After four sessions of better than expected earnings reports, companies that reported mixed earnings (including Amazon and Pandora) yesterday evening and this morning greatly disappointed investors. The market opened lower, with major indices continuing to trade in the red. The Dow Jones Industrial Average, so far decreased 0.72% to levels beneath the 17,000-level. With eight sectors in the red, the S&P 500, has fallen from its newest all-time high achieved yesterday. Unfortunately, there was not much economic data released today to alleviate the situation.

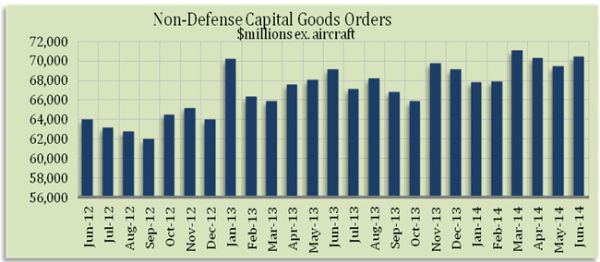

During the month of June, orders for durable goods increased 0.7%, after a 1% decline during the month of June, much higher than consensus at 0.5%. When excluding transportation, orders increased 0.8% in June, after a small dip of 0.1% in May. Major gains were posted in primary metals, machinery, computers and electronics, and "other." Transportation made a small comeback of 0.6%, after it fell 2.6% in May thanks to an increase in defense aircraft and nondefense aircraft orders; however, motor vehicle orders fell. Non-defense capital goods orders excluding aircraft rebounded 1.4% to 70,365 from 69,373 in May which can be observed in the chart below. Also, unfilled orders for nondefense capital goods excluding aircraft increased 1.2% in June after rising 0.5% in May. Manufacturers have been collecting a lot of orders, but need to begin delivering. Overall, we expect manufacturing to continue improving into the second half of 2014.