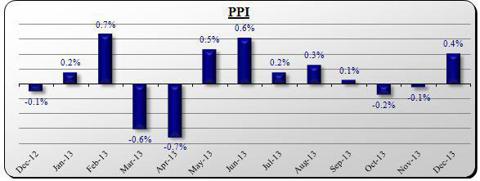

Another report today showed prices paid to producers climbed after two months of declines. According to the Department of Labor, the Producers Price Index (PPI) in December increased month-over-month by 0.4 percent; this compares with the Street's consensus estimate calling for a 0.3 percent rise. Because retailers try to pass costs on to consumers as soon as possible, the PPI reading can provide hints on future trends for the CPI data, which most on the Street have been talking about deflation, and this is serving to counter this notion of weakness. Excluding food and energy contributions to the price index, core PPI increased month-over-month by 0.3 percent, while economists' average forecast called for a 0.1 percent rise.

Also giving investors added confidence in stock trading today was that the World Bank raised its global economic growth forecasts to 3.2 percent from its June estimate of 3.0 percent. According to the Bank, easing of austerity policies in advanced economies is fueling their recovery, which in turn is boosting prospects for exports in developing economies. More encouraging from our perspective here at home was that while part of the increase reflects improvement in the 18-country euro zone, the U.S. is ahead of developed peers and is growing at twice the rate as Japan.

In all, the favorable economic data points and the increasing global growth forecasts presented today are serving to lift stocks much higher today, leading the S&P 500 index to new all-time highs and the NASDAQ to a 13-year high. And the Dow is up over 120 points in today's trading session, also on its way to reaching an all-time high.

Euro Bond Bliss

By David Urani

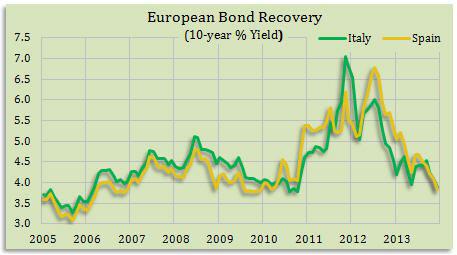

Hey, remember that whole European government debt crisis? It certainly got frightening back in 2011 and 2012, when the future of the euro zone was legitimately put in doubt and the world wondered if Greece, Spain, Italy, Portugal and others would be able to pay their debts and/or secure the needed bailouts.

Well, in the past week there's been a lot of encouraging action in European bond markets, suggesting that their crisis is well in the past. Take for instance Spain, who last Thursday sold $7.2 billion in 10-year bonds at a 3.67% yield, the lowest yield since September 2006. Italy held an auction of $11.23 billion in bonds on Monday (the biggest auction since May 2011) where 3-year notes went for a 1.51% yield, a record low. Yesterday Greece sold $2.2 billion of 13-week bills at a 3.75% rate, the lowest since October 2010. And finally, Portugal sold $1.4 billion of 1-year bills today at 0.87%, the lowest rate since November 2009.

You could say European bonds are 'back to normal,' and that's good news for us all as the euro zone is showing that it's coming out of its economic funk. Likewise, it makes for one of the more compelling macro-stories for 2014.