Time flies when you're having fun and accumulating funds in your 401(K)!

OK, it may not be "fun" to have those funds taken out every paycheck, but keep thinking about how and when you want to retire, and how much you dislike eating cat food on Saltines and living under a bridge. At least, that's my biggest fear about having to retire without enough money saved up (and invested in dividend growth stocks that are increasing their dividends at rates that beat inflation) to meet my monthly nut.

For starters, let's recap the three ETFs and one mutual fund that I had held in my 401(K) account:

- iShares High Dividend Equity Fund (HDV)

- iShares FTSE NAREIT Mortgage Plus Capped Index Fund (REM)

- Utilities Select Sector SPDR (XLU)

- Yacktman Focused Service Class (YAFFX)

As a refresher, the last time I reported about my 401(K) I had decided to initiate a fourth ETF in the coming months into which new funds will be funneled until that position's percentage allocation of my 401(K)'s total value approaches the other positions, or at least the other three ETFs. Previously, I had instructed Fidelity to allocate 25% of the withholdings from each paycheck into YAFFX, and to put 75% into my cash account, where the cash would accumulate until I had enough to justify the $7.99 commission I have to pay for each transaction. In mid-June, I changed that to an 80%/20% split, so that 80% of the money withheld each paycheck went into cash, in anticipation of initiating and then continuing to grow the new, fourth ETF.

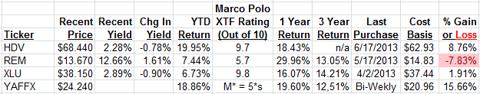

Here's how things looked back in mid-June when I last reported on this account:

Well, the time has come, and I decided to follow through with my plan and start a position in the ETF iShares Dow Jones Select Div Index Fund (DVY).

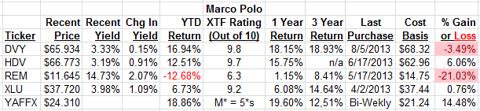

Unfortunately, my timing wasn't great in initiating this new position. Between the time that I decided to shoot for adding DVY to my 401(K) and the time that I had enough funds accumulated to make a purchase worthwhile, DVY and the market as a whole had a bit of a run up. I recently bought a starting position in DVY, but since then there's been a bit of a drop in the value of all of my ETF positions, such that here's the way things look now in this account as I write this:

We all know that mREITs have been taking a beating of late, so I'm not surprised by the drastic change of fortune of REM. Hopefully things will improve in the future, or at least not deteriorate any more than it already has for mREITs. I need to do some research in that area and see what the pundits are saying about the future of mREITs, but for now I'm content to sit tight on REM (and the mREITs in my IRA).

So DVY is not off to a roaring start as the newest member of my 401(K), but it's made up of solid dividend payers and growers, such as Lorillard, Inc. (LO), Lockheed Martin Corporation (LMT), and Chevron Corporation (CVX), to name the current top three holdings. And as I'm in this for the long haul (or at least as long as it takes me to get to retirement age), I'm confident that DVY will make up what it's lost in the short time I've held it, and then some.

That's it for the current state of my 401(K). The plan now is to continue to add to DVY every three pay periods or so, so about every month and a half through about November. At that time DVY should have a solid percentage allocation of the overall total, and I can start looking at where amongst the four ETFs now in my 401(K) to apply the next round of funds. If something changes in that plan, I'll be sure to let you know, but in the meantime, that's how it looks like things are going to play out.

Disclosure: I am long DVY, HDV, REM, XLU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not a professional investment advisor or financial analyst; I’m just a guy who likes to crunch numbers and can make an Excel spreadsheet do pretty much whatever I want it to do, and I’m doing my best to manage my own portfolio. This article is in no way an endorsement of any of the stocks discussed in it, and as always, you need to do your own research and due diligence before you decide to trade any securities or other products.