A nice Santa rally last week brought the SPX back above its 200MA, to rest at the 50MA. A quiet trading week that saw positive reports on US consumer spending and initial claims. Consumer confidence picked up. Existing home sales slowed, tarnishing real estates' reputation as a market driver this year. But all is not yet lost: new home sales continued to grow. 4Q2015 earnings are now starting to trickle in. Analyst expectations are for another contraction in earnings and revenues. Projections for the energy sector have been lowered once again following the most recent oil price mess. Nevertheless projections for 2016 continue to hold up with the forward 12 month EPS estimate slowly climbing higher, despite the 4Q negativity. The forward 12 month estimate needs to continue to climb to prevent large investors throwing in the towel early in 2016. Still a lot of hoo-ha about high yield bonds, but the broader bond market appears to be taking it in stride. 2 year swap spreads are stable, as are corporate / treasury spreads.

Outside the US, EU consumer confidence picked up slightly. Japan produced a mixed bag of indicators while all appeared quiet the night before Christmas in China. Its likely to be another subdued week given that we are still in the middle of the holiday season.

- Weekly review of the economy and Markets: Fear and Greed Trader

- Succinct summary of the week's indicators: this week we'll look to the New Deal Democrat who provides a comprehensive overview.

Credit Spread Positions

ESH16: A nice jog higher this week, with a normally bullish 3 white soldiers formation, but ending the week with an indecisive harami. The indicators are in no-man's land; neither overbought nor oversold. It's any one's guess what will happen next week. The best case is the Santa rally will continue and take ESH16 up to the previous high of 2095. At its present value of 2050 it is at the descending channel resistance, and it also has to overcome the most recent high at 2080. If we don't get past 2080 this week, it's likely we are going to go back down to 1995 and test support. Absent an external catalyst it's likely to bounce there and keep in the trading range. For short strikes, I'm looking for 1950 and below for a margin of safety.

NQH16: The same story as for the SPX Future, with NQH16 finishing above the 50MA. It has room to run to the upside, and on the positive side it continues to be accumulated. Support at 4500 appears solid, so we'll have to see how it runs next week. I have no particular insight. I like short strikes at 4450, and will look lower to 4350 if possible.

AAPL: It started to recover from the trouncing it took last week, and it didn't fall below 105, which is likely to the short - term support level. It didn't make much progress, however, failing to get past 110. It's still oversold on both RSI(5) and the stochastic. It has finally started to be accumulated, which should help push it higher next week. My feeling is it would be best to keep credit spreads as low as possible for AAPL; certainly below 105, and down to 100 if possible, since sentiment is not with it at the moment. We may have to wait until closer to earnings to see a more meaningful move upwards since this traditionally appears to be when analysts re-assess the earlier bearishness, get religion and start putting out more positive messages.

SWKS: This is a frustrating stock to watch. It's business has been solid over the past couple of quarters, but it is strongly tied to AAPL and to the China markets, both of which are now pariahs. Recent price action is, however, encouraging. It's moving in an upward channel and rising off support at 77. It's just popped above oversold and the shares are being accumulated. This bodes well for the short-term. It also has solid support at 75, all of which suggests to me it's good for credit spreads, particularly since its high volatility provides good premiums. I'm willing to go to 75 for short strikes, but I'd prefer 72.5 for added safety margin. Keep a close eye on this one should the market experience unexpected, strong weakness.

LNKD: At the moment I luuuurv LNKD. It has drifted slowly down to hit ~227 before moving back up last week. Support is at 227 - 230, and appears reasonably solid. It is moving off oversold and is now being accumulated, which suggests more upside potential. Premiums are excellent for LNKD, meaning it's possible to attain a decent margin of safety. I'm looking for shirt strikes of 2010, but I'd be willing to go to 2015 if need be, both of which are below the 200MA.

GOOGL: Can't get used to calling this Alphabet. It's been a model of stability over the past few weeks, holding firm to a 740 - 780 trading range. It's in indicator no man's land, so can't see an obvious direction for it next week. It's likely to hold 740 support unless bad news surfaces, and it may well find support at the 50MA, which is at 750. I like short strikes at 720, but premiums are not good here for expirations within the next couple of weeks. I'd be willing to go to 740 if strength holds up next week.

GILD: I continue to keep an eye on GILD for good opportunities to open spreads. I have been reluctant up to now because the whole heath care sector has been in the doghouse. However, over the past couple of weeks this sector has picked up strength, and the sector ETF XLV is now above its 200MA. So this may well an opportune time for GILD spreads. Price is in a symmetric triangle formation, so it will break out soon. No crystal ball for me to predict direction, but I'd lean on the upside as the whole sector is moving up. MACD has issued a buy signal, which has been confirmed with a price increase. RSI is moving up. All good. I'm looking at 97.5 for safety, but there's good support at 100. Tally-ho next week!

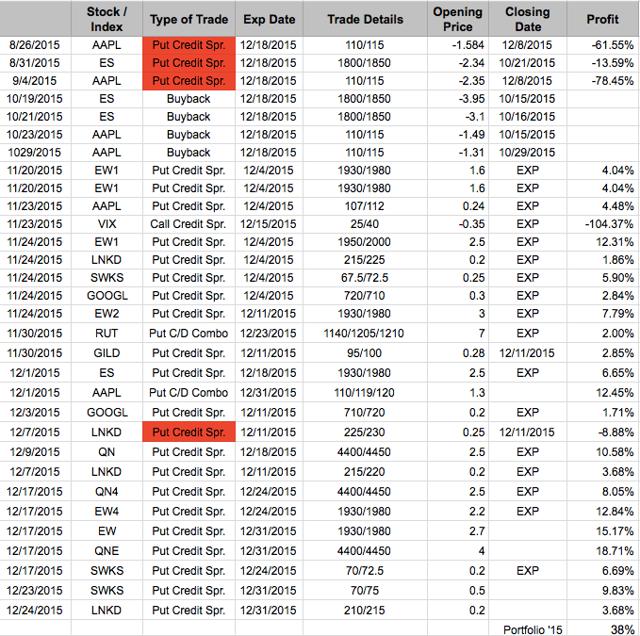

Trade Summary

So far this month trades have been good with the exception of one losing trade on LNKD, which I have almost recovered with additional LNKD trades over the course of the month. My idea of capturing a Santa Claus rally with RUT and AAPL combo spreads of short puts and ITM put credit spreads has not worked out, since we have had significant declines in both positions after I opened the spreads. My learning from this episode: this type of trade only really works when the market is climbing up from a low, which was not the situation when I opened the positions. Bugger.

I've broadened out the futures spreads by including NDX futures (NQ). So far, these have worked out well, but some care is needed because of the bid-ask spreads are significantly larger than for ES due to the lower volume of trades in NQ. The problem here is higher cost to close and roll compared to ES. However, the NDX has performed better than SPX for quite a while, and I believe NDX provides some diversification of risk. I also plan on using RUT regularly, but I like it for iron condors (already done 1 for January that closed within 2 weeks for 7% profit) and my strategy will be to focus on it when we have volatility spikes. In fact, for that circumstance, iron condors are great trades for all the futures as well.

So, with all the activity in December I've managed to claw back some of the losses I took as a result of the Flash Crash. By no means even close to all, but I made a dent in it. I'm hoping AAPL can crawl back above 110 by the end of next week so my short puts can close OTM. Otherwise I have spreads on ES, NQ, SWKS and LNKD open. With a bit of luck the market will cooperate and not gyrate too much next week. Best case scenario leaves me with a 38% profit for 2015, and an awful lot of lessons learned.

Reading List

China Beige Book shows some weakening of the manufacturing sector. Services have not yet picked up sufficiently to compensate. House prices are continuing to improve with second tier cities how joining in. http://www.bloomberg.com/news/articles/2015-12-17/china-beige-book-shows-disturbing-deterioration-on-all-fronts-iiaunzjp

Fear and Greed on the state of the economy and markets. A balanced perspective. Mildly optimistic in the face of a wall of negativity.

Key indicators for next year will earnings - which are projected to rise at this time. Global economy: Germany improving, China struggling to get back out of the hole. Market sentiment: down the toilet, contrarian bullish, ceratinly no sense of euphoria.

Oil: who knows? correlation with the stock market is not strong over the course of 2015, so is it really driving the market now?

High yield debt: not likely to drag the economy/markets down - this is not 2008.

Technicals: Nothing has been resolved over the past week, but no downside follow through on recent SPX slide < 2000 intraday.

The Fed is painting a picture of an improving US economy while commodities continue to tank, suggesting a world economy that is slowing. Will the US be able to pull the global economy along with it, since behind China it is the world's biggest consumer of commodities. No answer in the article, but the problem is posed nicely. http://www.investing.com/analysis/who's-right,-commodities-or-the-fed-376460

Drivers of the investment climate for 2016: USA, Europe, China, Emerging Markets. http://www.investing.com/analysis/four-drivers-of-the-investment-climate-in-2016-376458

A big drop in existing home sales for new November has brought on another episode of nail-biting. The National Association of Realtors blames new red tape for slowing the closing process. http://www.investing.com/analysis/homes-for-the-holidays-376705

More insight from the New Deal Democrat, this time on the US$ as a short leading index for consumer prices. The transmission occurs via commodities, which are inversely correlated to the US$. With the collapse in commodity prices, the consumer price index has dropped in tandem. Looking at petrol prices, the suggestion is that we are nearer the bottom than the top since prices are now approaching the 2008 low. If the US$ weakens, expect the parts of the US economy exposed to global trade to improve (e.g. transportation, industrials, energy, mining). http://bonddad.blogspot.tw/2015/12/gas-prices-and-us-as-short-leading.html

Is housing weakening? Mish seems to thinks so. http://globaleconomicanalysis.blogspot.tw/2015/12/existing-home-sales-plunge-105-nar.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+MishsGlobalEconomicTrendAnalysis+(Mish%27s+Global+Economic+Trend+Analysis)

Are economic forecasts for 2016 too optimistic? Seems like the economists have been too optimistic all through 2015. http://www.investing.com/analysis/surprising-surprises-377269

Still life in the market yet. Late cycle, but not recession. https://seekingalpha.com/article/3736786-2016-time-to-get-bearish-and-go-zero-hedge?li_source=LI&li_medium=liftigniter-widget

Japan inflation rate ex-energy is moving towards the BoJ goal. http://www.bloomberg.com/news/articles/2015-12-25/without-energy-s-drag-inflation-in-japan-is-approaching-target

No recession signaled at the present time. https://seekingalpha.com/article/3776436-no-recession-is-signaled-by-ims-business-cycle-index-update-december-24-2015

Fear and Greed Trader holding forth on the week's news. 1. The Junk story really revolves around a single fund, and that was a special case. No clear evidence of liquidity drying up over the past few weeks. 2. The US economy continues to move forward; the drop in housing starts is an outlier caused by changes in red tape. 3. EU is growing albeit slowly, but the economy is improving. 4. Earnings not looking pretty for Q4 2015, but forward estimates for 2016 indicate growth expected across all sectors. 5. Oil is not really driving the markets, panic aside. 6. Technicals are positive at the moment, but look for improvement, 7. Sentiment is being driven by bears. https://seekingalpha.com/article/3776386-weekly-update-s-and-p-stabilizes-but-sentiment-reveals-its-fashionable-to-be-a-bear