Latest News, Unconfirmed Rumors of Note :-), Articles & Presentations ...

--------------------------------------------------------------------

--------- M A N A G E M E N T__A C T I O N S ---------

Feb. 6, 2014 Axion Power Appoints David DiGiacinto to Board of Directors and The SEC Filing for the appointment. User Iindelco found this background on Mr. DiGiacinto at The Colemen Group.

July 15, 2013 Axion Power Announces Resignation Of Chief Financial Officer Charles R. Trego; Will Be Nominated To Serve On Board

--------------------------------------------------------------------

----------- F I N A N C I N G__ R E L A T E D -----------

Feb. 2, 2014 Axion Power: Out Of The PIPE And Into The Light - Part II

Jan. 31, 2014 John posted a follow-up as we are nearing the wind-down of the PIPE financing effects, Axion Power: Out Of The Pipe And Into The Light. As part of that new article, John was kind enough to make his conversions worksheet (.xlsx format) available so that folks could examine his considerations in detail.

Nov. 25, 2013 Updating The Impact Of Axion Power's PIPE by John Petersen.

--------------------------------------------------------------------

------- Q U A R T E R L Y__ R E P O R T I N G --------

Awaiting futre reporting.

--------------------------------------------------------------------

--------- S T A T I O N A R Y__ S T O R A G E ---------

Jan 31, 2014, an Axion Power Letter to Shareholders Regarding Systems with Solar PV and Storage was released that demonstrates some sample financial impacts of adding storage to a PV system

Nov. 13, 2013 Axion Power Announces Sale Of PowerCube™ Energy Storage System: "... received a purchase order, ... for a PowerCube™ to be commissioned into a solar project. The Cube will provide storage for energy created by the solar panel system and also service the frequency regulation market ... expects to ship all equipment to the site in the current quarter of 2013, with installation to begin immediately".

Mac325 posted a link to an Axion Power web site blog post on "Solar in the Caribbean". Iindelco posted a link to a slide show on some durable energy thinking in Curacao by Michael Garvin.

--------------------------------------------------------------------

------------ R A I L R O A D__ R E L A T E D ------------

Nov 7 2013 flyinglow, posted a comment saying Norfolk Southern is setting up classes for training in operation of all-electric locomotives. That started a thread of comments (well worth reading) by participants that led to flyinglow later saying it was in Atlanta. Subsequently Stefan Moroney posted a comment with a link to an article about NSC's training facility.

Oct. 10, 2013 Update Report On Hybrid Norfolk Southern Switcher Locomotive To Be Presented At 7th Annual ASME Rail Conference

Jan. 11, 2013 Axion Power PbC Batteries Continue To Demonstrate Effectiveness For Railroad Applications -- Axion completed shipping its high-performance PbC batteries to Norfolk Southern Corp. (NSC), one of North America's leading transportation providers, for use in Norfolk Southern's first all electric locomotive - the NS-999

--------------------------------------------------------------------

------------ T R U C K I N G__R E L A T E D -------------

Feb. 11, 2014 Video of Epower Test Drive by Jay Bowman. Thanks to John Petersen for sharing this!

Jan 27, 2014 Excerpts From EPower's January 26th Update by John Petersen

July 8, 2013

Axion Power Receives Additional Purchase Order From EPower Engine Systems To Supply PbC® Batteries And Battery Management Systems For (10) Class 8 Heavy-Duty Trucks --An extension of the existing agreement between Axion and ePower and ... current specifications, each conversion kit System would require 56 PbC batteries and the PbC battery management system (BMS). Axion values each truck conversion battery order at in excess of $20,000.00.

June 13, 2013 Axion Power Receives Order To Supply Class 8 Truck Battery Strings For ePower

December 6, 2012 "ePower's Series Hybrid Electric Drive - Unmatched Fuel Economy for Heavy Trucks" -- by John Petersen. Discusses the potential fuel savings for ePower's Hybrid electric drive for class 8 trucks using Axion's PbC batteries.

--------------------------------------------------------------------

---------------- M I S C E L L A N E O U S -----------------

Feb 5, 2014 The ABC's Of Axion Power's Business Execution And Price Performance by John Petersen.

Nov. 20, 2012 Axion Power - A Battery Manufacturer Charging Forward -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

March 20, 2013 Axion Power Completes New Continuous Roll Carbon Sheeting Process

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

--------------------------------------------------------------------

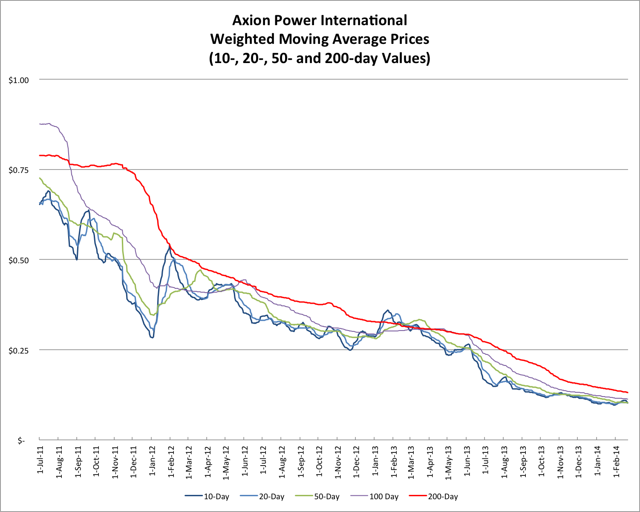

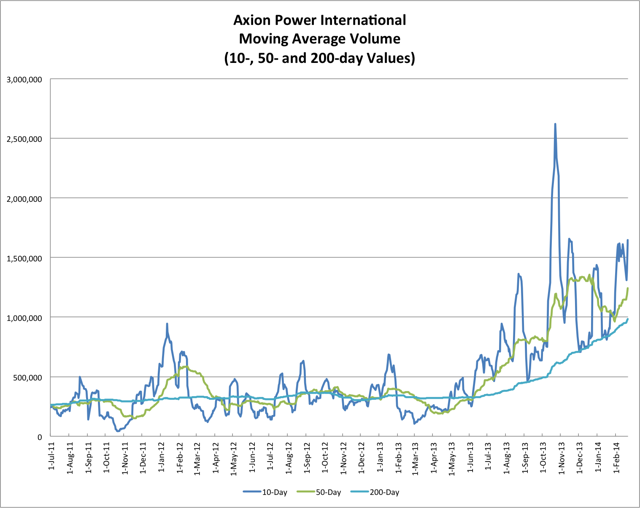

Axion Power Weighted Moving Average Prices and Volume:

Comments about these two charts from JP on 2/15/2015

--------------------------------------------------------------------

First, in the first half of February the 10-day volume has been bouncing around in a narrow band at 1.5 million shares a day. If the pattern continues; my estimate of Parsoon's remaining holdings is close to the mark; and Parsoon accounts for 15% of daily volume, they should be gone by the end of the month.

Second, while the change isn't massive, my 10-day VWMA has moved up through the 20- and 50-day VWMAs and even the 50-day has turned up slightly. After several months of misery I think the trend is encouraging.

--------------------------------------------------------------------

(UPDATED! through 2/22/14):

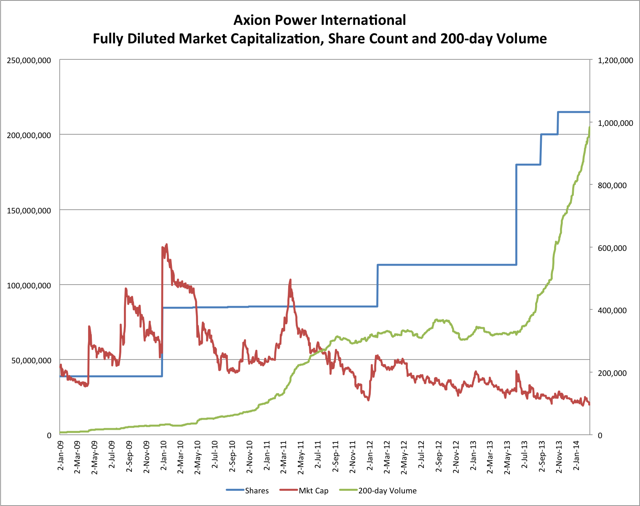

Axion Power Market Cap, Share Count and 200-day Volume:

Link to JP's write-up on this graph in the header of APC #248 --

(UPDATED! through 2/22/14)

--------------------------------------------------------------------

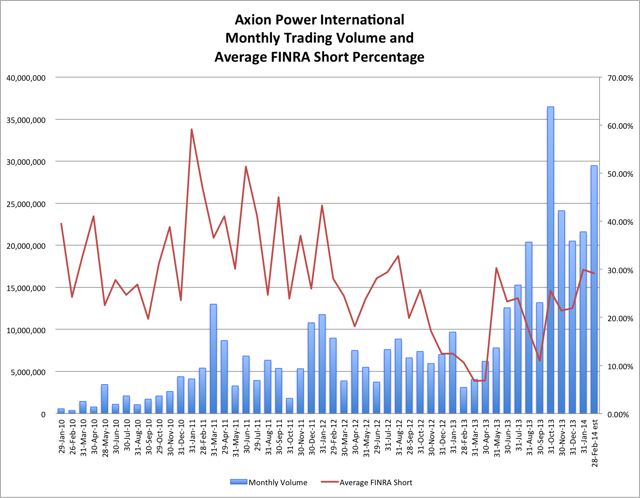

Monthly Volume and FINRA Short Percentage

(UPDATED! through 2/22/14)

--------------------------------------------------------------------

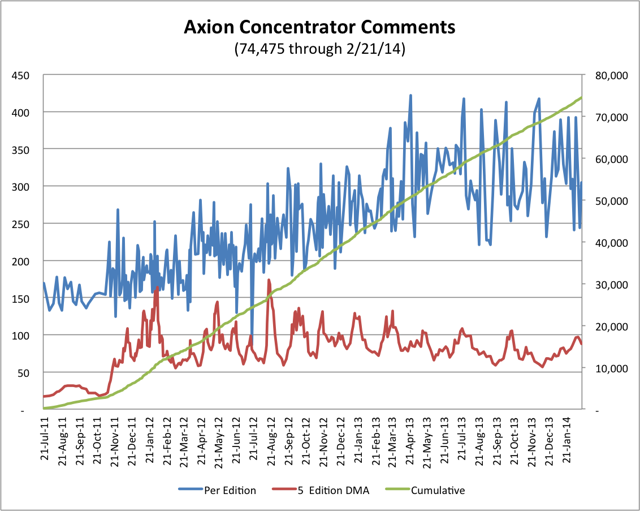

Axion Power Concentrator Comments Statistics:

(UPDATED! through 2/22/14)

--------------------------------------------------------------------

-------- O T H E R__U S E F U L__ P L A C E S --------

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra day Statistics Tracking: (current edition 1/30/2014) HTL tracks and charts AXPW's intra-day statistics.

PbC Cost Estimating Spreadsheet and Instablog: Apmarshall62 put together an instablog for estimating costs of the PbC. It includes a downloadable spreadsheet that you can use to plug in your own cost estimations.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy

Disclosure: I am long AXPW.