Is Quantitative Easing having more impact than the Government Shutdown? Ross Aldridge Las Vegas Nevada had RAC consultants review the information that was revealed by Mike Patton:

September 18, 2013 was an historic day in the annals of the Dow Jones Industrial Average (DJIA). It was during this day the Dow reached its highest mark ever, albeit brief. When the final bell rang, the bulls had triumphed, and despite a slight retrenchment from its momentary summit of 15,709.60, it ended the day at 15,676.90, setting a new record close for this 117 year old benchmark. But that was the peak of that mountain, at least for now. Since then, this grandfather of all stock indexes, along with its domestic siblings, and many of its global cousins, has been steadily falling. Not to suggest this is unusual. In fact, it's fairly normal. Well, almost normal. You see, this was also the day the Fed announced it would not begin to taper (i.e.; reduce the amount of U.S. monetary expansion), an announcement received with tremendous enthusiasm. And, this was one of the Dow's more volatile days with a 240 point swing from top to bottom. However, as the bulls celebrated their short-lived victory, they forgot, or perhaps chose not to remember, that another formidable opponent was waiting in the wings. And this opponent was poised and ready to take on the largest economy in the history of the world. That opponent? The fiscal year-end budget battle. The very next day, when the champagne was gone, and the hangovers remained, investors nervously began to sell stocks as they feared the two political parties would be unable to reach an agreement on funding the federal government. For without this accord, a government shutdown loomed as a real threat. Fast forward to the end of its fiscal year, and as predicted, on midnight September 30th, all non-essential federal government employees were sent packing for an unplanned vacation for an undetermined period of time. Which brings me to my point.

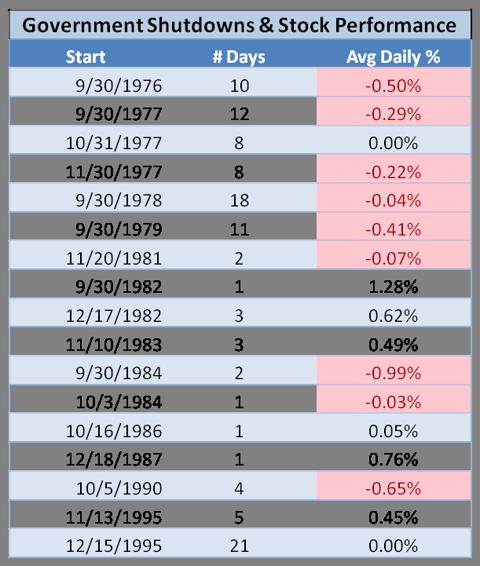

Since 1976, the bi-centennial of this great nation, there have been 17 government closures, with the eighteenth in progress. What intrigued me most was to compare this current shutdown to those of the past. Therefore, I decided to do a little excavating to see what I could uncover. Here's what I found. Excluding the current closure, the longest government shutdown began December 15, 1995 and lasted 21 days. President Clinton, hence, the Democrats, held the White House while the Republicans controlled both sides of Congress. That was the longest. The shortest disruption lasted one day. The average length of a shutdown is 6.5 days.

As mentioned earlier, there is an economic impact when our elected officials cannot agree on how to spend our money. One expert stated that for every week of the shutdown, GDP loses 0.1%. As difficult as it may be to measure the precise impact to our economy, it's fairly straightforward to calculate the performance of the stock market during these budgetary break-ups. Therefore, this is where I have concentrated my efforts. Are government shutdowns really bad news for stock investors? If all you consider is the current closure, you will likely conclude they are very bad for stocks. After all, the market has been falling since they turned out the lights. However, as with all things, perspective is so vital. And this is exactly what I hoped to gain by analyzing the 17 prior shutdowns. The following table illustrates the date of the shutdowns, how long they lasted, and the average daily percentage change in the Dow for each. All negative percentages are highlighted in red.

As you can see, the average daily percentage change ranges from a positive 1.28% per day to a negative 0.99%. Now that we have all the data we need to conduct a thorough analysis, we can answer the relevant question. Do government shutdowns have any effect on the performance of the Dow? Here are the results. The average daily percentage change of the Dow during the days when the government was closed was 0.03%. The average daily percentage change of the Dow from September 30, 1976 through October 3, 2013, was 0.03%. The results are exactly the same!

In short, the stock market's reaction is really no different when the government is working from when it's closed. Of course, this depends on your definition of "working." But I'll leave that bit of subtlety for another time. For now, it's a good idea to keep your eyes open for some buying opportunities as stocks are down from their record high. However, don't forget, there's another, more formidable opponent stepping into the ring. That opponent? The debt ceiling! And this issue is of greater importance than the current budget battle. Hence, the ride could get a little bumpy if Congress and the President fail to come to an agreement. As a comparison, if you've ever been white-water rafting, you realize the importance of having a well-qualified guide. The point? This may be good time to make sure you have a competent guide to help you maneuver the rapids which lie ahead if Washington doesn't reach an agreement on the debt ceiling.

Now lets review the market performance of the market based on Quantatative Easing dates:

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.