By Carlos Guillen

Yesterday, the Dow Jones Industrial Average dropped 231 points, its sharpest drop since February 3 when it dropped 326 points as the Institute for Supply Management (ISM) Purchasing Managers' index (PMI), considered by many to be a very important health indicator of the manufacturing industry here at home, suddenly plummeted. However, the Dow's drop yesterday was based on news that has been around for quite some time now. Investors appeared to have a delayed knee jerk reaction over the escalation of conflict between Ukraine and Russia, as well as to the slowdown in China.

Interestingly, Asian markets were in turn spooked by our markets' reaction, and the Japanese Nikkei 225 tumbled 3.3 percent as investors sought haven in yen, sending its value higher. A stronger yen makes goods sold by the country's exporters pricier for overseas buyers and demand declines. Hong Kong's Hang Seng dropped 1.0 percent and China's Shanghai Composite fell 0.73 percent.

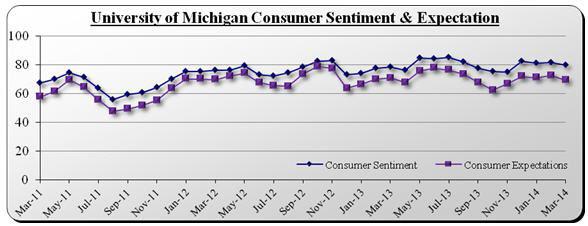

Also adding to the malaise today was that consumer sentiment not only landed lower than expected but also declined. The University of Michigan's Consumer Sentiment March result landed at 79.9, lower than the Street's expectation of 82.0, decreasing from the 81.6 reached in February. While U.S. consumer sentiment fell overall, consumers' view of current conditions actually rose, but expectations for the future dropped to their lowest level in four months. In fact, the expectations index decreased from 72.7 to 69.4. Both the overall index and the expectations index had ticked higher in February, but suddenly this month, sentiment has made a turn for the worse. The one-year and the five-year inflation expectations this month remained unchanged at 3.2 percent and 2.9 percent, respectively.

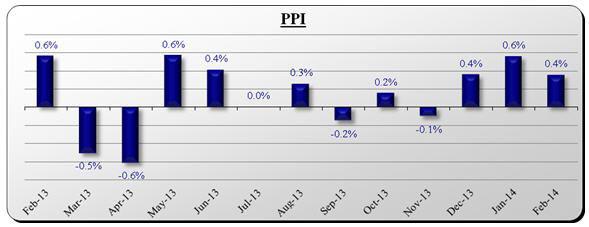

Another report today showed prices paid to producers climbed for a third consecutive month. According to the Department of Labor, the Producer Price Index (PPI) in February increased month-over-month by 0.4 percent; this compares with the Street's consensus estimate calling for a 0.2 percent rise. Excluding food and energy contributions to the price index, core PPI increased month-over-month by 0.1 percent, matching economists' average forecast.

As developments in the Ukraine continue, we should see more volatility in stocks around the world. However at this instant, despite equity gyrations, the Dow currently stands at 16,101, down just 8 points; 64 points from the high and 41 points from the low of the session. We would not be surprised if there is a rough trading session on Monday, a day after the vote in Crimea on the matter of possible annexation to Russia takes place. Stay tuned for the action this Sunday! Sunday! Sunday!

Crimea Conundrum

By David Urani

This Sunday brings perhaps the pivotal event in the Russia-Ukraine situation with Crimea holding a referendum vote. The market actually turned from negative to positive today when Russian Foreign Minister Lavrov, following a talk with John Kerry, stated that Russia has no intention of invading Ukraine and that they will respect the will of the Crimean people.

It sounds like a reasonable solution, to allow the Crimeans to vote on their status as a nation. The thing is, the vote itself is sketchy. The problem is that the Ukrainian constitution does not allow for individual regions like Crimea to vote on issues like this. Because of that, the United States' stance is that it breaks Ukrainian constitution and also international law. But the Russians contend that after the violence and upheaval of the Ukrainian government, with the pro-Russian Ukrainian President having fled to Russia, that constitution is already broken and void.

Another issue with this referendum is the fact that it doesn't even include the option for Crimea to stay in Ukraine. It's simply a yes or no vote with yes being a vote to become part of Russia, and with no being a vote to become an independent country. It seems Ukraine's claim to Crimea is being ignored entirely.

And with that said you have to wonder if the reason why Ukraine is being left out of the matter, or why the vote is being held in the first place, is because Crimea is essentially being occupied by Russia at the moment. You can decide yourself how legitimate and/or corrupt you think this vote is.

Whatever the case, the stage is set for Sunday and you'd have to assume that it's not going to go smoothly because there's already a debate between Russia, Ukraine, and the West over whether the vote should even exist at all. Putin doesn't seem like he's willing to take no for an answer, and as far as how the Crimeans will vote, who knows.