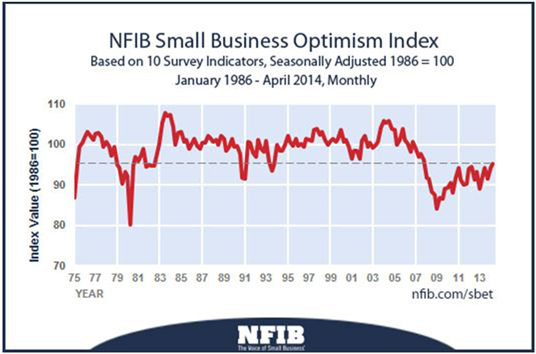

Small businesses, the backbone of the economy, create the most jobs, but they get the least amount of love from Washington DC. To be a small business, you must be optimistic by nature, and to bring down their morale things have to be pretty awful - that's been the case for some time. However, they are a beaten down bunch that has scratched, kicked, and clawed through this recent and most depressing of economic recoveries. Slowly, that natural optimism is rebounding, but it's measured and tepid.

Right now, there's a chance that this could be the year where some momentum builds with small businesses, as indicated by the chart - optimism is on the verge of a breakout!

Holding that breakout at bay is a variety of factors including:

22% Taxes

20% Government regulations and red tape

15% Poor sales

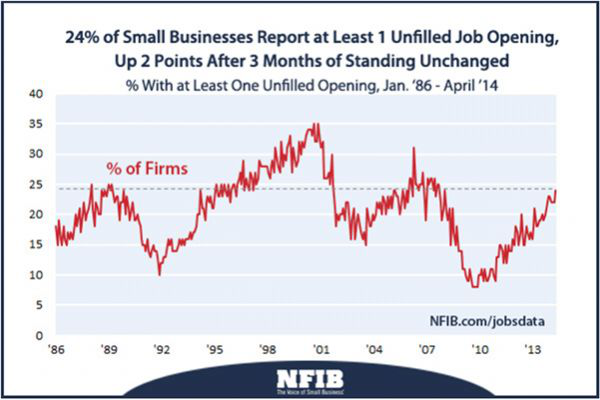

In the past year, the quality of workforce has been cited by 9% of small businesses as the biggest problem for growth, up from 7% a year earlier. This speaks to a more educated and motivated workforce.

In the meantime, job availability among small businesses is also growing:

There's no doubt in my mind that small businesses will bail out the nation, but it would be nice if we made it easier for them to do what comes naturally...be optimistic.

Rest of the Session

It's something of a tug-of-war in those high flying tech stocks where an oversold bounce seems to have faded. Actually, the entire market is mostly marking time, perhaps waiting for good news before making the next big leg higher. With that in mind, I like our cash level. I think we are going much higher over the next two years, but wonder when a long overdue correction might hit--I wish it had already. Some key tech stocks have hit the correction level and they should rebound.