Aussie Ills

Has the Aussie finally lost its luster? I think it's still too early to tell, but we definitely know a currency is in bad shape when it's making the Euro and the U.S. Dollar look good.

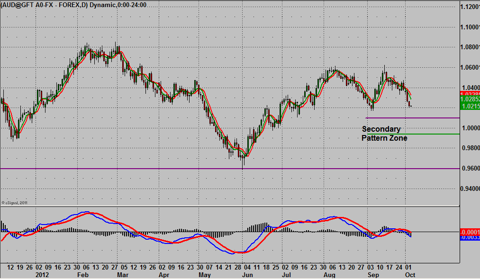

The Australian economy is definitely the big story in the currency markets right now as Wednesday's surprise increase in its trade deficit to over $2 billion hit the market on the heels of an RBA rate cut the day before. Australia continues to face an increase in unemployment which is causing plenty of uncertainty Down-under, and translating into lower currency prices across the board. We were looking at 1.01 to the downside near-term and will now need to adjust that down to .9950 given the current bearish momentum -- see Figure 1. The previous positive correlation between the Aussie and U.S. blue chip stocks has broken down sharply this week, which we need to take more seriously than previous break downs that occurred during lower volume dog-day, or holiday trade.

While it is still mid-week, the sharp sell-off in the Aussie did not carry over into the other financial markets; in fact the S&P 500 closed higher the last two sessions. Given AUDUSD's prominent position as a carry trade market however, currency traders need to be alert for further weakness in the Aussie pairs.

Euro Still Holding Plenty of Shorts Captive

Mario Draghi said it more succinctly than any other central banker in my many years of market watching: "It is pointless to go short on the Euro". And his words are still reverberating through the markets. Draghi's stance highlights Mega-Trend #3 in our book: Central Bank Policies. Don't fade the Fed has been gospel for U.S. traders over the last 30 years, and the same now goes for the European Central Bank, and the Reserve Bank of Australia.

While European economic numbers have been dismal, the ECB did buy time, and over time, all things being equal, people get back to making the best of it, which begins the path to recovery. We are however a long way from recovery in Europe and we still view the current two month up-move in the Euro as a short covering rally which had the added benefit of lending the ECB even more credence than it enjoyed during the January-February rally, and the 4th quarter 2011 rally before that. Right now though the real deal in the Euro is that there are still plenty of trapped shorts left over from last quarter, and it's hard to put a number on where the margin man will step in and hit the buy button for them. Our guess, just a bit beyond the September high at 1.3170.

To watch Jay Norris highlight trade set-ups and signals in live markets for this Friday's Employment number sign up at Live Market Analysis

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.