The market is beginning to recover from the earlier lows; overnight, US airstrikes were launched in Syria. The US government's military campaign against Islamic State militants has spread over the border of Iraq and into Syria, but comments mid- morning from President Obama actually sent the markets crawling back up but they have since broke down again. The breakdown was due to the U.S. Treasury's move to curb deals that allow U.S. companies to escape high taxes at home. The result was a wipeout of a combined $12.3 billion off the shares of nearly a dozen companies on both sides of the Atlantic. At the moment, it is unclear whether or not this tougher stance on "inversion" deals would end any of the handful of huge deals already in the works. Aside from Syria and the Treasury, there were quite a few mixed messages being digested by investors…

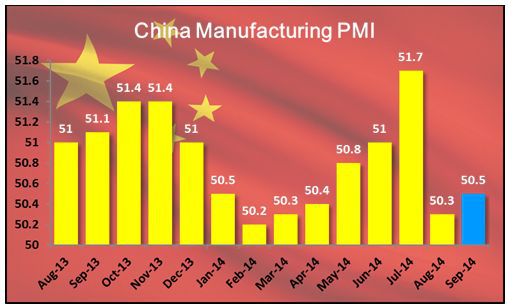

Firstly, a preliminary reading of China's manufacturing sector showed some surprising improvement so far this month, but there's no telling if this number will hold up after the country's holiday season that takes place at the end of the month. The preliminary reading of HSBC's manufacturing Purchasing Managers' Index (PMI) rose to 50.5; up from August's final reading of 50.2, and beat economists' expectation for a drop to 50.0; remember that the 50 mark divides growth from contraction. The sub-indexes were noted as painting a very mixed picture of the manufacturing activity in China. New export orders and overall new orders both showed gains at a faster rate than in August, but the employment sub-index fell at a faster rate. The slump in the employment component resulted in a five-and-a-half year low. There's no telling how much, or if, the Chinese government fudged the numbers this time, but odds are pointing to the fact that they are coming to realize that a GDP goal of 7.5% is far less realistic than originally thought.

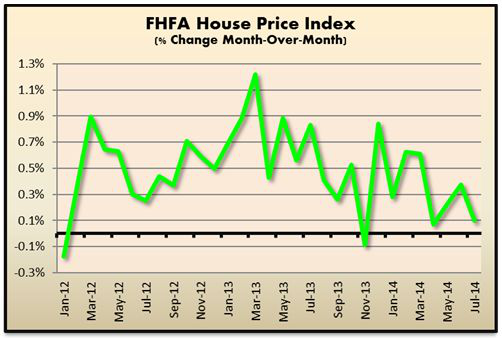

Back in the US, the Federal Housing Finance Agency (FHFA) noted that home price appreciation rose 0.1% in July after a 0.3% increase in June. July's number came in below consensus's expectation for a 0.4% advance. Year-over-year, the rate is continuing to slow as well, easing to 4.4% from 5.1% in June. On a regional basis, five of the Census regions reported increasing prices in July, two declined while two remained the same. This report further supports the notion that the US housing market is stalling - especially after yesterday's disappointing 1.8% decline in existing home sales for August.

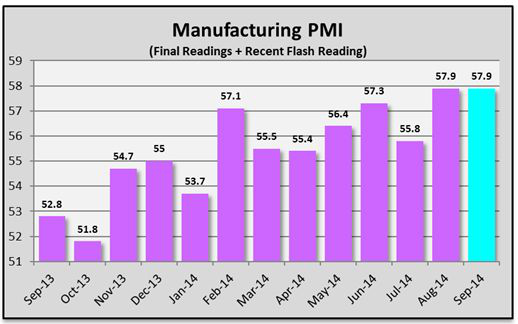

Next, Markit's preliminary reading of the manufacturing PMI for the month of September is showing strong and steady growth, for the month. The flash reading came in at 57.9; the same as the final reading for August, but slightly lower than the 58.0 flash reading from August. Markit does not offer details to the public, but the report noted that output is strong and new business in particular is showing strength. Backlog orders and export sales are also showing signs of recovery in September, as well as "robust" strength in employment among manufacturing firms. This report was the first gauge of national manufacturing activity so far this month. However, investors tend to focus on the Empire State report and especially the long established Philly Fed report for the first monthly readings on manufacturing. Both the Empire State and Philly Fed reports (released last week) showed similar strength. Ultimately, we believe this will point to a positive composite report.

Lastly, in addition to the Empire State and Philly indices, all the economic indicators for the Richmond Fed manufacturing index are also pointing to solid strength. The Richmond Fed's index rose 2 points in the month to 14 with details showing incremental acceleration with new orders (at 14) and shipments (at 11). Price data showed some acceleration for inputs while inventory data show desired builds for both raw materials and finished goods. The odds are good for the final PMI reading in September to actually be better than the preliminary data suggests.