Did anyone else notice that in the President’s State of the Union address, he criticized the denizens of Washington DC for all manner of sin, mostly for not working hard enough to help the great unwashed out here in the hinterlands to understand his various programs, domestic and foreign -- but then he continued to pound home his deeply-held conviction that Washington is the answer to every ill in America?

Maybe that’s why government, especially the federal government, is the biggest growth industry in America. And while he railed against Wall Street and the big banks, like all politicians, watch what they do, not what they say!

As near as I can uncover in my research, there were only two groups that got big raises, big bonuses, and continue to hire people for outsized salaries. Wall Street is one. They’ve taken our money and used it to play the markets, often pitting themselves against us in a zero-sum game. But those penalties, fouls, incongruities and slaps in the face are well-documented.

What’s less well-known is how the Beast grows from within. After all, quoting the President’s own words, they must attract and hire all manner of “experts” so that we poor mindless creatures don’t run with scissors and hurt ourselves. He said Washington must "make sure consumers . . . have the information they need to make financial decisions." Washington must "make investments," "create" jobs, increase "production" and "efficiency." Wow! That’s quite a task. Here I thought it was entrepreneurs, solid citizens, and good use of technology and innovation out here that did all those things. I mistakenly believed that all that came out of Washington was what always comes out the digestive tract of a gluttonous omnivore.

That’s not to say that the President is disingenuous. No, it’s just that he and his inner circle don’t know anything but “write grants, get taxpayer money.” Only one member of his cabinet has held a job in the private sector – Secretary of State Clinton was a lawyer. He and those he has gathered around him honestly believe that they need to change the way America works and the way to change it is via government programs, not by staying out of the way of those who create both opportunity and jobs.

Private industry is suspect by this crowd, not respected. Entrepreneurs are messy and disorganized and thus not as effective, according to these elitists, as someone with the right degrees and credentials doling out government grants to the deserving. So how do we attract the someones with the right degrees and credentials? Money, honey!

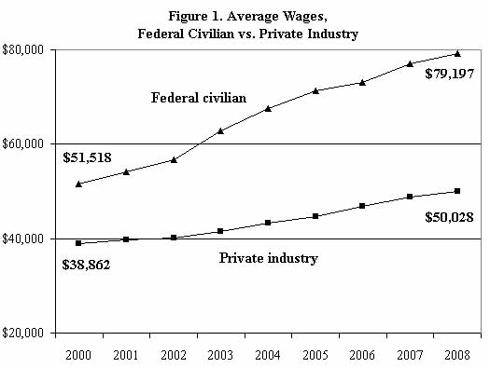

This chart comes directly from the numbers provided by the feral government’s Bureau of Economic Analysis. It shows that federal civilian workers make 66 % more than thee and me in the private sector. More recent data, for which I don’t have a chart, show that in the last two years, the average federal compensation is now more than double the average in the private sector.

But wait! There’s more!

Only Wall Street has enjoyed a hiring binge of more import than the federal government. (And at least they can figure “revenue per employee.” Since government is pure overhead and produces no income, the “revenue per employee for federal workers is a negative number.) To illustrate the hiring spree: In 2007 there was a grand total of one employee making more than $170,000 a year in base salary. Today, just two and a half years later, there are1,690!

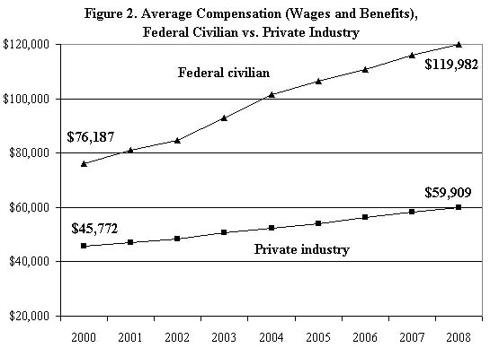

Figure 2 shows that the federal advantage is even greater when we include bennies and perks. Federal worker compensation averages an astonishing $119,982, compared to the private sector average of $59,909. This results in an overpaid group of elites who are making the most important decisions that affect the rest of our lives and livelihoods. They don’t “get” that we are having a tough time making ends meet because they get raises commensurate with real inflation (and better) – not just the specially massaged numbers put out by the Bureau of Labor Statistics and such.

(Anticipating the landslide of unfavorable comments from shills for the “public service” unions or from honest people who happen to have gotten a job working for the federal government and who say, “My salary is only $48,000” – well, ma'am, these are averages, so if you’re only making 48k, somebody else is making way above the average. And never forget, government is overhead, taxpayers are income. So we are all paying for those people way over the average, and we ain’t getting our money’s worth.)

The story actually gets weirder, if that’s possible. (But don’t despair; I do have a couple ideas as to how you might protect yourself via smart investing a bit later…)

I grew up studying graying images of privately-hired thugs beating up people who wanted --needed! -- to organize into unions to fight the rapacious robber barons. Once upon a time, unions helped this nation grow our human capital and our financial capital. But how the worm has turned today.

For the first time in our history, a majority of union members are government workers and not private-sector employees. Are they pushing for safer working conditions as the coal miner unions did? No. Are they pursuing better ways to care for family members if something bad happens? Not really. They are advocating one thing and that with a singlemindedness that would make the robber barons proud – they want more. More money, more health care, more pensions, earlier retirements, more double-dipping. More.

These aren’t blue-collar workers striving to put food on the table. Mostly they’re gold-collar workers who want to add some diamonds to the mix. According to BLS numbers, 7.2% of private-sector workers were union members in 2009. 36.8% of government workers are.

When the biggest unions are public unions (which, by the way, even FDR thought was a dreadful idea – the first one only came into being – in New York City -- in 1958…) their agenda is radically different from those of auto workers, steel workers, coal miners and truck drivers. The latter are being edged out in political clout as the new unions flex their bargaining muscle.

Of course this isn’t exclusively an issue at the federal level. In California, 85% of the state’s employees are unionized. For them, the state’s unfunded pension liability has increased by 2,000% since 2000! (The state’s revenues increased by a slightly lesser amount -- 24%.) There are now over 15,000 state government retirees receiving pensions of more than $100,000 a year. Many were able to retire at age 50 with a pension that equals 90% of their final year's pay. In California, 50 is the new 65. The pensions for these retirees are guaranteed by taxpayers forever—regardless of what happens to their own private retirement plans.

As a result, California is losing its entrepreneurs and innovators to states with less-punitive regulatory and tax laws at an alarming rate, yet with it’s highest-pay-and-benefits-package in the country for state employees, it won’t lose a single bureaucrat. Not a good trade-off. And the state’s options are limited. The President said the other night we are going to slash expenses (except for Social Security, Medicare, Homeland Security, etc., which together account for 83% of the federal budget.) That leaves just 17% which, if you “slash” by 20% -- fat chance – you’ve now reduced the deficit by 3.4% -- before additions for pork, new ideas for protected niches, dealer prep, undercoating, and delivery.

Ouch.

I promised I would suggest a couple ways to protect yourself from the train wreck that is surely coming as fiscal irresponsibility at the federal and state level meet economic reality. I grew up a poor kid, but my parents had the honesty to say, “We can’t afford it.” I wanted the same things other kids did, but I grew to respect the simple fact, simply stated, that we can’t afford it.”: Sometimes we could, sometimes we couldn’t. Why should it be any different for our state and federal governments?

A crunch is coming. Whether it is a freeze on federal and state wages, at least until the private sector and the average income-not-overhead worker starts seeing some wage gains; or a reduction of the diamond-and-sapphire-encrusted benefit packages are scaled back to more accurately reflect parity with the private sector, or some other reasonable solution, it will happen.

Until it does, I would avoid the municipal debt of at least New York, New Jersey, Wisconsin, Oregon, Vermont, Michigan, Illinois and California. Sometimes what not to do is as important as what to do. In this case, if you don’t own ‘em, don’t buy ‘em. If you do, now would be a great time to sell them.

In addition, I think the rest of the world sees rather more clearly what federal socialism does to capitalist entrepreneurialism. Many of the “emerging” nations were once socialist or communist – Brazil, Russia, India, China (which still is, at least in name), Indonesia, Eastern Europe, Israel, et al. Every one of them is now “Emerging” or “Developed” rather than Third World precisely because they threw off the yoke of Big Government! They know better than to keep buying our Treasuries when they see the madness of our policies.

While there might be a short-term flight to the “safety” of Treasuries if the market experiences a major decline, the long-term result is higher inflation and a lessened value for Treasuries. I am shorting them via the ProShares UltraShort 20+ Year Treasury ETF (TBT) and the Direxion Daily 30 YR Treasury Bear 3X ETF (TMV).

Knowing that inflation will be the most likely trigger to occasion belt-tightening, I’m also buying the iShares TIPS Bond ETF (TIP) and, as a way to diversify away from 100% US dollar fixed income investments, the PowerShares Emerging Markets Sovereign Debt Portfolio (PCY), which selects government bonds from (currently) 17 emerging market countries. The countries oare selected annually and the membership list is rebalanced quarterly. This is a play on the likelihood that these more responsible nations will see their sovereign debt rise in value as ours declines.

If you absolutely must buy Treasuries, at least buy short-term paper. The one I’d look at first is the PIMCO Enhanced Short Maturity Strategy Fund (MINT), an actively managed ETF that holds short duration (typically less than one year) investment grade debt securities, including Treasuries.

Finally, I suggest you research quality non-US names that pay a great dividend in other currencies. A few for your consideration might include Atlantic Power (ATLIF.PK), Bell Canada (BCE), New Zealand Telecom (NZT), France Telecom (FTE), and Pengrowth Energy (PGH.)

Author's Disclosure: We and/or clients for whom it is appropriate are long ATLIF, BCE, NZT, FTE, PGH, TBT, TMV, TIP, PCY, and MINT.

The Fine Print: As Registered Investment Advisors, we see it as our responsibility to advise the following: We do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice.

Also, past performance is no guarantee of future results, rather an obvious statement if you review the records of many alleged gurus, but important nonetheless – for example, our Investors Edge ® Growth and Value Portfolio beat the S&P 500 for 10 years running but will not do so for 2009. We plan to be back on track on 2010 but then, “past performance is no guarantee of future results”!

It should not be assumed that investing in any securities we are investing in will always be profitable. We take our research seriously, we do our best to get it right, and we “eat our own cooking,” but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about.