John Petersen was invited to present at the 13th European Lead Battery Conference, ELBC. He did a bang-up job, in our opinion, and has graciously permitted us to link to a SlideRocket Version of his presentation. It is highly recommended that you take the time, around 20 minutes, to view this if you've not seen it. It is not focused on Axion, but presents some opportunities and challenges facing the LA battery industry at-large.

Our very own (claiming him without asking!) Brishwain was able to attend some presentations and talk to some knowledgeable folks, including John Petersen and Enders Dickenson, Director of Research and Development at Axion Power. Brishwain's observations can be found in his comment section, but at this time these are particularly relevant.

- "... many auto OEMs ... looking at going the two-battery route ..."

- the Ford rep "... whole presentation essentially showing how pathetic the SS performance was ..." when discussing the current battery use.

---------------------------------------------------------------------------

The prior concentrator was headed up by APMarshall's Sep 2012 CEDIA Notes (discussing the Rosewater Residential Hub product), which are worth review if you've not seen them before.

---------------------------------------------------------------------------

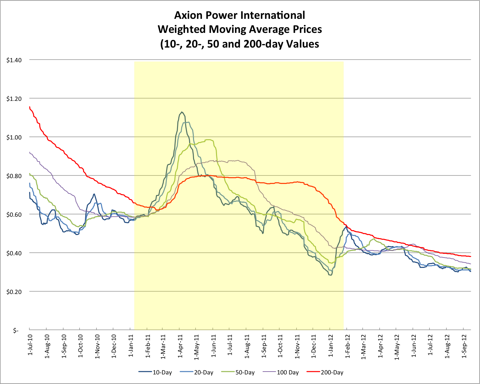

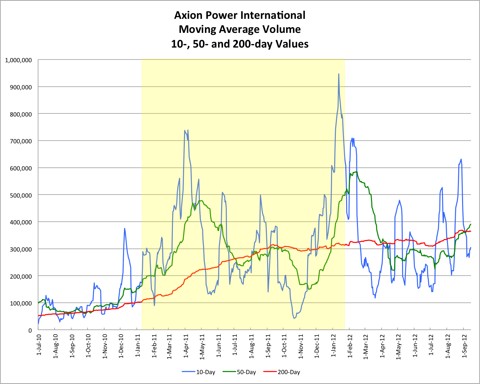

John Petersen has provided price and volume charts updated through 9/14/2012.

---------------------------------------------------------------------------

Axion Power Concentrator 149: Sep. 9, 2012: Rosewater Energy Hub Articles, John Petersen's Updated Graphs, has links to several recent Rosewater-related articles and earlier charts from John Petersen.

---------------------------------------------------------------------------

Links to valuable Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Chart Tracking. HTL tracks and charts AXPW's intra-day statistics.

Testing Summary Statistics On Stocks. FocalPoint Analytics has begun an instablog that will apply statistical disciplines to metrics of stock activity to produce summary indications of likely actions going forward. Well worth a visit.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.