By Jennifer Coombs, Research Analyst

You would never know the market was recovering from a massive pullback last week based on how today's session is going. All of the major indices are trading well above 1.0% higher for the session, and even the small cap index, the Russell 2000, is showing some signs of life, trading over 2.0% higher in the morning. Some better-than-expected earnings and optimistic outlooks from the Dow components are lifting the index, namely 3M Co. (MMM) and Caterpillar (CAT). With light negative news and no crashing international economies, the market is left getting a nice boost from the following economic releases in addition to the weekly jobless claims report.

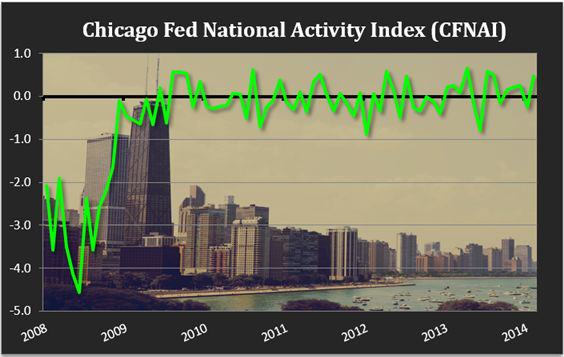

Although lagging by a month, the Chicago Fed's National Activity Index (CFNAI) demonstrates that September was actually a very good month for the economy. The CFNAI jumped to +0.47 from -0.25 in August. During the month, three of the four components increased, led primarily by production indicators thanks to a boost in manufacturing. The employment component also got a boost thanks to the drop in the national unemployment rate. The only negative component was consumption, which was offset by a boost in housing starts and permits. However, overall the report shows that growth is accelerating with the 4-week rolling average now at +0.25 compared to the +0.16 reading in August. Below is a chart of the CFNAI since the start of the recession.

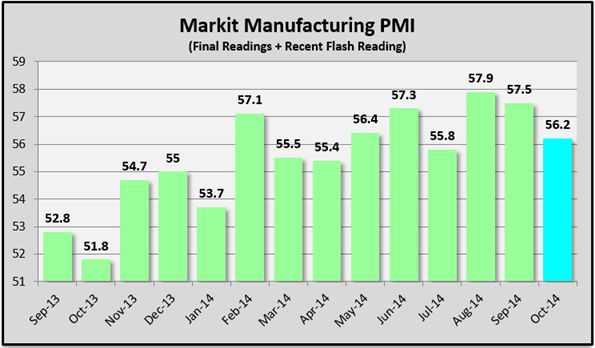

While not as powerful as the ISM reading, Markit released their flash reading for the October purchasing managers' manufacturing index (PMI). The preliminary reading points to a slight slowdown in manufacturing activity during the month of October at 56.2, which is lower than September's final reading of 57.5 and the September flash reading at 57.9. New business growth was described as being weaker than September and the slowest of the last 3 months, although the report mentioned a significant slowdown in growth for export orders. Inflation readings for both raw materials and finished goods slowed to multi-month lows. Ultimately, today's report is roughly in-line with the Philly Fed report from last week, and far stronger than the Empire State report. In the end September proved a strong month for manufacturing, but it's appearing rather difficult for October.

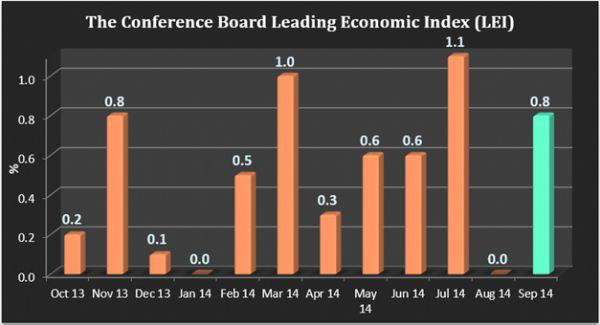

Lastly, the Conference Board's index of leading economic indicators (LEI) increased nicely in September by 0.8%, versus a relatively easy comparison in August at 0.0%. Low interest rates were the primary factor contributing to strength, and only one of the 10 components in the index (consumer expectations) was negative. There was substantial improvement in the labor market and manufacturing as well. Early indications during the month of October so far are mixed with interest rates moving even lower and the consumer sentiment and consumer comfort indexes both showing strength. However, unemployment claims and the early manufacturing readings are on the flat side.