The Coca-Cola Company (KO) a company founded in 1886, and has been publicly traded company since 1919. The following article will aid me and the potential investors decide to what extent, is the stock, refreshing in nature.

The Coca-Cola Company

The company is a multinational manufacturer which markets and retails world's largest non- alcoholic beverage. KO sells over 57 billion beverages and is consumed in more than 200 countries through its 500 brands. KO offers sparkling (Coca-Cola, Diet Coke, Sprite and Fanta) and still beverages (waters, juices, ready-to-drink teas and coffees, energy, and sports drinks). It owns a world's largest beverage distribution system network. This includes company-owned bottling, other independent bottling partners, distributors, wholesalers, and retailers.

The success of the company depends on their ability to successfully bond with its customers and meeting their needs by becoming a part of their lifestyle. The success also depends on how well can the company's employees can execute the business plan, and create value for their share-owners.

Business Framework

The net operating revenues of the company are generated by selling concentrates and syrups to authorized bottling and canning operations. These operators combine the concentrates with sweeteners, still water/sparkling water, or combine the syrups with sparkling water to produce the final desired beverages. The final beverages are then sold in cans refillable / non-refillable glass and plastic bottles and sold to retailers. In some markets (outside US), the company sells concentrates for fountain beverages to bottling partners, who then manufacture fountain syrups and sell the final beverage to restaurants.

The company's competitors include PepsiCo, Nestlé, DPS, Groupe Danone, Kraft Foods Group, and Unilever. Beer companies, in some markets have also been identified as their competition. Likewise, numerous regional and local companies and, private label beverages, have also been seen as rivals in some grocery stores. At the start of 2014, the company had approximately 150,000 employees.

Financial Health

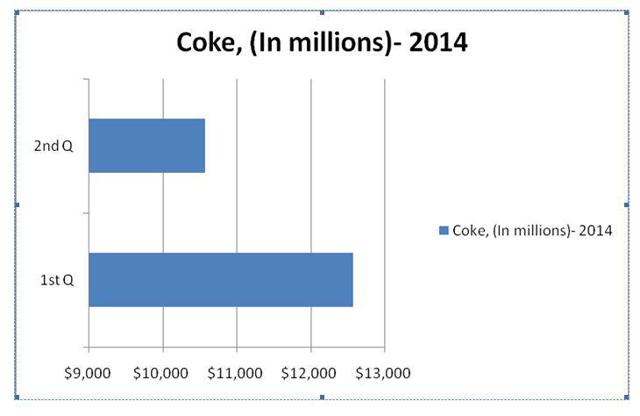

As per company's second quarter company report, net revenues, reduced 4% in the second quarter. Operating income declined 1% in the same quarter, while EPS was $0.58, down by 1%. Total company's volume grew 2%, Coca-Cola Americas grew 1% and Coca-Cola International grew 2% in the quarter. Cash generated from operations amounted to $1.1 billion. KO gained volume and value share in global core sparkling beverages in the quarter due to the company's sponsorship of the FIFA World CupTM globally and the marketing gimmick of "Share a Coke" was initiated internationally.

Muhtar Kent, Chairman and Chief Executive Officer of The Coca-Cola Company viewed this performance as, "At the beginning of this year, we shared our strategic plan to restore the momentum of our global business. As we now reach the midpoint of the year, we have delivered sound financial performance year to date and demonstrated sequential improvement in our global volume growth."

He remains confident in the company's 2020 vision and believes in consumer love and long- term performance goal. KO.'s net profit margin deteriorated from Q4 2013 to Q1 2014 and from Q1 2014 to Q2 2014.

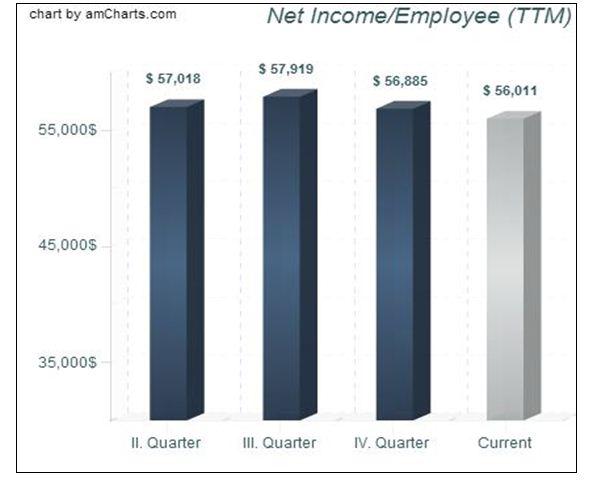

Net income per employee has also been reduced in this quarter.

Source: CSI Market

Moreover, sequential volume growth has a rapid acceleration of 3%. The company has a strong US price/mix (+3% in CSDs). Strong Latin American performance could also further improve in 2014, and further grow in other emerging markets such as China and India.

In the US, KO appears to gain the right balance between volume growth and pricing. The overall stable volume and positive price/mix performance in the US market will prove positive for the company in next Quarter.

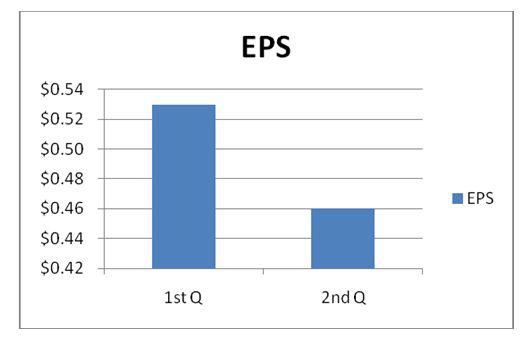

According to Credit Suisse, KO will face challenges in other regions such as the Middle East and Russia due to stagnation in their disposable income. Therefore, EPS of FY14 has been further lowered by 2% to reflect these diverse elements. KO generates 80% of its income abroad. The earnings from key emerging market currencies and Yen would improve in future.

Valuation

As per the yahoo finance analyst estimates, the next quarter average earnings estimate is $0.46. Current quarter earnings were $0.53, and the current price of the stock is $39.54. Based on this, the average price estimate is $34.31, making the stock overvalued at the present moment in time.

KO's Savings Program

KO initiated a new savings plan which has proposed to bring down the cost by $1billion, and expect most of these savings to be reinvested. This will assist the company to invest in the media (invest an incremental $400 million in 2014) and would help to increase the confidence of the management to increase of volume growth in 2014.

Additional Initiatives

The company can also eliminate unnecessary cost of its supply chain system. Operating Margins in US Market can be fruitful if the company decides to use smaller package sizes. Franchising is another factor which the company can look into.

Other Risks/ Concerns

As per the latest SEC filings, the company believes that issues such as obesity, water scarcity/ poor quality, changes in the non-alcoholic beverage business environment, loss of key retailers, and increased competition could hurt their business.

Failure to expand the business operations in developing and emerging markets can negatively affect the growth rate. Likewise, if the interest rates increases, then it would also affect the net income. Moreover, if the company is unable to maintain good relationships with their bottling partners and if the financial condition of these partners deteriorates, it can hamper the revenues of the company.

The company believes that the global /local market conditions and the economic environments in both local /international markets, fluctuations in foreign currency exchange rate, can affect the company's financial health. Furthermore, issues such as harsh weather conditions, unforeseen natural disasters, and social - political disturbances may affect the sales and earnings.

Conclusion

I am bullish on the future of KO as the management is committed to expanding its business globally. Currently, the stock is of undervalue therefore; it's a good option for long- term investors to invest in this stock. The company still has lots of prospective to progress on ROIC. Hold it and buy more in the next quarter as the stock has a lot of probabilities to outperform.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.