Summary

Q3'15 earnings will likely disappoint.

Full-year guidance may be lowered.

Weak FY16 guidance provided on its Q4'15 call in February.

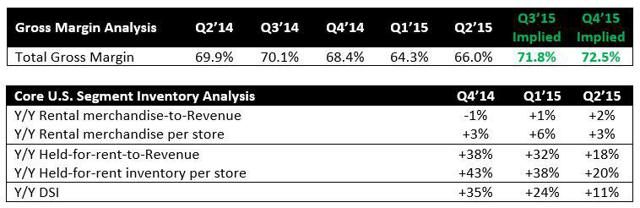

In my previous article found here, I outlined eight major reasons why I believed RCII's earnings are unsustainable. Specifically, I believed RCII's recent same store sales improvements were driven by the introduction of smartphone rentals in the 2nd half of FY14 and recent "90 days same as cash" sales promotions. However, I believed that (1) the same store sales improvements would begin to fade once smartphones revenue lapsed the year-over-year benefit beginning in Q3'15 and that (2) the 90 days same as cash promotion boosted same store sales with nearly zero-margin revenues that were not providing any economic benefit to the bottom line (hence cannibalizing margins).

Further, RCII had a significant inventory overhang as of Q2'15 and I believed that this portended a weak demand environment and that RCII would have to continue to utilize significant discounting in order to drive improvement to its same store sales but would make its back-end weighted gross margin guidance very difficult to achieve.

RCII will report its Q3'15 earnings after the market closes on Monday, October 26 and will hold an earnings conference call Tuesday morning before the market opens on October 27.

I believe this upcoming Q3'15 earnings report will be the first leg of how RCII breaks down. RCII will likely miss its Q3 EPS guidance of $0.43 and consensus estimate of $0.45 (due to weak margins) and lower its full-year guidance. However, if RCII continues to hold its full year guidance, I believe it will set up for an even bigger miss in an even more back-end weighted Q4. Further I believe the Company will likely give FY16 guidance that's lower than the current consensus estimate of $2.60 on its Q4 call. Look to the March 18, 2016 $30/$25 strike put options as the Company reports Q4'15 on Monday February 1, 2016.