These instablogs and the people who maintain them have no relationship whatsoever to Axion Power International. To our direct knowledge no person with a current relationship to Axion Power International other than being a shareholder participates in these instablogs.

---------------------------------------------------------------------------

Al Marshall's notes for CEDIA, September 6, 2012

RoseWater General Update - RoseWater is focusing on Residential Hub (RH) in the US because the high-end residential market and the US are what they know best and believe will come quickest. Eventually, they will expand internationally. At the show, folks from several Asian countries visited the booth and expressed strong interest. I didn't learn much about their other initiatives except that a university research project in Ontario is expected, in the short-term, to help size future Hub devices (2kw?).

Residential Hub Technical - Three main electronics components: Charge Controller, Inverter, and Uninterruptible Power Supply. I took photos of each with my cell phone and they are posted at the end of these notes [APH: photos replaced with links to them for various reasons]. Note that the inverter in the RH can perform that function for solar panels, eliminating about ~25% of the cost of a solar panel system.

Multiple hubs can be linked together although most of the examples I overheard involved a single bank of electronics being paired with up to five cabinets of batteries.

The first hub, which is the unit at the show, was custom built by Axion in New Castle (at the electrode plant not the battery plant). Future units will be built by a third party. Suppliers may change as Axion's purchasing process is still underway. I believe the unit displayed at the show has an indoor cabinet. Future units will be outdoor capable. Inferred that each Hub will have an IP address since the device can be remotely monitored and I believe controlled. I latched onto the issue (really opportunity) that Rosewater should collect data from all the hubs and use it to assess utility power quality. This information could be used to help installers sell, particularly if smaller hubs are introduced in an attempt to go down-market.

Competition - I didn't take the time to walk the entire show and gather info on competitors. I learned a little bit from the RoseWater folks. Pricing seemed to be in the ballpark of the closest comparable products, which really aren't that comparable. Mario pointed out that the major competitors (same guys mentioned at the annual conference) are building products aimed for the mass-market that are priced like the Residential Hub, something he believes won't work for the high-end residential market. I believe the biggest differentiator is Joe Pic's understanding of this market segment and the PbC battery.

Competitors that approach the Hub in capabilities will likely have lithium Ion batteries, but cost will limit them to only have a small number of batteries. Competitors that use lead acid can have similar storage capacity, but their units will be very short-lived if the unit provides the same level of power conditioning as the RH.

Note, this relates to the first question I asked: How important is the PbC's strengths in making the RH a truly differentiated product? The answer was that the batteries will be frequently tapped to provide power to fill power gaps and to accept power to eliminate power spikes. Thus, the combination of the electronics and the batteries will enable the RH to provide "perfect power" and to do it for many years. The safety aspects of the PbC are also important for indoor use as is the PbC's capability to operate outdoors. Looking at in another way, LI can't be used outdoors but is a safety risk indoors.

Another form of competition is a device which the helpful installer called a "power conditioner". This device (costs $7-10k) apparently smooths the spike in power surges but doesn't have a storage capability to fill in the valleys and otherwise create the high quality power provided by the Residential Hub.

I am not technical at all, so hopefully the above info is a good starting point for others who are more knowledgeable.

Selling Residential Hub - RoseWater is very concerned about making sure the Hub is profitable for the installers. It appears that RoseWater will allow, if not encourage, installers to add some sort of markup (or give discounting) on the RH to add margin even though they will also be charging for installation.

As I mentioned yesterday, most of the installers weren't concerned about the price. I remember one case where upon being told the price, the guy just shrugged, not even bothering to say "they'll pay it", which was the reaction from most of the folks. The most skeptical installer was a guy who agreed on the merits of the Residential Hub but thought he'd need help justifying the sale. This sparked a long and productive discussion, which in the end put him at ease.

No one believes there will be issues selling RH to the homeowner installing $500,000 in electronics. The RH will protect and extend the life of all that equipment while adding access to renewables and a generator (generators provide low quality power so it is particularly important to fully condition that power). That's a no-brainer. The open question then becomes at what total system cost does $45k+ for a Residential Hub no longer seem automatic.

Another factor that is good news for us is the fact that these very high-end homes tend to have unique circumstances associated with them. Often they are in isolated places that tend to have unreliable and poor quality power. Mountain homes fit this. One example was a home on a hilltop in California in an area where there are a lot of wildfires. Whenever there is a fire, the utility turns off the power in the entire area, often for an extended period. Apparently, this happens quite frequently.

One of the most interesting things I learned came from one of the installers. After visiting the booth, I asked one if he'd be willing to take a few minutes to answer some questions for me. The gentleman and his wife ended up talking with me for at least twenty minutes and shared a lot of fascinating information and viewpoints.

One very interesting point he made that relates to this topic was that nearly 100% of the very high-end homes being constructed today include wiring in the garage to support charging an electric car. He went on to say that 50% of these homes have the charging equipment installed. It would seem that these homeowners have come to accept electric cars to an entirely different degree than has the general public. I laughed and thought of JP when I heard this. It did make me think that RoseWater ought to market to electric car owners and purchase mailing lists of these owners if possible.

Another point by this same installer was that he thought the biggest problem selling the RH is that installers are generally electronically oriented and tend to lack expertise and may be intimidated by electrical systems. This point indirectly came up with another installer earlier in the day who told a story about another installer who caused a great deal of damage to the electronics in a house when he tried to test a generator that he had incorrectly connected.

As I mentioned earlier, I don't have any information to share on sales or how many sales RoseWater is expecting to make. They did share with me a number that may be a good starting point when it comes to the size of the potential market. I was told that roughly 4,000 high-end home electronic control systems like the ones sold by Crestron are sold in the U.S. each year (more on Crestron below). I believe that number is for systems valued at $100k or more (presumably doesn't include dealer installation and configuration costs of an additional 25% to 50%).

By my math, each 1% share of that market earned by RoseWater would likely yield about $1m for Axion, with half of that being PbC related and the other half a wag on Axion's pricing of the other components.

To better learn about these systems, I went to the Crestron booth, which appears to be the 500lb gorilla in the space based on their sales: ~$500m and presence at the show (their "booth" was 4-5 times as big as the second largest booth at the show). Privately held Crestron's products include the electronics and controls for: intercom, music, lights, climate, TV, shades, and security. At the show they were promoting their API (application programming interface) for installers to configure and customize systems. There's a recent Forbes magazine profile of the founder and CEO, who I saw at an early morning panel discussion on the future of the industry. If we want to learn about the market and potential of the Residential Hub, we should, amongst other things, try to find out as much as we can about Crestron.

RoseWater shared the booth with a company called Energysquad.com, which is their new Maryland dealer and I believe their first. EnergySquad seems to be a mixture of distributor and dealer but because the RH units will likely be made to order, I think their role will be more as a dealer/installer. I'm not certain of that however. Most of Energy Squad's booth seemed to be devoted to LED lighting although they have a great many other products and are adding more aggressively. I haven't had a chance to research Energysquad.com beyond what I learned from talking to their folks at the show.

Axion update mainly based on my conversation with Vani Dantam - Interest is very strong and his team is responding to a lot of inquiries/testing projects. I was not able to ascertain if activity has continued to increase beyond the high level reported in the annual meeting.

Lots of international interest. Vani had just that morning received an inquiry from a country in the Caribbean for batteries to support a solar project. He's also had lots of interest from India although he noted that Axion would need to establish support infrastructure there.

I sought and received Mr. Dantam's confirmation about the method JP uses to estimate PbC sales. He agreed with my statement that since Axion is charging customers for test batteries that John's PbC sales estimate will reflect the level/trend of testing activity.

Vani is well aware of the need to show sales before the next fund raise. He was optimistic that there would be good news before year-end. Obviously, he can't say much, but I had to voice the concern that every one of us must share.

There is one thing I can say about the personnel issues that several people have brought up. Marketing the Residential Hub to the CEDIA audience is obviously Joe P's thing. He conceived of the product two years ago, championed it, and eventually won Mr. Granville's approval. At CEDIA, Mr. Granville and Mr. Dantam stayed in the background. They sometimes listened in on the conversations between the RoseWater people and the installers but didn't say much, if anything at all, during those conversations. They seemed to be there for the same reason I was there.

On a related note, this is probably a good opportunity to point out the respect Joe showed to us Axionistas. He could have easily told me to go away and come back later when fewer people would be in the booth, or just have me hang back more. Instead, several times he told me to come in closer (Joe was in the process of losing his voice so it was very difficult to hear him while also keeping a respectful distance). A few of the installers seemed to take note of all the "hangers on" but none of them let it bother them. Clearly Joe understood that I was representing all of you and he thought that sufficiently important to justify allowing me to hang out in what was a relatively crowded booth.

In conclusion, I can't say this is comprehensive. I know I'm late getting this out. I'll add more as my recollection permits and am glad to answer your questions as best I can. I'll also go and review the questions on the instablog and add here any further responses to those questions.

---------------------------------------------------------------------------

In consideration of potential bandwidth and other concerns, we've omitted the pictures that APMarshal provided in APC 150. You can revisit Axion Power Concentrator 150: Sep. 12, 2012: APMarshall's Notes From CEDIA September 2012 to read the article and view the pictures or click the below links to just view the individual pictures.

https://static.seekingalpha.com/uploads/2012/9/11/1631091-13474164623192055-Axion-Power-Host_origin.jpg

https://static.seekingalpha.com/uploads/2012/9/11/1631091-13474165613913403-Axion-Power-Host_origin.jpg

https://static.seekingalpha.com/uploads/2012/9/11/1631091-13474167047484539-Axion-Power-Host_origin.jpg

https://static.seekingalpha.com/uploads/2012/9/11/1631091-1347416800736399-Axion-Power-Host_origin.jpg

---------------------------------------------------------------------------

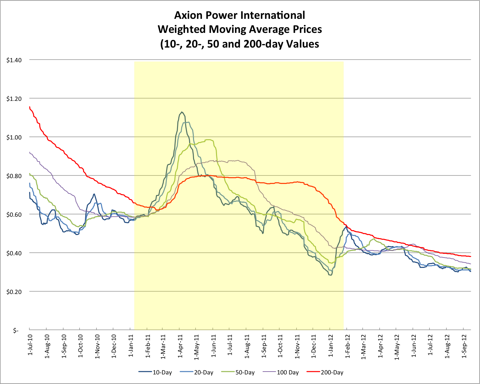

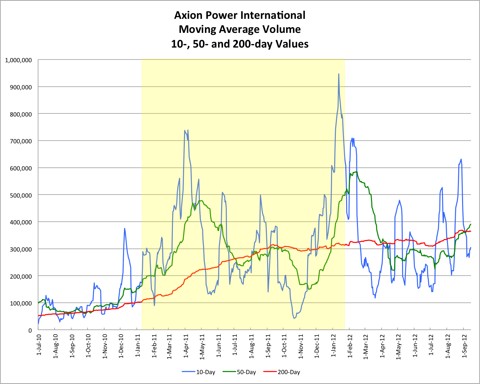

John Petersen has provided price and volume charts updated through 9/14/2012.

---------------------------------------------------------------------------

Axion Power Concentrator 149: Sep. 9, 2012: Rosewater Energy Hub Articles, John Petersen's Updated Graphs, have links to several recent Rosewater-related articles and earlier charts from John Petersen.

---------------------------------------------------------------------------

Links to valuable Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Chart Tracking. HTL tracks and charts AXPW's intra-day statistics.

Testing Summary Statistics On Stocks. FocalPoint Analytics has begun an instablog that will apply statistical disciplines to metrics of stock activity to produce summary indications of likely actions going forward. Well worth a visit.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.