*Subscribe to my RSS*

U.S Real-Estate Market Capitalization

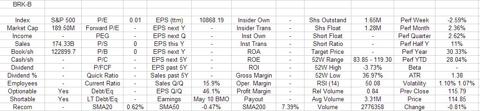

Market capitalization of the U.S. real-estate sector has shown a substantial increase to $18.6 trillion from $15.6 trillion, even taking into account the expected listing of U.S.-based realtor Berkshire Hathaway Inc. (BRK-B) on Sunday at its issue price of $115.79. The sector's market cap on the New York Stock Exchange (NYSE) will jump to 3.85% from 1.9% of NYSE's total market cap.

Worldwide Real-Estate Outlook

The global real estate-market grew to $1.2 trillion from $368 billion, according to a survey conducted in recent years. Analysts have pointed out that the doubling of the market cap of real-estate stocks worldwide is a positive sign for investors.

The Berkshire Breakdown

Berkshire Hathaway, run by Warren Buffet, disclosed details of its stock holdings at the end of its second quarter. Berkshire Hathaway's board of directors also reported that the company had made changes in its stock portfolio. The company disclosed that it had taken a new position in Dish Network Corp. (DISH), since the share prices were low. Berkshire purchased 547,312 Dish Network shares in the second quarter. Berkshire Hathaway also purchased 17,769,457 Suncor Energy (SU) shares. Suncor Energy reported net Q2 2013 results of $934 million, or $0.63 per common share. The results showed a great decline compared to 2012, which was $1.249 billion, or $0.80 per common share.

Strong REIT Outlook

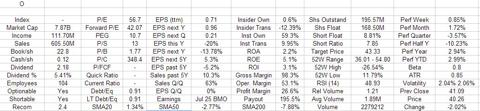

Realty Income Corp. (O) reported Q2 results on July 25. CEO Tom A. Lewis told the media that revenue of $866 million had been earned through new acquisitions. He also said the company's revenue had risen 60% compared to the same period last year. Realty Income shows that the company's current revenue is $184.3 million and that net income available to common stock holders was $0.23 per share. The acquisition of American Realty Capital Trust (ARCT) yielded the company rental revenue of $3.2 billion.

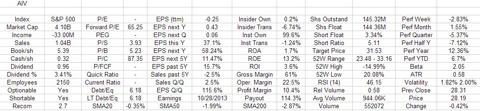

Apartment Investment and Management Corp. (AIV) reported that its 2Q net income to common stakeholders was $0.07, $0.16 less than Realty Income Corp. A substantial increase in its Fund From Operations (FFO) rose to $0.49 from $0.38. Estimated revenue for the second quarter had been estimated at $264.51 million, while actual revenue came in at $259.66 million. There was a considerable increase in revenue to $259.66 million from $253.29 million in the previous quarter. The company anticipates that its fiscal results will be in the range of $0.18 to $0.26 per share. Analysts expect the company to report earnings of $2.03 per share for FY2013.

Conclusion

The current situation indicates that now is a good time to purchase real-estate stocks intended for long-term investment and end use. The cyclical nature of the market also is expected to push up residential property rates over the next three years. Even as uncertainty plagues the current economic environment, major finance corporations estimate that investing in real estate will lead to a good return on investment.

Additional disclosure: *Check out, guruvix.com: If you have an interest in a company or options, message me! I will be more than happy to help you learn or to do an Options report for you!