The conflicting messages from Wall Street and the end of the world collided yesterday.

Wall Street's Odd Way of Showing Love

Virtually, all firms on the street are bullish in 2015 for a variety of reasons that include economic momentum, wage growth, an accommodative Fed (even a rate hike would be infinitesimal), and a strong dollar.

Yet, every single day this year, there have been more stock downgrades than upgrades. In fact, year-to- date, it is almost a two to one ratio. This morning, the ratio was almost 4 to 1, with only 11 upgrades.

Analyst Rating Changes | Yesterday | Year to Date |

Upgrades | 11 | 377 |

Downgrades | 41 | 660 |

I get that it is a lot harder now to find value than a few years ago. Compounding the problem is separating business potential, execution, and opportunities from the financial engineering of bottom lines and valuation metrics. I grapple with this as well. Moreover, the street is simply chasing performance, upgrading stocks like Netflix after a hundred-point pop and downgrading stocks like H&E Equipment after a 50% decline. (We are in both stocks; one on the hotline, and the other, on the newsletter service.)

Investor Emotional Swings

However, it is not just Wall Street, investors are also skittish. Now that the market is gaining traction, they are becoming more bearish and very quickly.

Analyst Rating Changes | % Emotion | Change |

Bullish | 37.1 | -9 |

Neutral | 32.1 | Unchanged |

Bearish | 30.8 | +9.3 |

Then, there is the doomsday clock that was established by the guys who built the atomic bomb to warn when mankind will finally destroy himself; it moved a minute closer to midnight.

This was its first move in three years; a big move to just three minutes to that fateful moment, because of WW III, climate change, modernization of nuclear weapons, and terrorism. The clock is something of a public relations tool for those over-anxious gearheads and the politically correct crowd.

Doomsday on the Mediterranean

There is a big election in Greece tomorrow. It might not have the impact it would have had a few years ago, even a few weeks ago, because the European Central Bank (ECB) will begin spreading cash throughout the continent, save skipping Greece for at least six months.

The Greek people, already living under austerity from the good old days, in return for hundreds of billions in bailout money want to go back, and they simply do not care about the fallout. Look at the goodies Syriza is promising if they take power in Greece.

Syriza Utopian Promises |

Free Electric |

Increased Food Stamps |

Free Universal Healthcare |

Free Public Transportation for Lower Incomes |

Increase Minimum Wage 751 Euro from 510 Euro |

Harder to Fire Workers & Strengthen Collective Bargaining |

Yes, reading that list was like reading President Obama's wish list and recipe for staying in power. However, this all comes with a hefty price tag. In Greece, the debt is 175% of the Gross Domestic Product (GDP), and unemployment is at 25%, down from 28%.

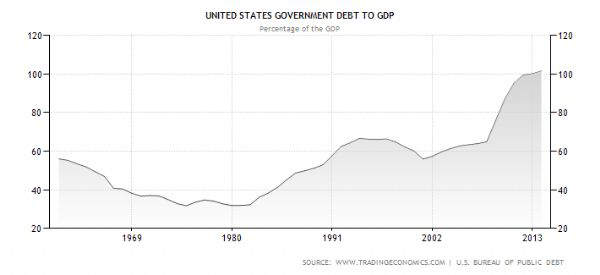

Today, our massive social programs and giveaways coupled with profligate spending, has sent our debt to a GDP ratio above 100%.

People say all the time that debt is no big deal, and we can always pay the interest, but there's a not-so-curious correlation to our slowing GDP growth and mounting debt- look at these numbers.

| Debt and Death of Growth Debt 40 to 110% GDP | |

Decade | GDP Growth |

1960s | 8.2% |

1970s | 6.7% |

1980s | 7.8% |

1990s | 5.9% |

2000s | 4.8% |

2010s | 3.4% |

While a Syriza win would be upsetting, the world is not being held hostage anymore, but the cautionary tale continues, because unlike Greece, when America's day of reckoning comes, there are not enough printing presses in the world to save us.

Today's Session

The major equity indices indicated lower in the premarket. Today, Markit will release its manufacturing flash purchasing mangers' index (PMI) for the month of January. It is projected that the headline will come in at 54.0, which is slightly higher than the December flash reading of 53.7 and December final reading of 53.9. Afterwards, the National Association of Realtors will release the December existing home sales report. Housing reports out this week have been mostly positive and we hope today's report will echo improvement in the housing sector as well.

Below are some of the major companies that reported yesterday afternoon and this morning.

Company | EPS | Consensus | Revenue ($M) | EPS Guidance | EPS Consensus |

COF | 1.73 | 1.78 | $5,813 | - | FY15 |

ETFC | 0.26 | 0.25 | $461 | - | FY15 |

ISRG | 4.92 | 4.40 | $605 | - | FY15 |

SWKS | 1.26 | 1.19 | $806 | Q2 1.12 | Q2 1.04 |

SBUX | 0.80 | 0.80 | $4,803 | FY15 3.09-3.13 | FY15 3.12 |

BK | 0.58 | 0.59 | $3,665 | - | FY15 2.64 |

GE | 0.56 | 0.55 | $42,004 | FY15 1.70-1.80 | FY15 1.76 |

HON | 1.43 | 1.42 | $10,266 | FY15 5.95-6.15 | FY15 6.11 |

KSU | 1.27 | 1.23 | $643 | - | FY15 5.48 |

KMB | 1.35 | 1.37 | $4,828 | FY15 5.60-5.80 | FY15 6.00 |

MCD | 1.22 | 1.23 | $6,572 | - | FY15 5.38 |