For those of you who have been in DGAZ and have been following my articles, the past few days has been very rewarding after working through the Natural Gas spikes. We have now made the bullish turn in DGAZ and now want to look for what we expect next and how I plan to trade the ranges, as I see them.

First, lets look at an update on the Natural Gas spot chart:

From the chart, we see some of the following:

- We appear to have broken through resistance to below the spiking pattern we saw end of January and early this month.

- Notice that MACD crossed over, confirming a bearish turn

- Current price is around 4.6, with upper resistance at 4.8 and support at 4.4.

I suspect that we will trade in this 4.4 to 4.8 trading range for up to a few weeks, then most likely, break below the support at 4.4 to then enter a trading range of 4.0 to 4.4. If there is another severe winter storm or some other fundamental change that causes us to break above 4.8, then we may look for the potential to go back to test the 5.4 level. But, at this time, I don't think this is highly probable. So, we will want to take advantage of the opportunity to trade this 4.4 to 4.8 range, and prepare for eventually working in the 4.0 to 4.4 range.

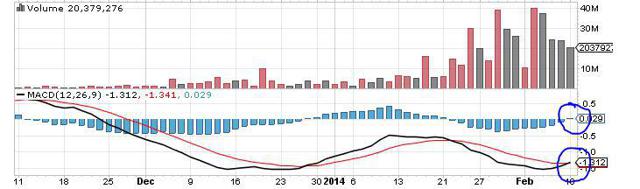

Now lets look at the updated DGAZ chart:

From the DGAZ chart, closing at around 4.60 today, we appear to be nearing resistance at 5. While in this current area 4.6 to 5.0 in DGAZ, we should expect some resistance and a pullback, but my expectation is this pullback will not take us lower than perhaps 4.1 to 4.25 as long as Natural Gas continues to hold its 4.4 to 4.8 range. The chart confirms that we have made and confirmed the bullish turn with high volume and the MACD crossover. In this near-term bullish trend, we may pull back but I think we should see DGAZ break through the 5.0 level, then find a trading range between 5.0 and about 7.0 where we will find some resistance at the moving average.

I plan to take the opportunities given in the trading ranges to reposition - adjust cost basis and take some profits along the way, selling some shares as we work to support levels and buying back lower cost when we hit the resistance levels. I may also trade options in BOIL and/or KOLD around these trading ranges as well.

Disclosure: I am long DGAZ.

Additional disclosure: I may trade and reposition DGAZ shares based on dynamics associated with the Natural Gas Market. I may also trade in and out of UGAZ, or buy/sell calls and puts on BOIL or KOLD (2X Leveraged ETFs on Natural Gas Index).The thoughts and opinions in this article, along with all stock talk posts made by the Author, are my own and are shared on the basis of helping others learn, to provoke other points of view that help us all on our journey to become better investors. My posts are never intended to provide investment advice. Investors should always view multiple sources of information in their due diligence process.