Corporate earnings are up big! Great!

Buy!

No wait!

The economy is going down the toilet!

Sell! Buy! Sell! Buy! Sell!

Help!

Anyone would be forgiven for thinking that the stock market has become bipolar.

According to the Commerce Department's Bureau of Economic Analysis, the answer is that corporate profits accounts for only a small part of the economy.

Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly, or are too small to have much of an impact.

Wages and salaries are in a three decade long decline. Interest and investment income is falling, because of the ultra low level of interest rates. Farm incomes are up, but are a tiny proportion of the total. Income from non-farm unincorporated business, mostly small business, is unimpressive.

It gets more complicated than that.

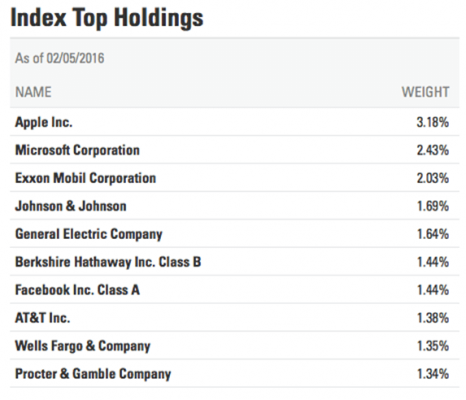

A disproportionate share of corporate profits is being earned overseas. So multinationals with a big foreign presence, like Apple (AAPL), Intel (INTC), Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes.

They really get to have their cake, and eat it too. Many of their business activities are contributing to foreign GDP's, like China's, more than they are here. Those with large domestic businesses, like retailers, earn less, but pay more in tax, as they lack the offshore entities in which to park them.

The message here is to not put all your faith in the headlines, but to look at the numbers behind the numbers. Those who bought in anticipation of good corporate profits last month, got those earnings, and then got slaughtered in the marketplace.

Caveat emptor. Buyer beware.

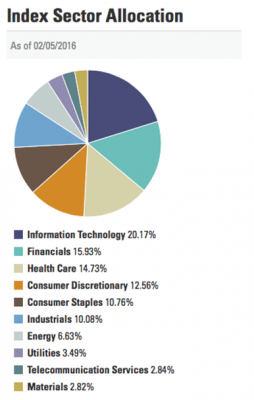

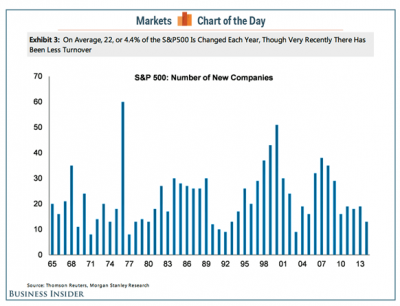

What's In the S&P 500?

Has the Market Become Bipolar?

The Diary of a Mad Hedge Fund Trader, published since 2007, has become the top performing trade mentoring and research service in the industry, averaging a 40% annual return for readers.

Its fundamental and technical calls on stocks, bonds, foreign currencies, energy, commodities, and real estate have been unmatched. It is published by John Thomas, a 50-year market veteran, and founder of the hedge fund industry.

John's elite team offers readers a daily market commentary, research letter, weekly strategy webinar, and Trade Alerts sent out instantaneously at market sweet spots. To receive a FREE 30-day subscription to our premium service please visit the Diary of a Mad Hedge Fund Trader at madhedgefundtrader.com