Latest News, Articles and Presentations...

Q2 2013 10Q Results Filing by Axion

Axion Power International's CEO Discusses Q2 2013 Results - Earnings Call Transcript

Axion Power Investor Relations Access to Conference Call Replay and Downloadable MP3 (click the microphone icon labeled "2nd Quarter 2013 Earnings Webcast" for "Thursday, August 15, 2013 at 11:00 a.m. ET. Registration required

--------------------------------------------------------------------

Understanding The Mechanics And Incentives In Axion Power's PIPE

Axion Power's Potential For Explosive Growth

CORRECTED: Axion Power: Is There Light At The End Of The PIPE?

Axion Power Receives Additional Purchase Order From EPower Engine Systems To Supply PbC® Batteries And Battery Management Systems For (10) Class 8 Heavy-Duty Trucks --The purchase order is an extension of the existing agreement between Axion and ePower and further validates the performance of the PbC batteries in this hybrid application. At ePower's current specifications, each conversion kit System would require 56 PbC batteries and the PbC battery management system (BMS). Axion values each truck conversion battery order at in excess of $20,000.00.

--------------------------------------------------------------------

FocalPoint Analytics' important comment on Axion Power's recent Financing Transaction

--------------------------------------------------------------------

Axion Power Receives Order To Supply Class 8 Truck Battery Strings For ePower

--------------------------------------------------------------------

Axion Power Reports First Quarter Results For 2013-Press Release

Excerpts from the First Quarter 10-Q --

--------------------------------------------------------------------

--------------------------------------------------------------------

Axion Power on Panel at Energy Storage Economics 2.0 for New YOrk City and Beyond --

--------------------------------------------------------------------

Axion Power's CEO Discusses Q4 2012 Results - Earnings Call Transcript

--------------------------------------------------------------------

Axion Power Reports Results for 2012 --

--------------------------------------------------------------------

Axion Power Completes New Continuous Roll Carbon Sheeting Process

--------------------------------------------------------------------

--------------------------------------------------------------------

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

Axion Power PbC Batteries Continue To Demonstrate Effectiveness For Railroad Applications -- Axion completed shipping its high-performance PbC batteries to Norfolk Southern Corp. (NSC), one of North America's leading transportation providers, for use in Norfolk Southern's first all electric locomotive - the NS-999.

"ePower's Series Hybrid Electric Drive - Unmatched Fuel Economy for Heavy Trucks" -- by John Petersen. Discusses the potential fuel savings for ePower's Hybrid electric drive for class 8 trucks using Axion's PbC batteries.

"Axion Power - A Battery Manufacturer Charging Forward" -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

--------------------------------------------------------------------

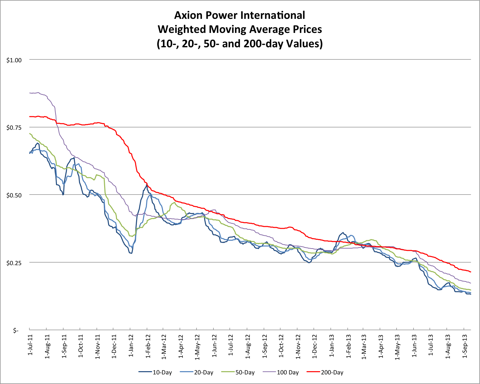

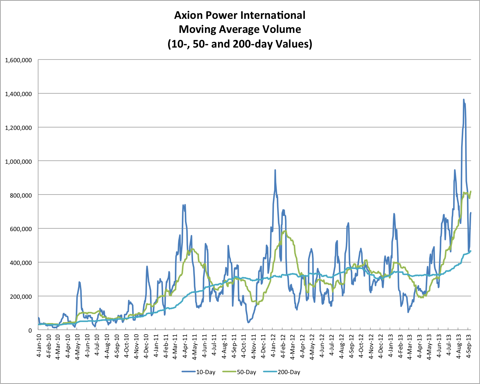

Axion Power Weighted Moving Average Prices and Volume:

(through 09/14/2013)

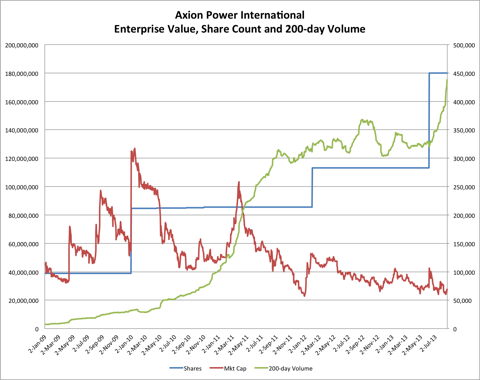

Axion Power Market Cap, Share Count and 200-day Volume:

Link to JP's write-up on this graph in the header of APC #248 --

(as of 09/14/2013)

--------------------------------------------------------------------

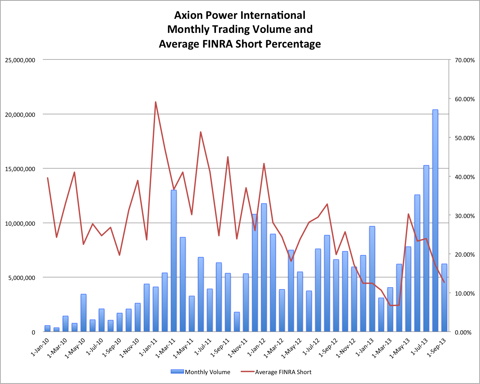

Monthly Volume and FINRA Short Percentage

The FINRA short tracking graph is beginning to look like it may be a reasonable proxy for selling by the PIPErs. It was an extremely useful tool for tracking the big uglies a couple years ago and so far it seems to be providing the same type of information. If the data does in fact track the PIPErs activity, the lines would suggest that they pounded hard in May to set up a fear dynamic, eased up a bit in June once the angst was established and eased up again in July as the angst gained momentum and the stock price stabilized. [Prior months graphs' comments follow APH] With three days left to go in the month, July is already the all-time volume leader by about 400,000 shares. Unless volume plummets over the next three days, I'm expecting a total volume of more than 15 million shares for the month. It's a lot of selling, but its also a lot of buying and I don't think the buyers are timid or weak.

(updated through 09/14/2013)

--------------------------------------------------------------------

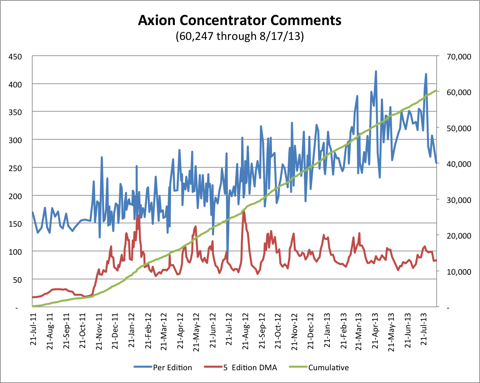

Axion Power Concentrator Comments Statistics:

(updated through 08/17/2013)

--------------------------------------------------------------------

Links to important Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra day Statistics Tracking: (new edition 9/1/2013) HTL tracks and charts AXPW's intra-day statistics.

PbC Cost Estimating Spreadsheet and Instablog: Apmarshall62 put together an instablog for estimating costs of the PbC. It includes a downloadable spreadsheet that you can use to plug in your own cost estimations.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.