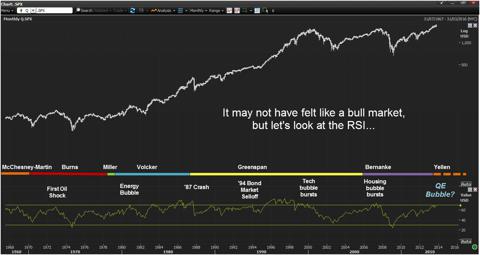

As we prepare for the end of Fed Chairman Ben Bernanke's tenure and the beginning of what is expected to be the Janet Yellen Fed, it's interesting to look back on previous Fed handovers and market activity at the time.

Bernanke's term began on Feb. 1, 2006. By summer, there was a palpable sense that the housing market had peaked (supported by tops in various housing indices) and the homebuilders started to guide market earnings expectations lower.

Source: Thomson Reuters Eikon/StarMine

A rough welcome

Rewind 19 years and Alan Greenspan also arrived as a market approached its crescendo. Greenspan's first day was Aug. 11, 1987. Within a matter of months, the markets' faith in "portfolio insurance" had been dashed and so began the first invocation of the Greenspan put.

Eventually the market would assume that any significant turmoil - whether a market crash, Russian default, bursting tech bubble or hedge fund collapse - would be met with a large dash of tequila into the punch bowl. Whatever the question - the answer seemed to be more stimulus! Or as the saying goes - when all you have is a hammer, everything starts to look like a nail.

Level of tequila in the punch bowl?

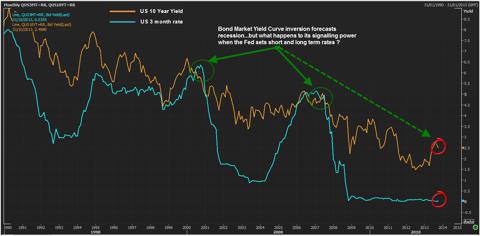

Arguments today rage over whether markets are overvalued and talking heads argue over the suitability of various valuation metrics: Are mid cycle valuations fairer? Are comparisons valid with changed tax codes? What impact does a zero interest rate policy have? One thing is clear - markets have advanced to new highs, valuations tend to imply continued growth in U.S. corporate earnings and there is a generally sanguine approach to how the Yellen Fed will slow and ultimately reverse the experimental policies of its predecessor.

This is by no means some doomsday assessment - and the actions of the Bernanke Fed did avert a much more catastrophic outcome. The question though remains: After a bull run driven more by liquidity than a strong economy, and the new Fed largely concerned with the timing of stimulus reduction, the risks are finely balanced and the equity market is still focused on the tequila.

Source: Thomson Reuters Eikon/StarMine

Source: Thomson Reuters Eikon/StarMine

Central bank support

Today's market is the beneficiary of unprecedented support from central banks globally and it will be interesting to see what equilibrium the market finds without Fed policy intervention across much of the U.S. yield curve. One need only look at the recent performance of emerging markets (equities and currencies) to see the immediate impact created by a withdrawal in liquidity.

No Fed chair can predict the future, but when one looks back at the rough welcomes her two predecessors received, it's possible the early months of a Yellen Fed might see some market drama.