(This concludes my trilogy of articles discussing why natural gas & why now (here), which exploration firms I think offer the best opportunity (here), and, below, the pipeline, gathering, storage, and processing firms I believe are poised to profit most.)

Most natural gas pipeline companies are organized as MLPs – Master Limited Partnerships. MLPs are a little like REITs -- Real Estate Investment Trusts -- since they don’t pay income taxes directly. Instead, income is allocated among all partners (that would be you and me as shareholders) in proportion to the number of shares we own. Typically, there will be a general partner, whose responsibility it is to actually run the business, and we shareholders are the limited partners.

To qualify for the tax advantage, the IRS demands that 90% of an MLP’s income come from real estate, commodities, or natural resources -- mining, timber or energy. MLPs typically provide a tax advantage because much of their distribution is classified as a return of investment instead of income and is thus tax-deferred. Some people shy away from MLPs because they are a pain in the neck at tax time.

Personally, I’d rather put up with that pain in the neck once a year and sleep soundly the other 364 nights, but your mileage may vary. The MLP’s general partner will mail individualized “K-1” tax forms to each shareholder (technically, since you are a partner, “unitholder”) in March of each year that specifies the tax treatment of the prior year's payouts.

The fraction of distributions that is not taxable gives you a tax break each year but must be subtracted from your original purchase price to compute your cost basis. When you finally sell, some of your gain will be taxed at the lower capital gains rate, but the portion of the gain that results from deductions such as depreciation and depletion will be taxed as ordinary income. I’m OK with that – better to pay my taxes in ever-less-valuable dollars 10 or 20 years from now than losing the value of compounding those distributions in today’s dollars.

A lot of people will tell you that MLPs aren’t appropriate for IRAs and other tax-sheltered accounts. If you have hundreds of thousands of dollars in MLPs, that may be true. But the advice actually stems from a relatively remote possibility for most of us. That segment of the distributions designated as ordinary income will be considered Unrelated Business Taxable Income (UBTI) by the IRS, and subject to tax. But UBTI is typically such a small percentage of total distributions (and it won’t be taxed as long as the amount of UBTI from all holdings doesn’t exceed $1,000 annually) so it is seldom a consideration for many investors.

Balance that advice with this: if you buy MLPs when they are cheap and expect a fine capital gain, better to pay a little tax as UBTI but shelter your gains for as many years as possible. Particularly in my clients’ Roth accounts, where both dividends and share price gains accrue and compound tax-free, I have no problem purchasing MLPs.

The MLPs I like best are the ones that transport natural gas, because I see natural gas as America’s immediate, available today, cheap and abundant energy salvation. I’ll let others hold high the banner of quintupling solar from its current 12/100 of 1% market share to 6/10 of 1%. I’ll watch and shake my head sadly as the administration subsidizes, cajoles and spreads pork and spin for “clean” electric cars which are in fact fueled mostly by coal, since it provides the electricity.

You won’t always find a pure natural gas carrier so when I speak of the pipeline MLPs I’m talking about those that transport natural gas, oil, gasoline, and other petroleum by-products through their pipelines. These MLPs enjoy a stable and profitable business (though not necessarily a stable stock price given the alternating cycles of investor despair and euphoria.) Since pipelines almost never overlap, they have no competition on the routes they serve.

It’s important to note, before you buy a pipeline MLP, that you can’t evaluate an MLP the same way you evaluate most common stocks. Because these MLPs own assets that provide big depreciation charges, you might view their reported earnings and conclude they are basket cases. But those reported earnings aren’t the most important factor in assessing a pipeline MLP – it is cash flow that powers distributions and provides the best likelihood of continued steady distributions, and provides cash for capital expenditures and for acquisitions.

One final caveat. Among pipeline MLPs, there are two primary subsets: oil & refined products (like gasoline or heating oils) pipelines and natural gas pipelines. The oil pipeline operators tend to have a more stable business environment, since their fees are regulated and are based on the volume of product transported, not by the price of oil. Natural gas pipeline firms, on the other hand, often operate gas-gathering systems, which connect individual wells to public pipelines, which then connect to processing plants. This makes natural gas pipeline MLPs more exposed to changes in the price of the underlying commodity. However, most operators use hedging strategies to reduce their susceptibility to price swings and guarantee a steadier market at a steadier price.

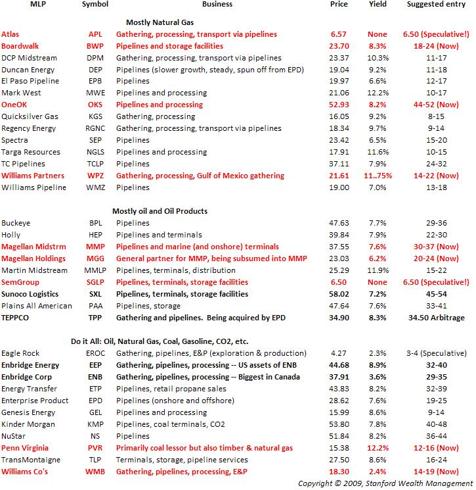

With all this as a solid foundation, here are some pipeline companies I follow. I’ll give you the basics so you can research them at your leisure and see if you agree with my choices. Those in bold are owned by officers and clients of Stanford Wealth Management LLC; those in bold and in red I still consider attractive for purchase even after the run-up of the past 6 months.

There are a couple anomalies in this list you may have noticed. Of the 13 companies we own, I only recommend 9 at their current prices and 2 of those are only for the most speculative accounts. Even those remaining 7 – BWP, OKS, WPZ, MMP, MGG, PVR and WMB -- are at the high end of their range for the trailing few months. You may wish to establish some percentage of your position now and add to it if it declines into the center of the range I’ve suggested.

The special situation above is that I’ve listed both MMP and MGG. If you buy only MGG, as we have done recently, it reduces the field to just 6 currently recommended. MMP is taking over the general partner’s share and will be self-managed. Since no deal is final until the ink is dry, MGG trades at a slight discount to the actual “takeover” price, giving us a small (less than a dollar) arbitrage opportunity here. I prefer MGG because I believe it is in all shareholders’ interest to approve the deal. I see it as highly likely to take place. If it doesn’t, I’m still pleased to own MGG. (TPP, not currently recommended – but owned by us – also has a slight arbitrage value as EPD has extended an offer almost certain to go through…)

That leaves the two speculative (!) MLPs, APL and SGLP.

I selected APL, even though it currently pays no dividend (a decision will be made in 2010 as to future distributions) based upon their partnership with WMB and the increased price I expect for natural gas. I think APL's JV with Williams gives them new-found credibility and a solid partner.

As for SGLP, it may or may not continue as a going concern. It was spun off from a private company desperate for cash. (It has now declared bankruptcy). SGLP is having to make its way in an unforgiving market environment. Worse, business has suffered as customers confuse them with the bankrupt former parent, which shared the same base name. (If management is on the ball, expect to see a name change in the near future. Even Enron Oil & Gas is prospering as EOG Resources!) The company has less than $3 million cash on hand and an unused credit availability under its revolving credit facility of just $27 million. They are skimming the surface of violating their bank covenants.

So why even talk about it? Sometimes an underdog like this, dealt a bad hand, has assets that may yet be realized. And I believe its price already reflects the current situation. They have, since the spinoff,reached a settlement with their former parent to clarify the division of asphalt processing and delivery assets; signed asphalt contracts with 13 new customers (resulting in 45 of SGLP's 46 asphalt facilities being under contract, with the majority of these agreements extending through 2011); negotiated an amendment to its credit facility, effective through June 2011; and signed new crude oil storage contracts at its Cushing, OK facility, increasing the total to 6.2 million barrels of shell capacity.

I wouldn’t bet the farm, but as an adjunct to a solid portfolio like the others recommended above, for those with a speculative bent I believe it may be worth a shot. Long live the underdog…

Full Disclosure: We are long the 13 issues in bold in the chart above.

The Fine Print: As Registered Investment Advisors, we see it as our responsibility to advise the following: We do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice.

Also, past performance is no guarantee of future results, rather an obvious statement if you review the records of many alleged gurus, but important nonetheless – especially so you are not over-impressed by the fact that our Investors Edge ® Growth and Value Portfolio has beaten the S&P 500 for 10 years running. What if this is the year we under-perform it?

It should not be assumed that investing in any securities we are investing in will always be profitable. We take our research seriously, we do our best to get it right, and we “eat our own cooking,” but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about.