MiMedx: A mispriced growth stock poised for outsized gains

Thesis:

Mimedx (MDXG) is a classically mispriced stock due to some recent events and it provides an opportunity for investors to buy this very high quality growth company at a reasonable valuation. MiMedx is positioned to be a multi-year, growth story and we think that the growth opportunity is underappreciated by the market.

Background:

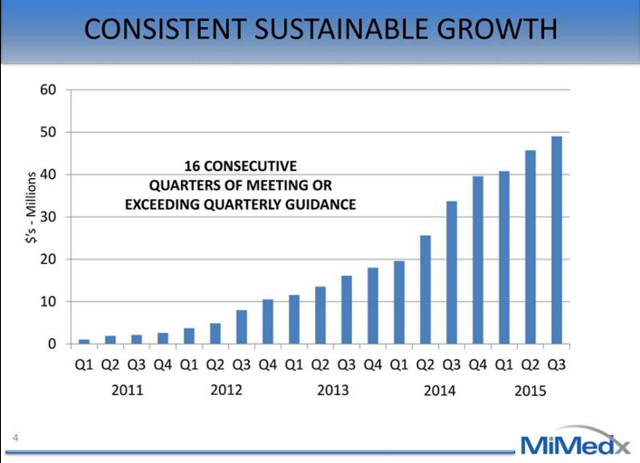

Mimedx is a regenerative medical products company with an excellent management team, very high margins, multiple underappreciated growth drivers, a $17 billion target market, highly effective products and a reasonable valuation. Over the past four years, management has met or exceeded lofty growth targets and produced a ~200% Revenue CAGR. Through superior product and sales execution, MiMedx has gone from an $8mm top-line company to being the market leader in the advanced wound care skin substitute market. All of MiMedx's products are derived from donated placentas leading to gross margins in the high 80% range. CEO and Chairman, Pete Petit, owns 6% of the FD shares and in total insiders own ~9%.

The company is now well positioned to become a platform for growth into multiple adjacent markets and product lines. We think that the shares are reasonably priced for just the continued growth of their existing products, leaving significant upside as management continues to execute as they expand into new markets. We think shares are worth over $13, which is 60% more than the current market price.

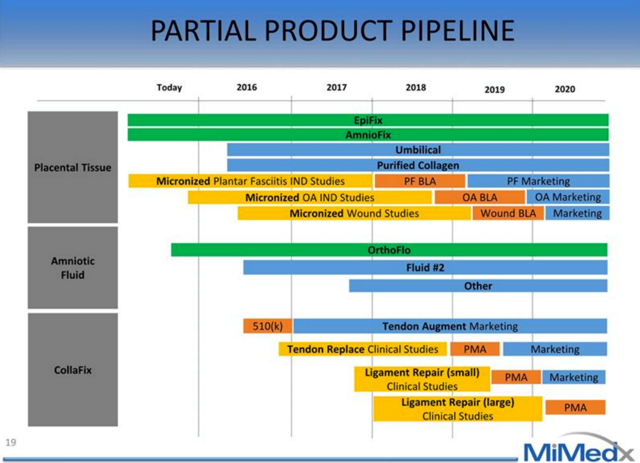

Product PlatformsAll MiMedx products are derived from various parts of placentas and amniotic fluids that are donated by new mothers after childbirth. Over time, the company has sought to find a use for all parts of the placenta and hence it just introduced two new product lines. Mimedx now has three product platforms, all with multiple new products and applications in the pipeline:

Amniotic Tissue

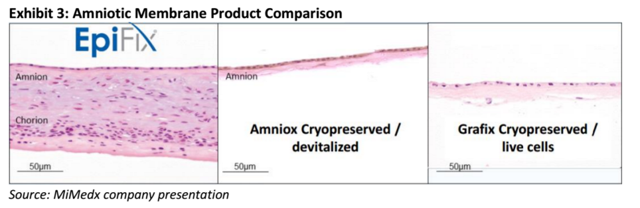

The two original products, EpiFix and AmnioFix, were derived from the Amniotic Tissue. These products are "stem cell magnets" that are able to support and accelerate the body's natural tissue repair processes. These products have been clinically proven to attract a human's own stem cells to the location where the product is placed, thereby allowing the body to heal itself faster. MiMedx's proprietary Purion process allows cells to be left intact and preserves both the Amnion and Chorion layers of the placenta. The intact cells and preservation of natural cytokines and growth factors allow EpiFix to outperform other skin substitute products on the market. It is also much more convenient to use since it is stable at room temperature and does not have to be frozen and defrosted before use. The company is expanding their product portfolio to address new surgical needs with amniotic tissues.

Amniotic Fluid

Launched in Q315, Amniotic Fluid represents a brand new product category for MiMedx. The first amniotic fluid product is OrthoFlo, an injectable for Osteoarthritis that will protect, cushion, lubricate, and reduce inflammation in the joints. It is derived from amniotic fluid and contains growth factors, nutrients, and hyaluronic acid (a common injectable used for Osteoarthritis). There are two other products in the pipeline to be disclosed in 2H16 and 2H17.

Collagen Fiber

CollaFix is a new product comprised of biomimetic fibers derived from human placental tissues. These fibers can be woven together to form tendon like grafts for sports medicine applications. The company will seek a 510(k) approval for tendon augmentation but file additional PMAs to expand into tendon and ligament repair. The CollaFix product is further from the market with the earliest approval occurring at the end of 2016, but as analysts learn more about the opportunity they will begin to reflect CollaFix in estimates.

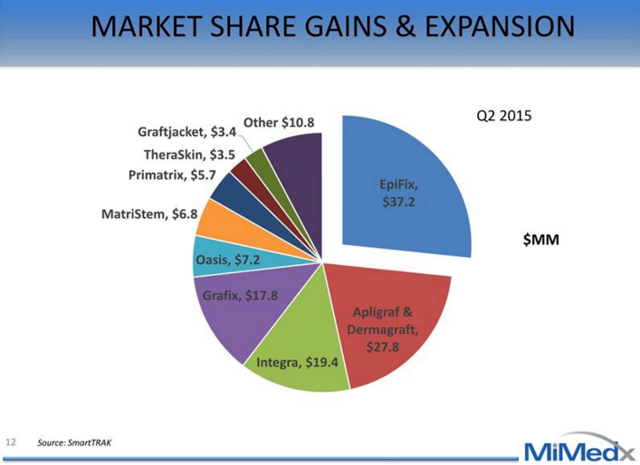

MarketsMiMedx has already demonstrated the ability to rapidly take market share in Advanced Wound Care. They have set their sights on expansion into new surgical markets and have an established technology platform and sales organization to execute.

Advanced Wound Care - $7.7 bn TAM

MiMedx plans to grow within Wound Care by continuing to take market share in diabetic foot ulcers (DFUs) and venous leg ulcers (VLUs) but also beginning to expand into pressure ulcers, burns, and trauma. Epifix has proven to be the most effective and convenient product on the market for chronic wound care, so expansion into other wound types should be achievable.

Surgical - $2.9 bn TAM

At the October 13th analyst day, management guided to Surgical, Sports, and Others (SSO) Revenue growing to be the same size as Wound Care by 2019. Typically, these sorts of lofty promises are met by skepticism. However, this management team has a consistent track record of hitting aggressive growth targets.

A specialty sales force is being constructed to sell into the operating room. Areas of focus include prostatectomies (robotic and open), plastic surgery, colorectal, and hernia repair. As this is a new area of focus, it may take longer for this new sales force to reach full productivity.

Orthopedics, Spine, Sports - $5.7 bn TAM

MiMedx has established private label relationships with Medtronic and Zimmer Biomet which could both contribute slightly to 2H15 revenues. Two completely new product launches were just unveiled in OrthoFlo and CollaFix.

Competition in Wound Care MarketBefore EpiFix seized the leading market share position, the skin substitute market was primarily owned by Organogenesis' Apligraf and Dermagraft. Dermagraft is a cryopreserved human skin substitute and Apligraf is a hybrid product made from bovine collagen and human skin cells. Competitors offering Amniotic products include Osiris' Graffix, Alliqua's Biovance, Derma Sciences' Amnioexcel, and Amniox's Neox. Even though the market is crowded, we believe that EpiFix is differentiated due to the clinical evidence of its efficacy, superior handling and ease of use, and cost advantages. This differentiation is evidenced by the rapid uptake of EpiFix by the medical and payer community.

Competitive AdvantagesEvidence Base for Regulatory and Reimbursement Approvals

MiMedx is devoted to sound science in order to prove the economic and clinical benefit of their products. They have produced 18 clinical publications, 8 Scientific publications and 45 posters. This focus on evidence has allowed them to gain widespread reimbursement by payers and market adoption by physicians. They are the only amniotic skin substitute company to receive positive reimbursement from all eight MACs and have widespread positive coverage from commercial payers. Both payers and the FDA have become increasingly difficult over the past several years and new products are under immense scrutiny. Smaller me-too companies lack the ability to produce the same kind of high quality data to back-up their claims and receive such widespread reimbursement.

IP & Patent Portfolio

The company has a strong patent portfolio with 25 amniotic tissue patents issued including: 7 related to the PURION Process; 6 to the Configuration of AmnioFix; and 2 to the configuration of EpiFix. Trade secrets are also used in the PURION Process. There are also 109 additional patent applications pending as well relating to the PURION Process, EpiFix and AmnioFix in the US and Internationally. Worldwide, CollaFix and HydroFix technologies are protected with 24 and 14 issued patents, respectively. Most of these patents are recently issued and expire between 2028 and 2032.

The proprietary Purion process allows MiMedx to produce two layer amniotic tissue products with the extracellular matrix and cells totally intact. There have been a number of amniotic products introduced recently due to the success of EpiFix. Most of these products like Amniox and Grafix are cryopreserved single layers. The company is currently suing 3 different companies with dual layer products for patent infringement.

Management Team - Deep Bench of Operators

Pete Petit, CEO and Chairman, is an experienced entrepreneur and operator with 40 years of experience of creating shareholder value in medical products companies. He founded Healthdyne in 1970 and took it public in 1981. Healthdyne grew both organically and through acquisitions and eventually split into three different public companies (Matria was the largest). All three were either acquired or merged with other companies at values over $1 billion. His team is stacked with a number of his former colleagues from Healthdyne and Matria, most notably Bill Taylor, President and COO, who is a likely replacement CEO if Pete steps back or retires.

Growth DriversMiMedx is positioned to be a multi-year, highly profitable, growth story and we think that the growth opportunity is underappreciated by the market. In the medium and near term, existing wound care products will continue to drive growth and there are several shots on goal from new products and markets in the longer term.

Incremental Payer Coverage

MiMedx has demonstrated a phenomenal track record of driving favorable reimbursement decisions from payers due to their strong evidence base and research focus. They are the only amniotic skin substitute product that has received coverage by all eight Medicare Administrative Contracts (MACs), as well as coverage by the VA and private insurers that in aggregate accounts for 170mm covered lives in the US. Three large payers still have not started covering EpiFix; UNH (41.6mm lives), Humana (14.2mm lives), and Aetna (23.7mm lives). Positive reimbursement decisions from all three are expected this year. Reimbursement from these three payers would increase the number of potential patients for existing products by over 45%.

International Expansion

MiMedx has already established regulatory approval in Canada, the UK, Switzerland, Slovenia, Italy, Ireland, and Korea. Operations in these countries are all at various levels of ramp up and should continue to drive growth. They are currently targeting near term regulatory approvals in Japan, Germany, Austria, Australia, and the Middle East. MiMedx handles their own regulatory submissions internationally then looks to partner distribution with a local player.

Product and Platform Development

MiMedx has a number of new pipeline products and applications for existing products in all three product categories. The new Amniotic Fluid product, OrthoFlo, is the most near term product launch that will drive growth in Surgical, Sports, and Other but there are a number of BLA, 510(k), and PMA approvals expected over the next few years. Management expects adoption of these new products to result in SSO revenues that match Wound Care by 2019. Finally, and perhaps most importantly, MiMedx has filed two patents for using amniotic tissue on the human heart. This is a large market; there are 6 million Americans living with heart failure and there are 670,000 new cases of HF each year.

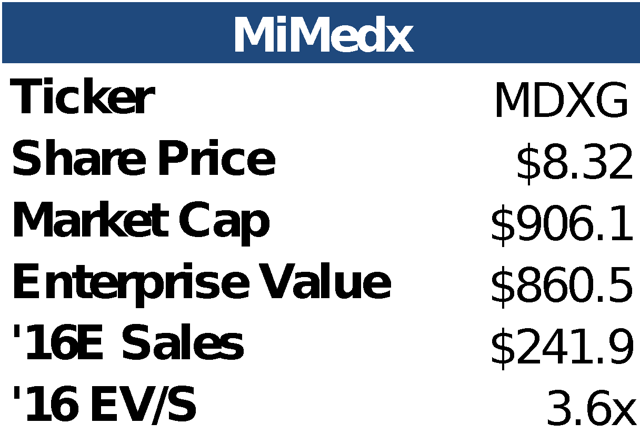

ValuationWhen compared to other high growth smid cap medical products companies, MiMedx looks like a bargain. At 3.6x Consensus 2016E sales, MiMedx trades at a discount to lower growth, lower margin medical products businesses like Zeltiq, Endologix, and Insulet. We believe there is upside to the street's revenue estimates as well as the opportunity for significant multiple expansion.

To come up with a target price, we applied the average forward EV/S multiple from the three closest growth comps from our High Growth Medical Products Group (Insulet 5.0x, Endologix 5.3x, and Zeltiq 4.1x). We believe this is a conservative approach since MDXG is higher growth and higher margin, while being EBITDA, Net Income, and Cash flow positive (Insulet and Endologix are both still not profitable). We believe that as management continues to execute and unveil more details around new products, the multiple should be at least in line with these three companies. We applied this "fair" multiple to the street consensus 2019 Sales. 2019 is the year that management guided to equal revenue contributions from the Wound Care and SSO product lines. We do not believe that the street has fully baked in this guidance and that the 2019 number is likely still too low. By applying our fair forward multiple to 2019 sales, we get our Future Enterprise Value in 2018 which we then discount back to today at a 10% discount rate. This analysis yields a price target of greater than $13 or 60% upside from today's price.

Financial SummaryIn three years, MiMedx was able to reach profitability and positive cash flows due to the high margin nature of the business. When your main raw material is donated to you, you have the ability to maintain high margins. Even with a rapid expansion of their direct sales force, the continued top-line growth will drive operating leverage. On October 18th, the company increased its share buyback by $10mm to a total of $23mm.

RisksCompetition - The key IP is MiMedx's Purion Process that produces dehydrated dual layer amniotic tissue. While we believe that the patent portfolio is robust, at any point a competitor could figure out a way to circumvent the Purion patents and create their own version of a dual layer product. Or a court could rule against MiMedx in any of their current or future IP disputes.

Key Man Risk - Pete Petit has been responsible for a lot of the value creation and execution at MiMedx. He is 76 years old and at any point could decide to retire or face health issues. Bill Taylor, President and COO, seems to be very capable of taking over the business and the rest of the bench is deep.

Reimbursement - MDXG products are paid for by a number of private and governmental payers. At any point, these payers can decide to stop covering or reduce reimbursement for MiMedx products, leading to compressed margins.

FDA Regulation - In August 2013, the FDA issued an Untitled Letter stating that MiMedx's micronized injectable product did not meet their standards of minimally processed human tissues and would require a new biologics license. The company has since had to stop marketing the product but can still sell it and it currently accounts for 10-15% of sales. The FDA could require the company to stop all sales of the micronized product or issue a similar ruling on any of their other products that did not originally require a full regulatory review.

Catalysts2016 Guidance being provided in mid-December

FDA resolution of the micronized injectable product (10-15% of sales currently) untitled letter would allow them to begin marketing the product again

More information on new products, including OrthoFlo (Q3 Earnings Call)

Positive reimbursement decisions by new payers

Potential Takeout - Chairman and CEO is almost 76 years old