Latest News, Unconfirmed Rumors of Note :-), Articles & Presentations ...

--------------------------------------------------------------------

--------- M A N A G E M E N T__A C T I O N S ---------

David DiGiacinto Appointed Chairman And CEO Of Axion Power and DiGiacinto appointment SEC Form 8-K.

Mar. 26, 2014 Axion Power CFO Resignation

Mar. 5, 2014 Axion Power Names Veteran Trucking Industry Executive Dr. James A. Smith as Special Consultant

Feb.. 6, 2014 Axion Power Appoints David DiGiacinto to Board of Directors and The SEC Filing for the appointment. User Iindelco found this background on Mr. DiGiacinto at The Colmen Group.

--------------------------------------------------------------------

----------- F I N A N C I N G__ R E L A T E D -----------

Jul 03, 2014 Axion Power Announces Shareholder Approval for a Reverse Stock Split and Decrease in Authorized Shares

May 29, 2014 Definitive Consent Solicitation Statement, Schedule 14A has been filed. Materials to be mailed on or about June 4, 2014.

May 04, 2014 Retired Aviator put up a blog expressing his concerns about the lack of adjustment for authorized shares in the proposed reverse split in Axion Power Reverse Split Authorized Share Count.

May 03, 2014 Understanding The Details Of Axion's Reverse Split Proposal by John Petersen

May 02, 2014 Axion Power Letter to Shareholders regarding the Reverse Split Consent Solicitation.

Apr. 30, 2014 Reverse Split Consent Solicitation Statement. Extensive discussion began with Articula's comment in # 327.

Apr. 21, 2014 John posted a comment linking to his updated share overhang workbook.

Feb.. 2, 2014 Axion Power: Out Of The PIPE And Into The Light - Part II

Jan. 31, 2014 John posted a follow-up as we are nearing the wind-down of the PIPE financing effects, Axion Power: Out Of The Pipe And Into The Light. As part of that new article, John was kind enough to make his conversions worksheet (.xlsx format) available so that folks could examine his considerations in detail.

--------------------------------------------------------------------

------- Q U A R T E R L Y__ R E P O R T I N G --------

May 17, 2014 PR: Axion Power Reports First Quarter Results for 2014

May 17, 2014 Axion Power International's CEO Thomas Granville on Q1 2014 Results - Earnings Call Transcript

May 17, 2014 Q1 2014 Conference Call MP3 Recording in HTL's Dropbox

May 15, 2014 Axion Power Q1 '14 Results Filing

May 12, 2014 Axion Power Announces Date For The Release Of First Quarter 2014 Results, Conference Call And Webcast

Apr. 04, 2014 Axion Power International's CEO Discusses Q4 2013 Results - Earnings Call Transcript

Apr. 02, 2014 Mp3 recording of 2013 Q4 & EOY CC.

Apr. 01, 2014 2013 Q4 & EOY 10-K and all exhibits and forms.

Apr. 01, 2014: PR Axion Power Reports Results For 2013.

--------------------------------------------------------------------

--------- S T A T I O N A R Y__ S T O R A G E ---------

May 14, 2014 Axion Power Announces Order For Four PowerCube™ Energy Storage Systems

Jan. 31, 2014, an Axion Power Letter to Shareholders Regarding Systems with Solar PV and Storage was released that demonstrates some sample financial impacts of adding storage to a PV system

Nov. 13, 2013 Axion Power Announces Sale Of PowerCube™ Energy Storage System: "... received a purchase order, ... for a PowerCube™ to be commissioned into a solar project. The Cube will provide storage for energy created by the solar panel system and also service the frequency regulation market ... expects to ship all equipment to the site in the current quarter of 2013, with installation to begin immediately".

Mac325 posted a link to an Axion Power web site blog post on "Solar in the Caribbean". Iindelco posted a link to a slide show on some durable energy thinking in Curacao by Michael Garvin.

--------------------------------------------------------------------

------------ R A I L R O A D__ R E L A T E D ------------

Jul. 10, 2014 Thanks to WTBlanchard, who has been more than diligent in tracking NS-999, for posting a link to the twitter posting of the painted NS-999. But, thanks to a suggestion by Pascquale in a PM, here's a cropped version.

(to view enlarged, right-click, copy image location and open in new tab, where ctrl and + allows zoom in)

Apr. 17, 2014 Advanced Wayside Energy Storage Systems for Rail Transit (PDF) was located and posted by Edmund Metcalfe. Many thanks for that and his comments and in-depth examination of related patents.

Nov. 7, 2013 flyinglow, posted a comment saying Norfolk Southern is setting up classes for training in operation of all-electric locomotives. That started a thread of comments (well worth reading) by participants that led to flyinglow later saying it was in Atlanta. Subsequently Stefan Moroney posted a comment with a link to an article about NSC's training facility.

--------------------------------------------------------------------

------------ T R U C K I N G__R E L A T E D -------------

Jul 14, 2014 John Petersen posted an update on ePower's progress, including a smoothed and consolidated graph of data from the GPS, ECM and BMS systems.

Mar. 14, 2014 John Petersen shared a new 4 minute video that Jay put on Youtube which combines in-cab video with a couple of real time data feeds as the ePower Engine Systems tractor climbs and cruises on flat ground with a light trailer (33,450 GVW). He explains some of the displays in this comment.

Feb.. 11, 2014 Video of Epower Test Drive by Jay Bowman. Thanks to John Petersen for sharing this!

Jan. 27, 2014 Excerpts From EPower's January 26th Update by John Petersen

June 13, 2013 Axion Power Receives Order To Supply Class 8 Truck Battery Strings For ePower

--------------------------------------------------------------------

---------------- T E C H N I C A L -----------------

Mar. 5, 2014 John Petersen, in this comment on the performance of carbon additives and the Ultrabattery, provided a link to the ELBC-13 Presentation from Banner Battery (1.65MB) that shows what carbon paste additives do for AGM batteries and emphasized slide 16.

He also provided a link to this ELBC-13 Presentation from Sheffield University (677KB) that compares four storage configurations including (a) an AGM Battery, (b) an AGM Battery with a 300F ultracapacitor, (c) an AGM Battery with a 2,400F ultracapacitor and (d) an Ultrabattery. He singled out slide 14 for emphasis.

--------------------------------------------------------------------

---------------- M I S C E L L A N E O U S -----------------

Feb. 5, 2014 The ABC's Of Axion Power's Business Execution And Price Performance by John Petersen.

Nov. 20, 2012 Axion Power - A Battery Manufacturer Charging Forward -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

--------------------------------------------------------------------

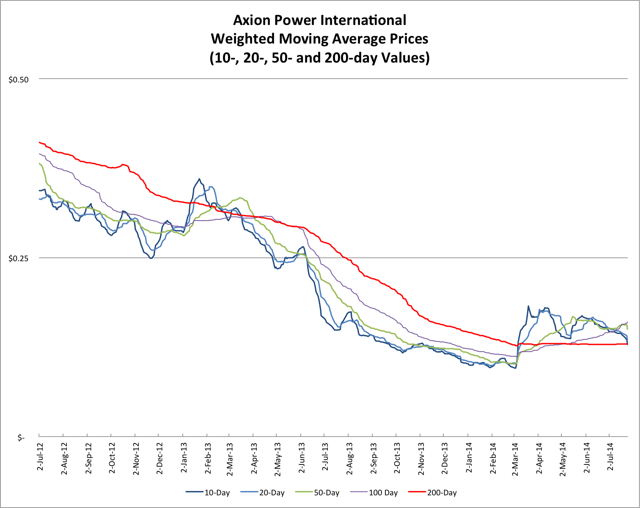

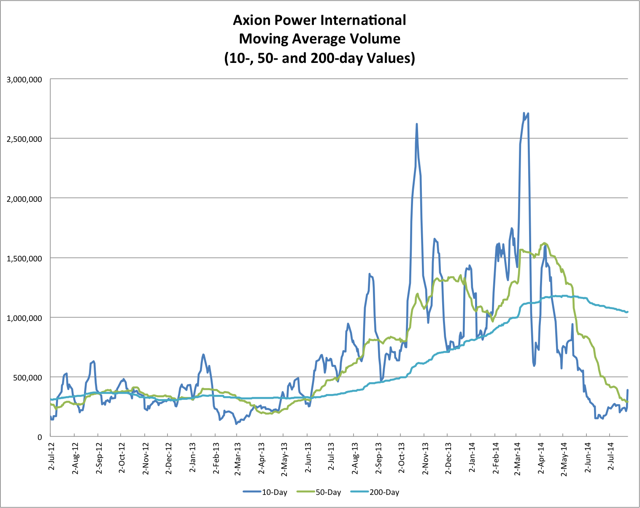

Axion Power Weighted Moving Average Prices and Volume:

3/27/2014 Comments from JP about the volume chart

--------------------------------------------------------------------

Historically the 10- and 50-day volumes traded in a band above and below the 200-day MAV but since June of last year the 200-day average was an absolute barrier. This week's plunge below the 200-day level is one more compelling bit of evidence that the PIPErs have left the building and we're seeing more normal trading activity.

--------------------------------------------------------------------

(Current through 7/25/2014)

(Current through 7/25/2014)

--------------------------------------------------------------------

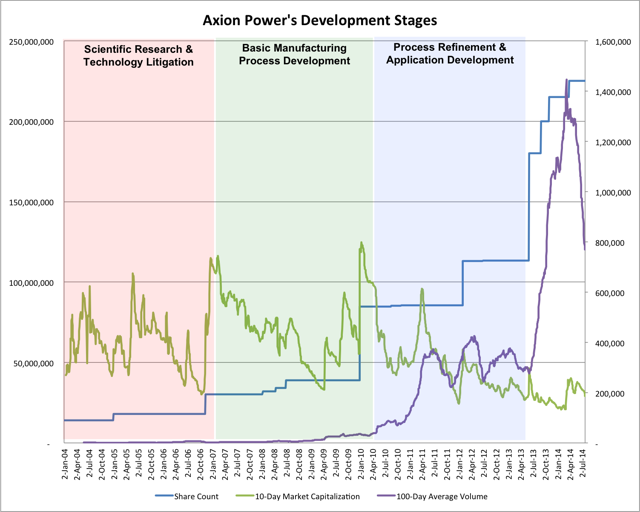

Axion Power Market Cap, Share Count and 200-day Volume:

5/18/2014 JP comments

--------------------------------------------------------------------

This week I did something unusual with the Market Capitalization graph and took it all the way back to inception. I then added colored blocks to highlight what I see as three discrete stages in Axion's development when it either had nothing to sell to customers, or only had pre-commercial prototypes. For the first six years the market cap exhibited a spiky but recognizable up-trend. Since 2009, the period when the greatest commercial value has been added to the PbC, the trend has been all downhill as trading volume exploded from stockholders behaving badly and shoveling more stock into the market than the market could possibly digest.

Link to JP's write-up on this graph in the header of APC #248 --

4/19/2014 JP comments

--------------------------------------------------------------------

The only change worth noting is that I increased my estimate of the fully diluted share count from 215 million to 225 million for the Market Capitalization graph. This adjustment ties back to the inaccurate acceleration assumptions I referred to in my comment that explained my error and apologized to D-Inv.

4/13/2014: JP comments

-------------------------------------

The only change worth noting is that I increased my estimate of the fully diluted share count from 215 million to 225 million for the Market Capitalization graph. This adjustment ties back to the inaccurate acceleration assumptions I referred to in my comment that explained my error and apologized to D-Inv

-------------------------------------

(Current through 7/25/2014)

--------------------------------------------------------------------

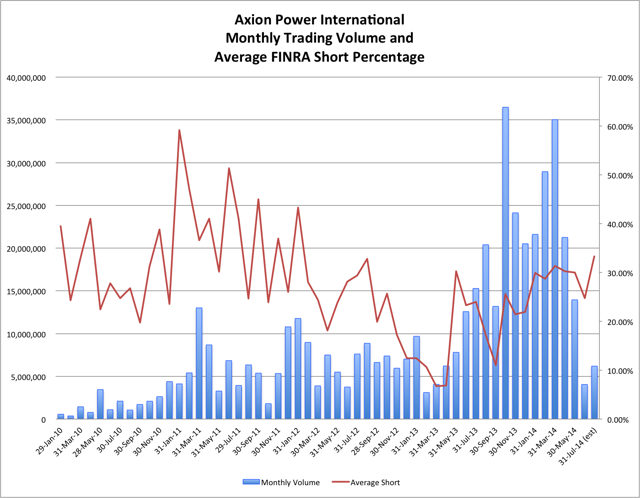

Monthly Volume and FINRA Short Percentage

3/15/2014: On the FINRA short graph, volume for the first half of March is within 2.3 million shares of total volume for February and exceeded total volume for 2010. Cumulative volume in Q1-13 is within spitting distance of total volume for 2011.

(Current through 7/25/2014)

--------------------------------------------------------------------

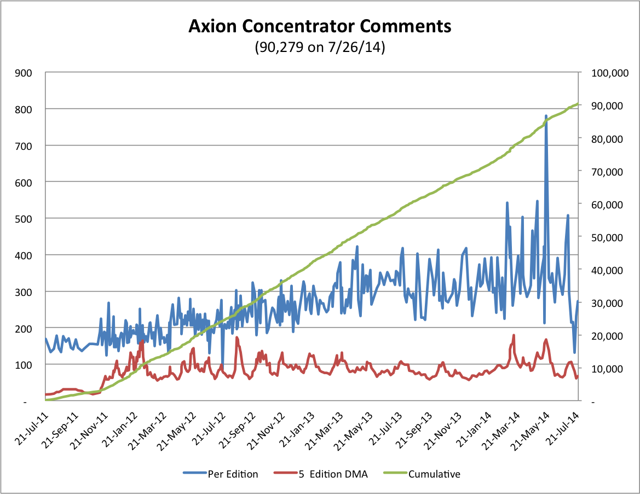

Axion Power Concentrator Comments Statistics:

3/15/2014: On the APC Comment graph, we've hit an all-time high of 176 for my 5 edition daily moving average, eclipsing the previous high of 174 in August 2012.

(Current through 7/25/2014)

--------------------------------------------------------------------

-------- O T H E R__U S E F U L__ P L A C E S --------

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra day Statistics Tracking: (current edition 7/1/2014) HTL tracks and charts AXPW's intra-day statistics.

PbC Cost Estimating Spreadsheet and Instablog: Apmarshall62 put together an instablog for estimating costs of the PbC. It includes a downloadable spreadsheet that you can use to plug in your own cost estimations.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy

Disclosure: The author is long AXPW.