There's good and bad news for Charles Schwab (SCHW) shareholders. The bad news is that rates are way down, crimping their ability to charge meaningful management fees on money market accounts. The good news is that rates almost MUST go up in the future, as the USA embarks on a massive debt binge.

In a release this morning, Schwab noted that positive data on metrics such as new assets and trading volume was offset by low rates.

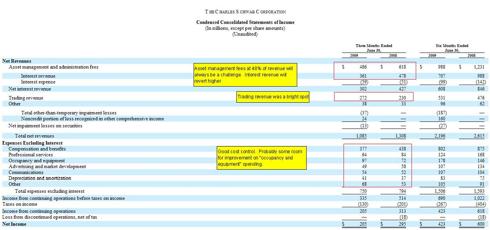

“As discussed previously, declining yields in the company’s proprietary money market mutual funds are leading to increased management fee waivers. We currently anticipate these waivers will reach approximately $80 million for the third quarter, up from $30 million in the prior quarter, which leads us to expect a sequential decline in asset management and administration fees of as much as 8 to 10%. These waivers will likely remain at heightened levels until rates begin to increase. We’ve also discussed how the lower rate environment has reduced investment portfolio yields, which in turn could result in a modest 2 to 4% sequential reduction in third quarter net interest revenue even as we continue to grow our client base.”

The thing to take away here is that Schwab, probably the best operator in this space, is still in the business of gathering assets in an industry with plummeting pricing power. Their best bet for upside is increased trading revenue, which unfortunately means encouraging your clients to "churn"their accounts, likely hurting their investment performance.

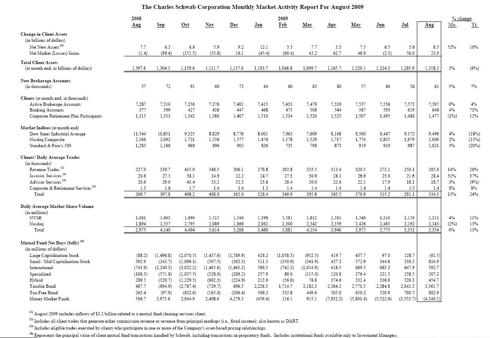

Also interesting is Schwab's data on transactions and money flow. Clients look like they've mostly participated in the upside of this rally. Surprising to me is the lack of interest in large cap funds.

Low rates a continued drag for Schwab

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.