Latest News, Articles and Presentations...

the developer of advanced lead-carbon PbC® batteries and energy storage systems, announced today that it has completed a private placement of $9 million principal amount of senior convertible notes and warrants with institutional investors and an additional $1 millionprincipal amount of subordinated unsecured convertible notes and warrants in an ancillary transaction with directors, officers and one of the original Axion founders. Maxim Group LLC acted as placement agent.

On the senior convertible notes of $9 million, Axion at closing received approximately $2.6 million in proceeds, net of placement fees and expenses, and will receive nine subsequent monthly tranches. The notes carry an 8% interest rate and have a nine-month amortization schedule with interest beginning at closing and can be paid, at the Company's option, in cash or in discounted registered shares. In addition, the investors are entitled to convert the note, or any portion of the note, into shares, utilizing the 105% 'premium to market' price determined at closing ($.26.4). The investors are also entitled to approximately 50% warrant coverage in 5-year warrants, at a 120% 'premium to market' price ($.30.2), that will not be exercisable for six months after the closing. Any funds received from warrant conversion to common stock would be incremental to the offering.

------------------------------------------------------------------------------

Axion Power on Panel at Energy Storage Economics 2.0 for New YOrk City and Beyond --

The developer of advanced lead-carbon PbC® batteries and energy storage systems, announced its Senior Vice President of Sales and Marketing, Vani Dantam, has been invited to participate as a panel expert on energy storage, at the upcoming AGRION event in NYC.

------------------------------------------------------------------------------

Axion Power's CEO Discusses Q4 2012 Results - Earnings Call Transcript

Thomas Granville CEO: "We left the designation 'development stage company' in the dust in 2012 and there's no slowdown in sight."

------------------------------------------------------------------------------

Axion Power Reports Results for 2012 --

Chairman & CEO Thomas Granville commented, "Axion continued to make important strides in the fourth quarter, making 2012 a landmark year overall. Obviously our best year ever will be the first year when PbC revenue starts to show significant growth but it was a good step in that direction that we were able to recognize the first big PbC sale in the 4th quarter, to Norfolk Southern. This coincides with our first 10K filing without "development stage company" status. With our increase in sales, and more specifically sales of our core business product, we are now recognized as a commercial entity for filing purposes.

------------------------------------------------------------------------------

Axion Power Completes New Continuous Roll Carbon Sheeting Process

"This is a giant leap forward for us and allows us to make a better product at a reduced cost," said Axion Power's Chairman and Chief Executive Officer Thomas Granville. "It's the final step in automating our complete activated carbon negative electrode manufacturing process and it brings us tighter quality control, better production yields, meaningful production quantities and significant labor cost reductions..."

-------------------------------------------------------------------------------Axion Power and EPower Engine Systems Inaugurate Strategic Alliance Using PbC Batteries in Hybrid Drivetrains for Class 8 Trucks

-------------------------------------------------------------------------------

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

Axion Power PbC Batteries Continue To Demonstrate Effectiveness For Railroad Applications -- Axion completed shipping its high-performance PbC batteries to Norfolk Southern Corp. (NS), one of North America's leading transportation providers, for use in Norfolk Southern's first all electric locomotive - the NS-999.

Axion Power Residential Energy Storage HUB Certified to UL, CSA Standards -- Axion receives UL certification and CSA Standards for their Residential Energy Storage HUB.

"ePower's Series Hybrid Electric Drive - Unmatched Fuel Economy for Heavy Trucks" -- by John Petersen. Discusses the potential fuel savings for ePower's Hybrid electric drive for class 8 trucks using Axion's PbC batteries.

"Axion Power - A Battery Manufacturer Charging Forward" -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

---------------------------------------------------------------------------

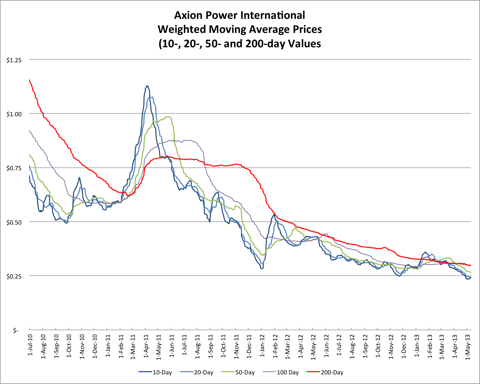

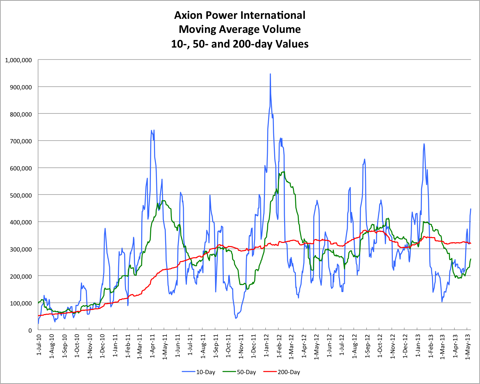

Axion Power Weighted Moving Average Prices and Volume:

(updated through 5/10/2013)

---------------------------------------------------------------------------

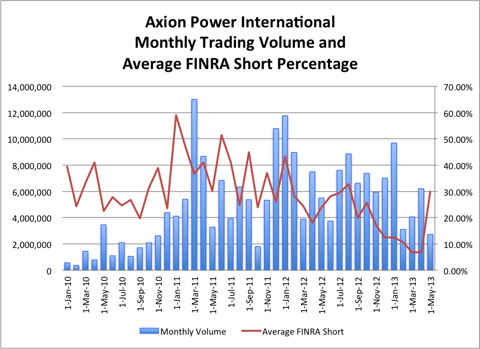

Axion Power Monthly Volume versus FINRA Short Percentage:

(by John Petersen)

In late January I wrote an Instablog about the precipitous decline in reported FINRA short sales as a percentage of total trading volume. Over the last two weeks that trend has accelerated and the percentages for the month of February and the last four weeks are solidly in single digits. I view this graph as another confirmation of seller exhaustion. The big uglies are history and it looks like everybody who really wanted to sell already has.

John Petersen's instablog here.

---------------------------------------------------------------------------

Links to important Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra day Statistics Tracking: (updated 5/1/2013) HTL tracks and charts AXPW's intra-day statistics.

PbC Cost Estimating Spreadsheet and Instablog: Apmarshall62 put together an instablog for estimating costs of the PbC. It includes a downloadable spreadsheet that you can use to plug in your own cost estimations.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.