Now that we are several months into the PIPE effects, I see that my experimental stuff, which had normal markets in mind, is much less useful for now. I do believe the history of data and calculations may be useful in detecting when normalcy begins to return and also provide a template of possible effects of other PIPE financing deals for other folks down the road. So I'll keep capturing the data and updating the charts.

I'll also keep examining stuff but will chop my commentary down to minimal comments unless something really exceptional pops up.

To help keep the instablog shorter, I truncate some of the historical metrics, but keep enough here to hopefully keep the context clear and helpful.

Discussions related to the PIPE financing, and links, should be reviewed by those unfamiliar with them. To reduce load time and required scrolling, I've now eliminated them here as they've been up for a long time. Those can still be found in the header of AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 10/1/2013.

A discussion of some daily short sales, and related, is also contained in that header.

I've been manually collecting this data for about 21 months now while volume was low and it was therefore reasonable to do so. I'll stop when it gets too arduous unless I can craft a mechanized capture of most of the stuff.

I've captured enough data now that I can reasonably expect to be able to detect patterns on the charts that may signal, somewhat reliably, when price moves are about to occur. To help more easily identify any useful patterns, I've made an instablog,

Axion Power International (AXPW) 2/13/2012 And Forward One Year Experimental Charts Snapshots. I've also added some lines to them that may assist in this. For anybody with an interest, I welcome any suggestions and/or help.I'll update this instablog daily as long as I can for anybody that might find it useful. The charts will stay near the top and the text updates detailing daily data and expressing my most recent thoughts will follow after the charts.

I've arranged the chart segments in this instablog to put what I think are related stuff close together.

This is the fifteenth installment of the original "AXPW: Some Intra-Day Trade Charting" instablogs I've started doing on Seeking Alpha. The others grew, as I added daily commentary and FINRA data, to the point I was afraid the load time might become an irritant for folks that have less internet bandwidth or older computing equipment so I've started rolling to a new one aperiodically.

Versions subsequent to the original (latest to oldest) can be found here.

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 10/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 9/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 8/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 7/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 6/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 5/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 3/1/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 02/01/2013

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 12/15/2012

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting 11/14/2012

AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting

AXPW: Intra-Day Trade Charting 9/6/2012 - Xx/xx/2012

AXPW: Intra-Day Trade Charting 7/7/2012 - 9/5/2012

In the below chart note that the volume is inverted to enhance readability! Be aware when you view it!

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

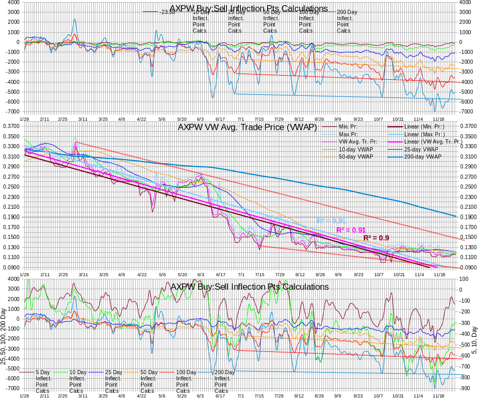

The following are modified inflection point calculations bracketing a price chart for comparison. Note that the false bullish moves and contrary moves of the 5-day has been eliminated.

The two inflection points are calculated identically but differently from the original above. I have two different presentations of this newer version. The top one has all periods on the same scale. The bottom one has longer periods on the left scale and shorter periods on the right scale. The hope is that shorter period changes will be easier to spot because of both the increased visual scale and the offset from the zero point of the long-term scale. More work to do, this is a start, hopefully.

I've identified some changes I want to try on the new inflection point calculations but haven't had time to implement them yet. I'll work them in over time after a little experimentation.

Comments and further suggestions welcome.

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

To reduce blog size, I've trimmed the oldest "2013 Dly Sht % of 'sells' values". Changes in the current set will be noticed and serve the same purpose. If needed, we can compare behavior to older stuff. Weekly 85% price summaries going back to 6/14/2012 have been also trimmed, along with some day-to-day VWAP changes stuff going back to 10/09. Older stuff for all three items is available in AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 10/1/2013.

Continuing tracking the "Dly Sht % of 'sells'", inflection point calculations values, and end-of-week 85% PIPE price factors are now only in the latest daily comment - attempting to keep things shorter for faster loading.

11/29/2013: EOD stuff partially copied to the concentrator.

# Trds: 67, MinTrSz: 500, MaxTrSz: 49000, Vol: 405469, AvTrSz: 6052

Min. Pr: 0.1161, Max Pr: 0.1230, VW Avg. Tr. Pr: 0.1184

# Buys, Shares: 15 78269, VW Avg Buy Pr: 0.1197

# Sells, Shares: 52 327200, VW Avg Sell Pr: 0.1181

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:4.18 (19.3% "buys"), DlyShts 89269 (22.02%), Dly Sht % of 'sells' 27.28%

ABERRATION! FINRA-reported daily short sales trade volume is missing 195,700 shares of the daily trade volume. I've e-mailed FINRA for clarification - it could be a case of partial volume which will be rectified on the next business day. There could be unreported short sales included in the (apparently) missing volume. Regardless, adding that to the FINRA trade volume raises it from 209,769 to my total and would lower the short percentage from 42.56% to my 22.02%. If new data is received Monday, the day's record will be updated and this note may be removed.

Keep in mind that today trading ended at 13:00 so all the times and numbers are affected by this holiday-shortened trading. This might include such as price ranges and buy:sell ratios as well.

The average of the lowest 20 VWAPs times 85% today is $0.985 vs. $0.0986, $0.0987, $0.0988 and $0.0991 on prior days. 85% of today's VWAP is $0.1006 (YIPPEE! An up day!) vs. $0.0996, $0.1006, $0.0974 and $0.0972 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today, VWAP, trade volume, and daily short sales moved +1.03%, -22.35% and +197.56% respectively. With this being a day after Thanksgiving and a short trading day, I don't know how much weight we should give these readings.

Regardless, I take comfort in the daily short sales volume and percentage (note the "ABERRATION!" above) behaving in the expected fashion (up and down in a general up trend from the absurd lows seen recently) in conjunction with the buy percentage being low. This confirms I'm getting a handle on the relationships even if I can never be sure why these behaviors apparently correlate well - just theories and deductions for the "why" of it all.

Yesterday I had concern with the buy percentage dropping to 10.5%. This was because all the buys occurred in the highest price range, $0.1199-$0.1219. It was ~10.5% of day's volume with ~90% of the day's trades being sellers stepping past the offers and directly hitting the bids. Maybe I worry too much, but this cycle of the daily short sales looks, within context of the longer term, as if we're heading towards the basement again with the longer-term trend having lower highs of daily short sales. If we get into a long period of very low daily short sale percentages VWAP can be expected to decline.

The pattern is clearly seen on the chart. Regardless of that concern, today both daily short sales ("ABERRATION!" again) and buy percentage bounced back some, continuing the expected short-term daily short sales pattern: 28.82%, 21.42%, 5.45%, 3.93%, 6.04%, 23.10%, 7.64%, 13.37%, 5.75% and 22.02% today.

No late-day weakness today - well, with a shortened trading day there was no "late-day" to weaken. See the trading breakdowns for a yawner.

The peeks at the asks today yielded four increases and seven decreases. The bid moves were fairly balanced - eight up vs. five down. Remember these are arbitrary peeks and not complete tracking.

Here's a trading breakdown by arbitrary time-frames.

09:33-09:38: 132500 shrs, 32.68% of vol, VWAP $0.1213, 24.9% buys

09:40-10:11: 056271 shrs, 13.88% of vol, VWAP $0.1168, 18.3% buys

10:16-12:33: 091298 shrs, 22.52% of vol, VWAP $0.1167, 14.3% buys

12:45-12:59: 125400 shrs, 30.93% of vol, VWAP $0.1172, 17.5% buys

Here's a breakdown by arbitrary price range.

$0.1161-$0.1166: 150700 shrs, 37.17% of vol, VWAP $0.1163, b:s , 0.0% buys

$0.1170-$0.1175: 092269 shrs, 22.76% of vol, VWAP $0.1171, b:s 1:5.04, 16.5% buys

$0.1190-$0.1199: 051000 shrs, 12.58% of vol, VWAP $0.1196, b:s 50.00:1, 98.0% buys

$0.1200-$0.1230: 111500 shrs, 27.50% of vol, VWAP $0.1216, b:s 1:7.58, 11.7% buys

On the traditional TA front we are still predominately trading below the 50-day SMA, now down at $0.1203. Since 11/18 our trading has been like this. See today's trading breakdowns. But I have a new worry (What?! I don't have enough already?!).

I have a long-term descending resistance constructed atop the highs (with some small "overshoot" 5/31 and 6/1. Origin is 5/5 with touches 5/31 and 6/1 (two consecutive days), 6/14, 11/15 and now today, 11/29. Note this last is approximate as the resolution of both the construction and reading is imprecise. Anyway, it looks like that resistance was $0.1236 today and our high was $0.123. We can hope this won't offer much resistance but the 6/14 and 11/15 touches had appreciable volume. Since these are the most recent I think it suggests the resistance could be strong. If today were a full trading day maybe today's volume would have been strong enough to also suggest strong resistance though.

As if we needed some more negative bias to come into play.

Our low rose slightly today from $0.1155 to $0.1161, as did the high going from $0.1219 to $0.123. The close moved from $0.116 to $0.117. With the shortened trading day preventing adding volume assessment into the mix I'm loathe to get excited about some small continued bullish price moves, especially with the daily short sales behavior, the continued trading mostly below the 50-day SMA, the long-term descending resistance, ...

The oscillators I watch are showing mostly slowly improving behavior. RSI and stochastic are just below neutral (~47.9 and ~45.7 respectively) and momentum is slightly positive (~1.04). Accumulation and distribution is a continuing concern. It is still weakening. Williams %R, ADX and related, and MFI continue to move in a positive fashion, but are below neutral.

On my experimental stuff, I'm most concerned with the continuing deterioration in the average trade size. It's below all averages and, more importantly, the 10, 25 and 50-day averages (yesterday 8561, 8863 and 8510 respectively) continued down to 8127, 8809 and 8461 today. But we had a short trading day - any effect? Regardless, this is more visible on the chart where the average trade size has also been below a short-term rising trend four straight days now.

In the past this has generally foretold weaker prices. I should hasten to add though that I am being likely premature here - I think the longer-term rising trend is really going to be the important point. So let's look at this for now as just suggesting less likelihood of a sustained price rise in the near-term.

Another point of ... disgust actually, is the buy percentage averages. All I'll say is take a look at the chart and note both the averages and trend lines. If you imagine that chart inverted, you see a rising "sell" percentage for a very long time now - since the month after the PIPE financing announcement.

My original inflection point calculations continue to suggest, at best, reducing weakening. This is an effect of the essentially flat trading behavior, leading to three periods showing slight improvement and three showing slight weakening. My newer calculations and charts, sensitive to additional factors, have all periods but the five-day in agreement - slight improvement. The five-day period shows noticeable weakening.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below! Also, 11/27-11/29 was affected by Thanksgiving holiday - no trading 11/28 and 1/2-day 11/29.

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

11/22 $0.1144 +00.66% 14.9%

11/25 $0.1145 +00.14% 34.9%

11/26 $0.1183 +03.28% 47.3%

11/27 $0.1172 -00.96% 10.5%

11/29 $0.1184 +01.03% 19.3%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/25: 20 lowest intra-day VWAPs in 40 days avg, $0.1162, x 85%: $0.0988

11/26: 20 lowest intra-day VWAPs in 40 days avg, $0.1161, x 85%: $0.0987

11/27: 20 lowest intra-day VWAPs in 40 days avg, $0.1160, x 85%: $0.0986

11/29: 20 lowest intra-day VWAPs in 40 days avg, $0.1159, x 85%: $0.0985

Vol, in K, for above days: 776.50, 796.76, 522.19, 405.47.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are omitted from the concentrator.

Week ending values related to the PIPE 85% share pricing:

09/20: 20 lowest intra-day VWAPs in 40 days avg, $0.1301, x 85%: $0.1105 VWAP $0.1256

09/27: 20 lowest intra-day VWAPs in 40 days avg, $0.1273, x 85%: $0.1082 VWAP $0.1227

10/04: 20 lowest intra-day VWAPs in 40 days avg, $0.1243, x 85%: $0.1056 VWAP $0.1155

10/11: 20 lowest intra-day VWAPs in 40 days avg, $0.1200, x 85%: $0.1020 VWAP $0.1246

10/18: 20 lowest intra-day VWAPs in 40 days avg, $0.1198, x 85%: $0.1018 VWAP $0.1286

10/25: 20 lowest intra-day VWAPs in 40 days avg, $0.1198, x 85%: $0.1018 VWAP $0.1254

11/01: 20 lowest intra-day VWAPs in 40 days avg, $0.1195, x 85%: $0.1015 VWAP $0.1249

11/08: 20 lowest intra-day VWAPs in 40 days avg, $0.1193, x 85%: $0.1014 VWAP $0.1229

11/15: 20 lowest intra-day VWAPs in 40 days avg, $0.1183, x 85%: $0.1006 VWAP $0.1203

11/22: 20 lowest intra-day VWAPs in 40 days avg, $0.1166, x 85%: $0.0991 VWAP $0.1144

Vol, in thousands, for above weeks: 2,929, 3,439, 4,406, 6,963, 13,769, 9,640, 3,519, 6,816, 9,769 and 3,977

The 10/11 week was affected by PR of an Axion/NSC presentation at a conference. The effect carried over into the week ending 10/18 with ~2.89MM shares traded that Monday, 10/14. The week ended 10/18 had ~13.8MM shares traded.

On my ORIGINAL inflection point calculations, readings for 5, 10, 25, 50, 100 and 200 day periods:

---- 1-day change ----

11/19 +15.6% -04.8% -02.9% -01.1% -02.0% -01.9%

11/20 +17.3% +10.8% +00.7% +00.8% -00.3% -00.4%

11/21 +32.8% +00.1% +08.7% +01.1% +00.5% +00.0%

11/22 +09.8% +03.2% -02.1% -01.3% -00.5% -00.9%

11/25 -02.2% +02.7% +04.6% +00.1% -00.4% -00.4%

11/26 +49.4% +25.8% +05.2% +00.4% -00.5% +00.3%

11/27 -34.2% +06.7% +03.5% -00.4% -00.6% -00.7%

11/29 -32.5% +13.5% +02.3% +00.3% -00.6% -00.4%

---- 5-day change ----

11/19 +105.5% +083.1% +020.3% +037.9% +011.7% +017.9%

11/20 +523.2% +413.5% +038.4% +070.6% +025.2% +016.3%

11/21 +355.9% +050.1% +269.0% +238.4% +039.9% +031.9%

11/22 +007.4% -007.4% -009.0% -076.7% -014.9% +003.2%

11/25 -009.4% -032.0% +014.7% -157.2% +012.7% +005.4%

11/26 +010.1% +226.6% +085.1% +571.4% +054.2% +059.6%

11/27 -035.3% -017.6% +013.4% -101.5% -026.5% -016.2%

11/29 -080.1% +024.7% -036.4% -4394.3% -066.7% -27.8%

---- 5-day rate of change ----

11/19 +131.1% +135.4% +076.9% +207.2% +073.1% +091.8%

11/20 -056.5% +181.2% +094.8% +141.3% +165.2% +237.3%

11/21 +01719% +065.3% +11899% +086.3% +693.2% +897.3%

11/22 +012.8% -007.7% -000.2% -024.9% -029.2% +011.2%

11/25 -002.5% -032.5% -013.6% -021.6% +046.3% -003.3%

11/26 -035.6% +020.4% +028.6% -019.3% +016.5% +013.3%

11/27 -054.3% -054.6% -003.8% -076.9% -038.7% -025.0%

11/29 -282.1% +008.3% -085.9% -297.8% -097.1% -056.6%

On my NEWER inflection point calculations, for those same periods:

---- 1-day change ----

11/19 +007.80% -013.47% -013.28% -011.10% -013.55% -014.21%

11/20 +014.00% +006.46% -003.81% -004.39% -006.22% -006.71%

11/21 +036.25% +007.26% +014.77% +008.06% +008.23% +008.24%

11/22 +014.24% +006.17% +000.42% +001.00% +002.02% +001.64%

11/25 +002.28% +006.50% +008.15% +003.73% +003.79% +004.10%

11/26 +057.84% +036.60% +017.00% +013.48% +014.27% +016.49%

11/27 -049.88% +001.50% -000.42% -005.62% -006.40% -006.46%

11/29 -034.17% +013.46% +003.36% +001.13% +000.37% +000.88%

---- 5-day change ----

11/19 +143.95% +128.52% +035.89% -021.16% -055.20% -050.50%

11/20 -005.05% +107.44% -1001.77% -595.96% -593.01% -725.64%

11/21 +652.47% +370.79% +352.31% +287.35% +215.80% +199.14%

11/22 -022.05% -057.18% -086.78% -121.93% -152.11% -161.89%

11/25 -007.66% -019.76% +107.62% +060.65% +050.10% +046.26%

11/26 +028.98% +330.57% +346.40% +1523.74% +654.47% +574.55%

11/27 -029.35% -011.09% +010.74% -000.27% +005.55% +007.57%

11/29 -072.14% -000.85% -035.95% -035.89% -037.66% -032.82%

---- 5-day rate of change ----

11/19 +544.29% +513.59% +160.41% +070.04% +053.78% +064.24%

11/20 -090.58% -024.27% -093.76% -087.92% -105.64% -105.42%

11/21 +2846.3% +166.91% +2101.7% +800.90% +1640.4% +1681.5%

11/22 -033.49% -056.36% -092.60% -115.75% -146.89% -140.31%

11/25 +002.33% -034.48% +049.12% +043.85% +044.66% +040.60%

11/26 -024.06% +095.98% +387.88% +603.13% +294.56% +315.27%

11/27 -033.66% -019.90% +048.41% +056.92% +088.32% +090.99%

11/29 -256.26% -072.42% -107.48% -112.19% -102.15% -094.81%

Rolling 5-day ORIGINAL inflection point calculation aggregate change:

******* ******* *5 Day** *10 Day * * 25Day ** 50 Day **100Day* 200 Day

11/19 5 Day +0063.23 -0205.33 -0983.43 -1012.00 -1760.21 -2566.84

11/20 5 Day +0394.05 +0643.71 -0605.45 -0297.30 -1316.47 -2148.74

11/21 5 Day +1796.51 +0966.07 +1022.93 +0411.53 -0791.84 -1463.46

11/22 5 Day +1929.43 +0894.90 +0931.06 +0095.78 -0909.94 -1416.44

11/25 5 Day +1748.77 +0608.73 +1068.07 -0054.77 -0794.04 -1340.00

11/26 5 Day +1925.02 +1988.25 +1976.83 +0258.17 -0363.97 -0541.67

11/27 5 Day +1244.97 +1639.01 +2241.60 -0003.77 -0460.29 -0629.28

11/29 5 Day +0247.40 +2043.91 +1424.81 -0169.21 -0767.09 -0804.35

Average change/day, 5 days

____ **5 Day *10 Day *25 Day *50 Day 100 Day 200 Day

11/19 +066.36 +125.78 -086.18 +118.97 -044.73 -024.26

11/20 +028.88 +353.77 -004.52 +287.11 +029.17 +033.31

11/21 +525.39 +584.82 +533.66 +535.02 +231.42 +332.20

11/22 +592.79 +539.76 +532.80 +401.78 +163.82 +369.46

11/25 +577.76 +364.37 +460.55 +314.88 +239.70 +357.41

11/26 +372.36 +438.72 +592.05 +254.03 +279.25 +405.03

11/27 +170.18 +199.06 +569.41 +058.71 +171.24 +303.89

11/29 -309.82 +215.57 +080.38 -116.15 +004.95 +131.82

Rolling 5-day NEWER inflection point calculation aggregate change:

******* ******* *5 Day** *10 Day * * 25Day ** 50 Day **100Day* 200 Day

11/19 5 Day +0040.96 +0024.85 +0019.61 +0051.13 +0109.67 +0145.23

11/20 5 Day +0038.89 +0051.54 -0176.88 -0253.59 -0540.66 -0908.64

11/21 5 Day +0292.63 +0242.66 +0446.28 +0475.10 +0626.11 +0900.81

11/22 5 Day +0228.10 +0103.91 +0058.99 -0104.19 -0326.28 -0557.52

11/25 5 Day +0210.62 +0083.38 +0122.47 -0041.00 -0162.81 -0299.60

11/26 5 Day +0271.67 +0358.99 +0546.72 +0583.70 +0902.73 +1421.74

11/27 5 Day +0191.94 +0319.18 +0605.41 +0582.11 +0952.82 +1529.30

11/29 5 Day +0053.47 +0316.48 +0387.74 +0373.20 +0594.02 +1027.42

Average change/day, 5 days

____ **5 Day *10 Day *25 Day *50 Day 100 Day 200 Day

11/19 +0032.15 +0059.00 +0142.58 +0220.03 +0361.87 +0577.55

11/20 +0003.03 +0044.68 +0008.89 +0026.58 -0020.40 -0031.32

11/21 +0089.27 +0119.26 +0195.78 +0239.44 +0314.21 +0495.27

11/22 +0059.38 +0052.05 +0014.49 -0037.70 -0147.32 -0199.67

11/25 +0060.76 +0034.10 +0021.61 -0021.17 -0081.52 -0118.59

11/26 +0046.14 +0066.83 +0105.42 +0106.51 +0158.61 +0255.30

11/25 +0030.61 +0053.53 +0156.46 +0167.14 +0298.70 +0487.59

11/29 -0047.83 +0014.76 -0011.71 -0020.38 -0006.42 +0025.32

2013 Dly Sht % of 'sells' values JIC it turns out to be useful...

============ 2013 ===============

Tue. 09/03: 9.29% 34.87% 3.29% 6.14%

Mon. 09/09: 16.71% 16.28% 26.78% 37.54% 20.75%

Mon. 09/16: 13.75% 19.05% 6.49% 13.42% 0.00%

Mon. 09/23: 13.81% 8.28% 30.17% 16.94% 8.34%

Mon. 09:30: 24.17% 6.41% 6.91% 17.84% 19.68%

Mon. 10/07: 17.11% 8.60% 5.98% 61.69% 53.13%

Mon. 10/14: 45.42% 62.53% 67.90% 30.41% 73.99%

Mon. 10/21: 48.19% 47.09% 32.37% 38.06% 32.08%

Mon. 10/28: 37.81% 82.02% 21.45% 10.13% 7.45%

Mon. 11/04: 29.83% 49.63% 31.37% 45.17% 50.60%

Mon. 11/11: 27.53% 35.80% 45.77% 33.82% 46.96%

Mon. 11/18: 37.39% 7.21% 5.99% 14.59% 27.14%

Mon. 11/25: 12.23% 25.80% 6.42% 27.28%

============ 2013 ===============

Jan Avg: 44.20%, min: 00.00%, max: 262.58%

Feb Avg: 20.90%, min: 02.88%, max: 055.65%

Mar Avg: 15.42%, min: 00.00%, max: 100.79%

Apr Avg: 40.63%, min: 00.00%, max: 690.95%

May Avg: 67.58%, min: 09.15%, max: 150.50%

Jun Avg: 47.48%, min: 15.07%, max: 098.99%

Jul Avg: 44.47%, min: 11.23%, max: 122.28%

Aug Avg: 30.24%, min: 02.56%, max: 086.11%

Sep Avg: 16.30%, min: 00.00%, max: 037.54%

Oct Avg: 35.95%, min: 05.98%, max: 082.02%

Nov Avg: 28.42%, min: 05.99%, max: 050.60%

1129 Vol 0209769, Sht 0089269 42.56% LHC 0.1161 0.1230 0.1170 b:s 1:4.18[98]

1127 Vol 0522193, Sht 0030000 05.75% LHC 0.1155 0.1219 0.1160 b:s 1:8.50

1126 Vol 0796756, Sht 0106540 13.37% LHC 0.1155 0.1200 0.1170 b:s 1:1.10

1125 Vol 0776502, Sht 0059362 07.64% LHC 0.1120 0.1200 0.1150 b:s 1:1.79

1122 Vol 0406110, Sht 0093800 23.10% LHC 0.1120 0.1198 0.1140 b:s 1:5.71

1121 Vol 0281320, Sht 0017000 06.04% LHC 0.1120 0.1150 0.1139 b:s 1.38:1

1120 Vol 0582923, Sht 0022932 03.93% LHC 0.1111 0.1140 0.1120 b:s 1:1.91

1119 Vol 1332681, Sht 0072610 05.45% LHC 0.1111 0.1239 0.1115 b:s 1:3.20

1118 Vol 1373735, Sht 0294250 21.42% LHC 0.1160 0.1250 0.1200 b:s 1:1.31

1115 Vol 1853919, Sht 0538550 29.05% LHC 0.1150 0.1350 0.1151 b:s 1:1.59[97]

1114 Vol 1827868, Sht 0419031 22.92% LHC 0.1110 0.1225 0.1130 b:s 1:2.14

1113 Vol 2142796, Sht 0632986 29.54% LHC 0.1120 0.1279 0.1220 b:s 1:1.84

1112 Vol 2709292, Sht 0695002 25.65% LHC 0.1120 0.1310 0.1126 b:s 1:2.53

1111 Vol 1219966, Sht 0213133 17.47% LHC 0.1203 0.1350 0.1230 b:s 1:1.78

1108 Vol 1993612, Sht 0613441 30.77% LHC 0.1200 0.1300 0.1230 b:s 1:1.56

.... OTC markets down 11/07 until ~15:00 resulting in an aberrant day!

1107 Vol 0369750, Sht 0074900 20.26% LHC 0.1210 0.1300 0.1261 b:s 1.23:1

1106 Vol 1471255, Sht 0347896 23.65% LHC 0.1210 0.1335 0.1220 b:s 1:3.10

1105 Vol 1287910, Sht 0443810 34.46% LHC 0.1252 0.1399 0.1329 b:s 1:2.02[96]

1104 Vol 1643903, Sht 0342362 20.83% LHC 0.1203 0.1400 0.1350 b:s 1:2.08

1101 Vol 1124204, Sht 0065000 05.78% LHC 0.1200 0.1298 0.1220 b:s 1:3.90

1031 Vol 0608756, Sht 0047977 07.88% LHC 0.1200 0.1300 0.1201 b:s 1:3.65[95]

1030 Vol 0673218, Sht 0109287 16.23% LHC 0.1205 0.1251 0.1211 b:s 1:3.25

1029 Vol 0542552, Sht 0184438 33.99% LHC 0.1233 0.1300 0.1250 b:s 1.34:1

1028 Vol 0564849, Sht 0136699 24.20% LHC 0.1230 0.1315 0.1251 b:s 1:1.78

1025 Vol 1175537, Sht 0266692 22.69% LHC 0.1220 0.1329 0.1231 b:s 1:2.54

1024 Vol 0980046, Sht 0277600 28.33% LHC 0.1280 0.1300 0.1290 b:s 1:2.91

1023 Vol 2093489, Sht 0459040 21.93% LHC 0.1280 0.1375 0.1285 b:s 1:2.16[94]

1022 Vol 2873365, Sht 0825575 28.73% LHC 0.1295 0.1385 0.1352 b:s 1:1.52[92]

1021 Vol 2444176, Sht 0760929 31.13% LHC 0.1237 0.1348 0.1275 b:s 1:1.86

1018 Vol 1476191, Sht 0553173 37.47% LHC 0.1230 0.1360 0.1241 b:s 1:1.07

1017 Vol 3092833, Sht 0616357 19.93% LHC 0.1200 0.1299 0.1218 b:s 1:1.98[92]

1016 Vol 2978470, Sht 1063555 35.71% LHC 0.1222 0.1349 0.1290 b:s 1:1.21[91]

1015 Vol 4122321, Sht 1390478 33.73% LHC 0.1000 0.1320 0.1270 b:s 1:1.18

1014 Vol 2083880, Sht 0601501 28.86% LHC 0.1150 0.1350 0.1151 b:s 1:1.75[90]

1011 Vol 2317847, Sht 0681882 29.42% LHC 0.1200 0.1300 0.1200 b:s 1:1.28

1010 Vol 2649600, Sht 0838193 31.63% LHC 0.1000 0.1260 0.1153 b:s 1:1.06[89]

1009 Vol 0505800, Sht 0025310 05.00% LHC 0.1002 0.1075 0.1031 b:s 1:5.12

1008 Vol 0927512, Sht 0064165 06.92% LHC 0.1000 0.1193 0.1079 b:s 1:4.36

1007 Vol 0557660, Sht 0166600 11.94% LHC 0.1130 0.1173 0.1131 b:s 1:2.31

1004 Vol 0643987, Sht 0100787 15.65% LHC 0.1150 0.1175 0.1151 b:s 1:3.89

1003 Vol 1238821, Sht 0149800 12.09% LHC 0.1150 0.1217 0.1151 b:s 1:2.11

1002 Vol 0619474, Sht 0038312 06.18% LHC 0.1200 0.1205 0.1200 b:s 1:8.58

1001 Vol 1307672, Sht 0075394 05.77% LHC 0.1200 0.1228 0.1200 b:s 1:8.33[88]

0930 Vol 0585803, Sht 0097900 16.71% LHC 0.1200 0.1270 0.1220 b:s 1:2.24

0927 Vol 0428346, Sht 0031800 07.42% LHC 0.1200 0.1260 0.1201 b:s 1:8.11

0925 Vol 0535930, Sht 0092500 17.26% LHC 0.1200 0.1250 0.1211 b:s 1:1.64

0924 Vol 1314622, Sht 0084490 06.43% LHC 0.1190 0.1235 0.1200 b:s 1:3.46

0919 Vol 0842050, Sht 0077500 09.20% LHC 0.1241 0.1270 0.1250 b:s 1:2.22

0918 Vol 0695935, Sht 0033000 04.74% LHC 0.1250 0.1269 0.1255 b:s 1:2.71

0917 Vol 0437262, Sht 0053514 12.24% LHC 0.1251 0.1290 0.1251 b:s 1:1.80

0916 Vol 0590260, Sht 0057010 09.66% LHC 0.1251 0.1330 0.1251 b:s 1:2.36

0913 Vol 0605493, Sht 0065375 10.80% LHC 0.1255 0.1318 0.1281 b:s 1:1.09

0912 Vol 0711600, Sht 0169200 23.78% LHC 0.1251 0.1348 0.1251 b:s 1:1.73

0911 Vol 1043283, Sht 0182950 17.54% LHC 0.1255 0.3128 0.1255 b:s 1:2.07

0910 Vol 1250920, Sht 0139949 11.19% LHC 0.1290 0.1385 0.1291 b:s 1:2.20[87]

0909 Vol 0537787, Sht 0076725 14.27% LHC 0.1305 0.1350 0.1310 b:s 1:4.70[86]

0906 Vol 0726300, Sht 0037100 05.11% LHC 0.1300 0.1390 0.1305 b:s 1:4.96

0905 Vol 0240810, Sht 0007000 02.91% LHC 0.1305 0.1348 0.1305 b:s 1:7.67

0904 Vol 0260078, Sht 0060471 23.25% LHC 0.1300 0.1340 0.1310 b:s 1:2.05

0903 Vol 0852891, Sht 0055000 06.45% LHC 0.1300 0.1370 0.1300 b:s 1:2.27

[86] There were two AH trades totaling 19K FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 537,787 to my total and would lower the short percentage from 14.72% to my 13.78%. If the shares are also added to the short sales, the short volume moves from 76,725 to 95,725 and the short percentage would be 17.19%.

[87] There was one AH trade of 19K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 1,250,920 to my total and would lower the short percentage from 11.19% to my 11.10%. If the shares are also added to the short sales, the short volume moves from 139,949 to 150,047 and the short percentage would be 11.90%.

There was one pre-market trade of 10K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 1,307,672 to my total and would lower the short percentage from 5.77% to my 5.72%. If the shares are also added to the short sales, the short volume moves from 75,394 to 85,394 and the short percentage would be 6.48%.

[89] There was one after-market trade of 51K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,649,600 to my total and would lower the short percentage from 31.63% to my 31.58%. If the shares are also added to the short sales, the short volume moves from 838,193 to 843,193 and the short percentage would be 31.76%.

[90] There was one after-market trade of 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,083,880 to my total and would lower the short percentage from 28.86% to my 28.80%. If the shares are also added to the short sales, the short volume moves from 601,501 to 606,501 and the short percentage would be 29.03%.

[91] There was one pre-market trade of 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,978,470 to my total and would lower the short percentage from 35.71% to my 35.65%. If the shares are also added to the short sales, the short volume moves from 1,063,555 to 1,068,555 and the short percentage would be 35.82%.

[92] There was one pre-market trade of 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 3,092,833 to my total and would lower the short percentage from 19.93% to my 19.90%. If the shares are also added to the short sales, the short volume moves from 616,537 to 621,357 and the short percentage would be 20.06%.

[93] There were four pre-market trades totaling 45K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,873,365 to my total and would lower the short percentage from 28.73% to my 28.29%. If the shares are also added to the short sales, the short volume moves from 825,575 to 870,575 and the short percentage would be 29.83%.

[94] There was one pre-market trade of 10K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,093,489 to my total and would lower the short percentage from 21.93% to my 21.82%. If the shares are also added to the short sales, the short volume moves from 459,040 to 469,040 and the short percentage would be 22.30%.

[95] There was one AH trade of 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 608,756 to my total and would lower the short percentage from 7.88% to my 7.82%. If the shares are also added to the short sales, the short volume moves from 47,977 to 52,977 and the short percentage would be 8.63%.

[96] There was one AH trade of 50K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 1,287,910 to my total and would lower the short percentage from 34.46% to my 33.17%. If the shares are also added to the short sales, the short volume moves from 443,810 to 493,810 and the short percentage would be 36.91%.

[97] There were two pre-market trades totaling 15K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 1,853,919 to my total and would lower the short percentage from 29.05% to my 28.82%. If the shares are also added to the short sales, the short volume moves from 538,550 to 553,550 and the short percentage would be 29.62%.

[98] ABERRATION! FINRA-reported daily short sales trade volume is missing 195,700 shares of the daily trade volume. I've e-mailed FINRA for clarification - it could be case of partial volume which will be rectified on the next business day. There could be unreported short sales included in the (apparently) missing volume. Regardless, adding that to the FINRA trade volume raises it from 209,769 to my total and would lower the short percentage from 42.56% to my 22.02%. If new data is received Monday, the day's record will be updated and this note may be removed.

11/27/2013: EOD stuff partially copied to the concentrator.

# Trds: 72, MinTrSz: 100, MaxTrSz: 61000, Vol: 522193, AvTrSz: 7253

Min. Pr: 0.1155, Max Pr: 0.1219, VW Avg. Tr. Pr: 0.1172

# Buys, Shares: 9 54993, VW Avg Buy Pr: 0.1208

# Sells, Shares: 63 467200, VW Avg Sell Pr: 0.1167

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:8.50 (10.5% "buys"), DlyShts 30000 (5.75%), Dly Sht % of 'sells' 6.42%

The average of the lowest 20 VWAPs times 85% today is $0.0986 vs. $0.0987, $0.0988 and $0.0991 on prior days. 85% of today's VWAP is 0.0996 vs. $0.1006, $0.0974 and $0.0972 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today, VWAP, trade volume, and daily short sales moved -0.96%, -34.46% and -71.84% respectively. With this being a day before Thanksgiving, I don't know how much weight we should give these readings.

Even with that in mind, the buy percentage dropping to 10.5% does concern me. Look at the trading breakdown and note that all the buys occurred in the highest price range, $0.1199-$0.1219. It was ~10.5% of day's volume. So ~90% of the day's trades were sellers stepping past the offers and directly hitting the bids.

It does match expected behavior with very low daily short volumes and percentages though. I'm guessing that some MM was long with incoming shares backing prior sell orders which had generated short sales the MM had already covered with buys at lower prices. This would logically result in lower daily short sales volume (although it could be due to such as intra-broker trades too), less price support from the market-makers and a higher "sell" percentage as the MM(s) cleaned out their portfolio. Looking at minimum trade prices, VWAPs and buy percentages over the last week, this seems reasonable.

That doesn't make me feel any better.

The 400K+ quantity bid at $0.11 is still there, untouched. After seeing the aggregate size of that potential support level shrink as higher bids from particular MMs masked these $0.11 bids, it is starting to return to the aggregate 700K+ level as VWAP continues to sink and folks apparently ask "Why bid higher?". Today we're seeing CANT 421K, NITE 292K, PERT 11K and TEJS 5K - ~730K. I expect this will grow some more starting next week.

Our late-day weakness today was, well, weak. I think it was because ARCA was absent all day. This left ATDF, BTIG and CDEL as the primary participants at the top of the offers most of the day. Since they often do seem to care about getting the best price they can, unlike ARCA who behaves as if price is no object, I believe the lack of ARCA explains the weak late-day weakness today.

The peeks at the asks today yielded only one increase and one unchanged. The other six were decreases. The bid moves were balanced between up and down - ten vs. eight. Remember these are arbitrary peeks and not complete tracking.

Here's a trading breakdown by arbitrary time-frames.

09:30-10:06: 016599 shrs, 03.18% of vol, VWAP $0.1214, 90.4% buys

10:38-10:54: 134300 shrs, 25.72% of vol, VWAP $0.1168, 00.0% buys

11:19-12:56: 072594 shrs, 13.90% of vol, VWAP $0.1186, 48.2% buys

13:04-14:04: 039350 shrs, 07.54% of vol, VWAP $0.1170, 00.0% buys

14:05-14:27: 096400 shrs, 18.46% of vol, VWAP $0.1165, 05.2% buys

15:01-15:25: 107700 shrs, 20.62% of vol, VWAP $0.1173, 00.0% buys

15:25-15:59: 056250 shrs, 10.77% of vol, VWAP $0.1157, 00.0% buys

Here's a breakdown by arbitrary price range.

$0.1155-$0.1160: 080850 shrs, 15.48% of vol, VWAP $0.1157, b:s , 0.0% buys

$0.1163-$0.1170: 314950 shrs, 60.31% of vol, VWAP $0.1168, b:s , 0.0% buys

$0.1171-$0.1185: 071400 shrs, 13.67% of vol, VWAP $0.1177, b:s , 0.0% buys

$0.1199-$0.1219: 054993 shrs, 10.53% of vol, VWAP $0.1208, b:s , 100% buys

On the traditional TA front we are still predominately trading below the 50-day SMA, still at $0.1206. Since 11/18 our trading has been like this. See today's trading breakdowns.

Our low stayed flat today as the medium-term descending channel support continued down, again increasing the gap. I said if this continues, I might begin to believe something positive might occur. Today we got a higher high, 1.58%, but volume was down ~34.5%, as detailed above. With volume down that much the higher high should be viewed with suspicion, especially with the VWAP weakening -0.96%. Also, keep in mind that 10% buy percentage was all trades at the day's highest prices.

As another cautionary flag, let's toss in that buy percentage, a non-traditional factor. While thinking of that, take a look at my experimental charts and note behavior of the various averages for buy percentage. Not a pretty sight and not a picture conducive to optimism for bullish price action currently.

My thought about the oscillators I watch are unchanged: with the price action being and the volume being (sporadically?) up, the oscillators I watch have continue early improvement and beginning to exit oversold in some cases. Others are around neutral readings. The accumulation and distribution remains very negative though, continuing to show increasing distribution.

As I've iterated a couple times now, there is no bullishness reflected in my experimental inflection point calculations yet - only reducing weakening from the flat behavior in the market. I noted yesterday "The flat action has been long enough that the reduction in weakening is becoming quite noticeable on my original chart. The three shorter periods have developed a noticeable trend up. The three longer periods are still undecided, but have shown some recent blips suggesting they may come to a more positive stance". Today's behavior interrupted that, bring the three longer-term calculations to increased weakening, along with the five-day, leaving only the 10 and 25-day calculations still suggesting reducing weakening.

Unlike my original calculations, my newer calculations and charts, sensitive to additional factors, have all periods in agreement - weakening rate, which was decreasing yesterday, is on the increase again.

Something of more concern, which I've not mentioned in some time, is the average trade size. Prior to the pipe deal the average trade sizes achieved some stability at a low range (see the chart) and began to climb after the deal as price eroded. This is as one might expect if there is a good deal of bullish investors that see the price erosion as a rising opportunity - maybe an improved risk/reward scenario.

But this behavior has taken a potentially negative turn. Three of the last four trading days have had average trade size below all averages - currently 8,561, 8,863, 8,510 and 7496 for the 10, 25, 50 and 100-day averages respectively. Further, three of the last four days have also been below a short-term rising trend support line which had been offering some hope that we might eventually break up from our current trading range. I think these smaller transaction sizes suggest market-makers are having to work much harder to make their money, which is not the case when bullish sentiment is strong and larger buyers are in the market.

If we could stabilize in this area I think we'd have a good chance of at least remaining in our sideways price trading range for a while longer. If average trade size continues to drop, I think it will be difficult.

N.B. Keep in mind that we have a relatively large aggregate quantity of shares bid at $0.11 and if we hit this range while PIPErs are flush with fresh shares we'll probably have a spike in the average trade size, for a day or two(?), while we have a deterioration in VWAP to around that level. Relative to the PIPErs available shares, this (currently) 400K-500K aggregate quantity is small and may not be support that can last very long.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

11/22 $0.1144 +00.66% 14.9%

11/25 $0.1145 +00.14% 34.9%

11/26 $0.1183 +03.28% 47.3%

11/27 $0.1172 -00.96% 10.5%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/25: 20 lowest intra-day VWAPs in 40 days avg, $0.1162, x 85%: $0.0988

11/26: 20 lowest intra-day VWAPs in 40 days avg, $0.1161, x 85%: $0.0987

11/27: 20 lowest intra-day VWAPs in 40 days avg, $0.1160, x 85%: $0.0986

Vol, in K, for above days: 776.50, 796.76, 522.19.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are are in the latest daily post above.

11/26/2013: EOD stuff partially copied to the concentrator.

# Trds: 124 , MinTrSz: 100 , MaxTrSz: 82300 , Vol: 796756 , AvTrSz: 6425

Min. Pr: 0.1155 , Max Pr: 0.1200 , VW Avg. Tr. Pr: 0.1183

# Buys, Shares: 53 376829 , VW Avg Buy Pr: 0.1193

# Sells, Shares: 69 412927 , VW Avg Sell Pr: 0.1174

# Unkn, Shares: 2 7000 , VW Avg Unk. Pr: 0.1190

Buy:Sell 1:1.10 (47.3%) DlyShts 106540 (13.37%), Dly Sht % of 'sells' 25.80%

The average of the lowest 20 VWAPs times 85% today is $0.0987 vs $0.0988 and $0.0991 on prior days. 85% of today's VWAP is $0.1006 vs $0.0974 yesterday - at last something positive! These are potential prices for the next tranche of shares to the PIPErs.

Today, VWAP, trade volume, and daily short sales moved 3.28%, 2.61% and 79.48% respectively. As I've mentioned, the rise in daily short percentage towards the trend line above it is both erratic and something we need to see for any price movement. As predicted, we are seeing the lows of each "wave" move higher. We should the highs begin to move up too, but we have a short week. I don't know if this will affect the movement this week or not.

Our move to the ~$0.12 price level remains intact - it's today's high and the VWAP has moved to close to it too. Today's low, high and VWAP moved 3.13%, 0.00% and 3.28% respectively.

The 400K+ quantity bid at $0.11 is still there, untouched. Again, some of the other MMs' $0.11 bids were hidden as they had higher bids masking them.

We again had some additional larger bids similar to yesterday's. I won't detail them again until they seem to change. Right now they have had a few days of consistency.

No late-day weakness appeared today. I think it was because ARCA was playing hide 'n seek again. In early, disappeared after price dropped a bit, came back when it rose (too much?), etc. ATDF was their primary for top spot on the ask.

The bid and ask moves were both balanced between up and down. Remember these are arbitrary peeks and not complete tracking.

Here's a trading breakdown by arbitrary time-frames. NOTE: the 09:49-09:58 time-frame includes a 100K buy @ $0.1150, which had a big impact on both the time-frame results and the complete day's results due to the 100K constituting 12.88% of day's trade volume. It also included a 45K sell at $0.1130.

09:30-09:57: 056558 shrs, 07.10% of vol, VWAP $0.1197, 96.1% buys

10:07-10:58: 016093 shrs, 02.02% of vol, VWAP $0.1155, 1.2% buys

11:15-11:59: 036654 shrs, 04.60% of vol, VWAP $0.1184, 67.0% buys

12:01-13:29: 096625 shrs, 12.13% of vol, VWAP $0.1171, 35.5% buys

13:30-13:47: 005000 shrs, 00.63% of vol, VWAP $0.1175, 100.0% buys

14:02-14:16: 038400 shrs, 04.82% of vol, VWAP $0.1180, 0.0% buys

14:21-14:44: 162300 shrs, 20.37% of vol, VWAP $0.1194, 65.9% buys

14:46-15:08: 260099 shrs, 32.64% of vol, VWAP $0.1187, 40.8% buys

15:09-15:59: 125027 shrs, 15.69% of vol, VWAP $0.1168, 36.3% buys

Here's a breakdown by arbitrary price range.

$0.1155-$0.1168: 158178 shrs, 19.85% of vol, VWAP $0.1163, b:s 1:6.91, 12.6% buys

$0.1170-$0.1185: 319175 shrs, 40.06% of vol, VWAP $0.1178, b:s 1:4.86, 17.1% buys

$0.1189-$0.1199: 252953 shrs, 31.75% of vol, VWAP $0.1197, b:s 23.60:1, 93.3% buys

$0.1200-$0.1200: 066450 shrs, 08.34% of vol, VWAP $0.1200, 100% buys

On the traditional TA front we are still trading completely below the 50-day SMA, down to $0.1206 today from yesterday's $0.1208. Since 11/18 our trading was predominately below that metric.

Our low rose today while my medium-term descending channel support continued down, increasing the gap. If this continues, I might begin to believe something positive might occur. With the daily short sales behaving according to expectations, the possibility grows stronger it may continue within the channel for a longer period.

These comments are exactly the same as yesterday. With the price action being really sort of flat and the volume being up, the oscillators I watch have switched from reducing rate of weakening to starting to exit oversold, in some cases, and hovering around neutral readings in other cases. The accumulation and distribution remains very negative though, continuing to show increasing distribution.

I'm sticking to my thought that there is no bullishness reflected in my experimental inflection point calculations yet - only reducing weakening from the flat behavior in the market. However, the flat action has been long enough that the reduction in weakening is becoming quite noticeable on my original chart. The three shorter periods have developed a noticeable trend up. The three longer periods are still undecided, but have shown some recent blips suggesting they may come to a more positive stance.

My newer calculations and charts, sensitive to additional factors, have all periods in agreement - weakening rate is definitely reducing. If the current trading behavior continues, it won't take much for them to start forming the pattern I want to see for a bullish indication. But it's not here yet.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

11/22 $0.1144 +00.66% 14.9%

11/25 $0.1145 +00.14% 34.9%

11/26 $0.1183 +03.28% 47.3%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/25: 20 lowest intra-day VWAPs in 40 days avg, $0.1162, x 85%: $0.0988

11/26: 20 lowest intra-day VWAPs in 40 days avg, $0.1161, x 85%: $0.0987

Vol, in K, for above days: 776.50, 796.76.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

11/25/2013: EOD stuff partially copied to the concentrator.

# Trds: 86, MinTrSz: 500, MaxTrSz: 100000, Vol: 776502, AvTrSz: 9029

Min. Pr: 0.1120, Max Pr: 0.1200, VW Avg. Tr. Pr: 0.1145

# Buys, Shares: 26 271261, VW Avg Buy Pr: 0.1163

# Sells, Shares: 59 485241, VW Avg Sell Pr: 0.1137

# Unkn, Shares: 1 20000, VW Avg Unk. Pr: 0.1125

Buy:Sell 1:1.79 (34.9% "buys"), DlyShts 59362 (7.64%), Dly Sht % of 'sells' 12.23%

The average of the lowest 20 VWAPs times 85% today is $0.0988 vs. yesterday's $0.0991. 85% of today's VWAP is $0.0974. These are potential prices for the next tranche of shares to the PIPErs.

Today, VWAP, trade volume, and daily short sales moved 0.14%, 91.20% and -36.71% respectively. As I mentioned yesterday, the rise in daily short percentage towards the trend line above it is erratic in behavior. We should continue seeing the lows of each "wave" move higher, along with the highs, over the days ahead. This happened today with the low percentage (21.42%, 5.45%, 3.93%, 6.04%, 23.10% and 7.64% today).

In the past few days I've mentioned "... a move to the mid-point of ~$0.12 or so would not be unexpected. Much higher would be unexpected, all things considered". Still holding there with the high of $0.12. Today's low, high and VWAP moved 0.00%, 0.17% and 0.14% respectively.

The 400K+ quantity bid at $0.11 is still there, untouched. Again, some of the other MMs' $0.11 bids were hidden as they had higher bids masking them.

We again had some additional larger bids ($0.111 CDEL 61K, $0.113 ATDF 90K, $0.1135 100K ETRF, $0.1116 98K NITE - yesterday 100K at $0.111) and a few somewhat larger offers continue to appear (BNCH $0.12 x 40K and CDEL $0.122 x 50K).

Late-day weakness decided to appear in the morning today. Our drop in the afternoon was only a few tenths of a penny, as seen in the trading breakdown below. I believe this was from ARCA coming in early and then leaving early, rather than hanging around as is often the case.

The bid moves were balanced between up and down and most on the offer were down (12 vs. 5 - but remember these are arbitrary peeks and not complete tracking).

ARCA was in at 9:39 but after tussling with (mostly) ATDF all morning was gone when I checked at 12:20. ARCA did not reappear. They seem to have a habit of doing this after they've moved price lower (check the time when VWAP begins to recover a bit in the trading breakdown by time).

Here's a trading breakdown by arbitrary time-frames. NOTE: the 09:49-09:58 time-frame includes a 100K buy @ $0.1150, which had a big impact on both the time-frame results and the complete day's results due to the 100K constituting 12.88% of day's trade volume. It also included a 45K sell at $0.1130.

09:30-09:37: 042500 shrs, 05.47% of vol, VWAP $0.1195, 91.8% buys

09:39-09:48: 176974 shrs, 22.79% of vol, VWAP $0.1139, 0.0% buys

09:49-09:58: 201500 shrs, 25.95% of vol, VWAP $0.1139, 51.6% buys

10:01-10:49: 096099 shrs, 12.38% of vol, VWAP $0.1135, 31.2% buys

11:21-11:50: 007262 shrs, 00.94% of vol, VWAP $0.1137, 51.8% buys

12:08-12:56: 049500 shrs, 06.37% of vol, VWAP $0.1159, 21.2% buys

13:00-13:58: 015000 shrs, 01.93% of vol, VWAP $0.1179, 100.0% buys

14:01-14:42: 035500 shrs, 04.57% of vol, VWAP $0.1143, 0.0% buys

15:21-15:57: 152167 shrs, 19.60% of vol, VWAP $0.1148, 45.3% buys

Here's a breakdown by arbitrary price range.

$0.1120-$0.1136: 267329 shrs, 34.43% of vol, VWAP $0.1130, b:s 1:26.48, 3.4% buys

$0.1140-$0.1150: 407673 shrs, 52.50% of vol, VWAP $0.1145, b:s 1:1.49, 40.2% buys

$0.1160-$0.1180: 052500 shrs, 06.76% of vol, VWAP $0.1177, b:s 16.50:1, 94.3% buys

$0.1198-$0.1200: 049000 shrs, 06.31% of vol, VWAP $0.1199, 100% buys

On the traditional TA front we are now trading completely below the 50-day SMA, $0.1208 today. Since 11/18 our trading was predominately below that metric. As I've mentioned, still no signs, other than in some of my experimental stuff, that this may change soon. My experimental stuff continues to show reducing weakening - not to be mistaken for strengthening! They are, essentially, reflecting the long period of action dwelling in a narrow band of behavior. This is an improvement from the long period of fairly constant downward movement in the past.

Our low stayed flat again at $0.1120 while my medium-term descending channel support continued down, leaving the low above it by a tiny amount again. With the daily short sales behaving according to expectations, the possibility still exists it may continue within the channel for a longer period.

With the price action being really sort of flat and the volume being up, the oscillators I watch have switched from reducing rate of weakening to starting to exit oversold, in some cases, and hovering around neutral readings in other cases. The accumulation and distribution remains very negative though, continuing to show increasing distribution.

I'm sticking to my thought that there is no bullishness reflected in my experimental inflection point calculations yet - only reducing weakening from the flat behavior in the market.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

11/22 $0.1144 +00.66% 14.9%

11/25 $0.1145 +00.14% 34.9%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/25: 20 lowest intra-day VWAPs in 40 days avg, $0.1162, x 85%: $0.0988

Vol, in K, for above days: 776.50.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

11/22/2013: EOD stuff partially copied to the concentrator.

# Trds: 62, MinTrSz: 500, MaxTrSz: 27600, Vol: 406110, AvTrSz: 6550

Min. Pr: 0.1120, Max Pr: 0.1198, VW Avg. Tr. Pr: 0.1144

# Buys, Shares: 11 60484, VW Avg Buy Pr: 0.1167

# Sells, Shares: 51 345626, VW Avg Sell Pr: 0.1140

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:5.71 (14.9% "buys"), DlyShts 93800 (23.1%), Dly Sht % of 'sells' 27.14%

If PIPErs received shares today they would pay only $0.0991 vs. yesterday's $0.0995.

Yesterday I said, in part, "... but when the daily short sales get so low we sometimes get an immediate stop of the VWAP descent. Sometimes it takes a few days though". I also said "... the past behavior suggests an erratic (but not always) trend up in daily short sales again until it intersects (or sometimes just "nears") the trend line ...".

Today, VWAP, trade volume, and daily short sales moved 0.66%, 44.36% and 451.76% respectively. Following the identified patterns, the daily short percentage moved to 23.1% from yesterday's 6.04%. There may seem a disconnect since the higher short percentage came on lower buy percentage, counter to one of the things I look for. But this is OK because we had come off the extreme low of daily short sale percentage and the normal trend in that case is for the short percentage to begin moving towards the trend line above regardless of "buy" strength. So we're still on-script.

Following the script, I wrote yesterday "While this is happening, the VWAP price trend should be generally flat, at worst, with an upward bias also possible. It will not be a large upward bias though, ... ". In my traditional TA comments I said "Looking at the traditional Bollingers (20 period), we have been bumping the lower limit and a move to the mid-point of ~$0.12 or so would not be unexpected. Much higher would be unexpected, all things considered".

Today we hit our high at $0.1198 (+4.17% from the prior day's high of $0.115) and our low was $0.112.

The 400K+ quantity bid at $0.11 is still there, untouched, which may act as support later in the game. Again, some of those bids were hidden as the MMs had higher bids masking the $0.11 bids from those MMs.

We again had some additional larger bids ($0.111: NITE 100K and CDEL 61K) and some larger asks also appeared (BNCH $0.12 x 55K and CDEL $0.122x50K).

Today was another day of little late-day weakness, but also no late-day strength.

Regardless, most of the moves on the bid were upwards and most on the ask were down. But as various levels of the ask were taken substantially higher asks, were exposed and became the best ask. Trading range tended to move up to it for a while before ...

The usual suspect sellers made another move. These included predominately ARCA, NITE and ATDF. ATDF was the most aggressive, followed by ARCA. NITE was aggressive only early in the day.

With a narrow spread and low volume again there's no utility in the trading breakdowns, so I'll skip them until something occurs that suggests usefulness.

On the traditional TA front we continue trading predominately below the 50-day SMA, $0.121 today, since 11/18. Still no signs, other than in some of my experimental stuff, that this may change soon. Yesterday I mentioned we had been bumping the bottom of the traditional Bollingers (20 period) a move to the mid-point of ~$0.12 or so would not be unexpected. As mentioned above, it played as expected. That removes the Bollinger band as a predictive consideration and offers no suggestion either way.

Our low stayed flat (+0.00%) while my medium-term descending channel support continued down, leaving the low above it by a tiny amount. With the daily short sales continuing to trend up (volume +451.8% today), there's still a chance it may stay within the channel for a longer period, as I mentioned yesterday, for maybe another week or so?

With the price action being really sort of flat the oscillators I watch continue weakening at a slower rate.

I had mentioned yesterday the experimental inflection point calculations' big positive moves in the 5-day rate of change and most were due to some large negative numbers falling out of the respective periods. I said I don't assign much weight to a suggestion of some bullish action coming yet. But with stability in the buy;sell, daily short sales and price, I said we should see continued improvement in these derivatives of the inflection point calculations. We did see this and the changes were much smaller. I'm sticking to my thought that there is no bullishness reflected in these yet - only reducing weakening from the flat behavior in the market.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

11/22 $0.1144 +00.66% 14.9%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/18: 20 lowest intra-day VWAPs in 40 days avg, $0.1182, x 85%: $0.1004

11/19: 20 lowest intra-day VWAPs in 40 days avg, $0.1179, x 85%: $0.1002

11/20: 20 lowest intra-day VWAPs in 40 days avg, $0.1175, x 85%: $0.0999

11/21: 20 lowest intra-day VWAPs in 40 days avg, $0.1170, x 85%: $0.0995

11/22: 20 lowest intra-day VWAPs in 40 days avg, $0.1166, x 85%: $0.0991

Vol, in K, for above days: 1373.74, 1332.68, 582.92, 281.32 and 406.11.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are are in the latest daily post above.

11/21/2013: EOD stuff partially copied to the concentrator.

# Trds: 36 , MinTrSz: 500 , MaxTrSz: 26000 , Vol: 281320 , AvTrSz: 7814

Min. Pr: 0.1120 , Max Pr: 0.1150 , VW Avg. Tr. Pr: 0.1136

# Buys, Shares: 18 160820 , VW Avg Buy Pr: 0.1138

# Sells, Shares: 17 116500 , VW Avg Sell Pr: 0.1134

# Unkn, Shares: 1 4000 , VW Avg Unk. Pr: 0.1129

Buy:Sell 1.38:1 (57.2% "buys") , DlyShts 17000 (6.04%), Dly Sht % of 'sells' 14.59%

If PIPErs received shares today they would pay only $0.995 vs. yesterday's $0.0999.

Yesterday VWAP, trade volume and daily short sales volumes were down -2.57%, -56.26% and -68.42% respectively. The daily short sale percentage was down to 3.93%. The day before I had said "Likely down on the VWAP for at least several more days". But when the daily shorts hit 3.93% yesterday, I should have revised my expectations and failed to do so. The other items behaved as expected but when the daily short sales get so low we sometimes get an immediate stop of the VWAP descent. Sometimes it takes a few days though.

Today, VWAP, trade volume, and daily short sales moved 0.99%, -51.7% and -25.9% respectively. In a comment today I said, in part, "... makes me think we'll see a higher daily short sale percentage today even though the absolute volume will be low". That expectation was met. I mention this only because seeing results more-or-less as expected gives me comfort that I am understanding things correctly.

With that in hand, the past behavior suggests an erratic (but not always) trend up in daily short sales again until it intersects (or sometimes just "nears") the trend line. If a new cycle is beginning, it may penetrate the trend line and get rather high, although the shape of this cycle suggests that's less likely.

While this is happening, the VWAP price trend should be generally flat, at worst, with an upward bias also possible. It will not be a large upward bias though, as can be plainly seen on the price and volume charts, if the patterns conform to past behavior. Today supports this with the intra-day high and low up just 0.81% and 0.88% respectively.

We still haven't hit the potential support that may exist at $0.11, where CANT maintains their 421K bid, totaling 529K with the others that have joined in. Today CANT and a couple others were still there but several that had been there were all at higher bids today. So we could only see 491K bid at $0.11 today, due to the higher bids "masking" the lower bids on Level 2.

With the daily short sales and VWAP behavior (and we mustn't overlook the declining trade volume), I don't think we'll test $0.11 until we start another down leg in the daily short sales or the PIPErs receive another tranche of dirt-cheap shares. These two events may coincide.

Again today we had no strong start. In fact, with only a 3/10ths of a penny spread, the only strength was "flat". Movement on the bids were almost exclusively upward - even when lower bids were uncovered, one of the usual suspects almost immediately appeared with a higher bid, keeping the market from moving down much at all.

On the ask side, movement was mixed but tightly constrained between $0.113 and $0.1148 all day, finishing to the higher side late in the day.

We did have some other larger bids again (NITE $0.111x103K, CSTI $0.1105x50K). On the ask side some larger offers were from BNCH at $0.12 x 55K and CDEL at $0.122 x 50K. These never got that close to the top of the queue though because ARCA was in from 10:10 onward and was competing, mostly, with ATDF to sell. At various points CANT, NITE and CSTI also appeared with the best offers, keeping the market upside constrained.

With the narrow spread and low volume there's no utility in the trading breakdowns, so I'll skip them until something occurs that suggests usefulness.

On the traditional TA front we've now been trading predominately below the 50-day SMA since 11/18. There are no signs, other than in some of my experimental stuff, that this may change soon. Looking at the traditional Bollingers (20 period), we have been bumping the lower limit and a move to the mid-point of ~$0.12 or so would not be unexpected. Much higher would be unexpected, all things considered.

Our low continues riding my medium-term descending channel support. Yesterday I said I don't expect it to hold for long with what's going on. But with the daily short sales beginning to rise, there's a chance it may stay within the channel for a longer period - another week or so? The oscillators I watch are weakening at a slower rate now, as would be expected, and momentum has actually reversed and begun to improve, reading still below neutral though at ~0.934.

In a normal trading environment I would judge all this as possibly indicating consolidation with a likely bounce to start a leg up to the descending resistance of the medium-term channel, around $0.131 currently. There's a longer-term descending resistance currently at ~$0.128 that would have to be breached first though. In this market, with a new tranche of PIPEr shares due out in the first week of December, I would be surprised if we got too close to either of those marks, even with the daily short sales percentage on the rise (apparently - one step up is really too early to determine if the trend has started).

Both my original and newer experimental inflection point calculations had some big positive moves in the 5-day rate of change. Most of these are due to some large negative numbers falling out of the respective periods, so I don't assign much weight to a suggestion of some bullish action coming ... yet. However, with the buy;sell, daily short sales and price all stabilizing for the moment, we should see continued improvement in these derivatives of the inflection point calculations as less radical numbers enter and more radical negatives fall out of the calculations.

Regarding my newer version I said "If the positive action of today doesn't hold that negative pattern should begin very quickly to develop again". The 5 and 10-day inflection points, reflecting reduced rate of weakening, were countered by the longer-term calculations suggesting increased rate of weakening. The changes today negate that assessment. I believe the charts will continue to reflect reduced weakening in all periods for a while before the expected reflection of a trend down can reappear, if that is indeed what's in place.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

11/21 $0.1136 +00.99% 47.2%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/18: 20 lowest intra-day VWAPs in 40 days avg, $0.1182, x 85%: $0.1004

11/19: 20 lowest intra-day VWAPs in 40 days avg, $0.1179, x 85%: $0.1002

11/20: 20 lowest intra-day VWAPs in 40 days avg, $0.1175, x 85%: $0.0999

11/21: 20 lowest intra-day VWAPs in 40 days avg, $0.1170, x 85%: $0.0995

Vol, in K, for above days: 1373.74, 1332.68, 582.92 and 281.32.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

11/20/2013: EOD stuff partially copied to the concentrator.

# Trds: 59, MinTrSz: 150, MaxTrSz: 90000, Vol: 582923, AvTrSz: 9880

Min. Pr: 0.1111, Max Pr: 0.1140, VW Avg. Tr. Pr: 0.1125

# Buys, Shares: 24 200317, VW Avg Buy Pr: 0.1133

# Sells, Shares: 35 382606, VW Avg Sell Pr: 0.1121

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.91 (34.4% "buys"), DlyShts 22932 (3.93.%), Dly Sht % of 'sells' 5.99%

First things first! If PIPErs received shares today they would pay only $0.0999! This is the first occurrence of the 85% price being below $0.10.

Recall yesterday that VWAP, trade volume and daily short sales volumes were down -3.73%, -2.99% and -75.32% respectively. And I said "The daily short sales percentage says no upside here. Likely down on the VWAP for at least several more days". Today VWAP, trade volume and daily short sales volumes were down -2.57%, -56.26% and -68.42% respectively. The daily short sale percentage was down to 3.93%.

Bad ju-ju is in the air!

We haven't hit the potential support that may exist at $0.11 where CANT maintains their 421K bid, totaling 529K with the others that have joined in, but the "sells" percentage, which as of yesterday has averaged ~67.3% since 10/30, suggests that this potential support volume will be easily overwhelmed. OTOH, today's total volume was less than the total of those $0.11 bid. If everyone holds their position and volume keeps sinking, maybe we get lucky. Today's sell percentage was 65.6%.

Today was unusual: no strong start - in fact no strength anywhere today. See the trading breakdowns below. ARCA was in from the start on the ask, but they really had little to do with all this. Bid sat at $0.112 for a very long time with no movement and NITE, ATDF and CSTI did most of the lowering of the offers. CANT made a token appearance again. ATDF had an offer of 100K early on, but I suspect they gave up and just hit the bid with those shares, for which they were asking $0.1195. I suspect this because our largest trade was a 90K "sell" and had some larger (>= 10K) "sells" right around it. Never saw that offer again shortly after the open, but it could have been masked by other ATDF better offers. Tomorrow will probably tell the tale.

ATDF also had a 73K bid in at $0.111.

Here's some arbitrary snapshots of ending time, buy percentage, VWAP and volume. The first three values are for the period end and the last three are cumulative.

10:11:28 10.37% 0.1122 195250 10.37% 0.1122 195250

10:40:09 27.06% 0.1127 141500 17.38% 0.1124 336750

11:43:11 96.81% 0.1135 031332 24.14% 0.1125 368082

12:46:35 89.40% 0.1130 095750 37.61% 0.1126 463832

15:13:37 80.66% 0.1125 025850 39.89% 0.1126 489682

15:56:17 05.36% 0.1121 093241 34.36% 0.1125 582923

On the traditional TA front that new descending trading channel I constructed yesterday seems to be valid. Our low is riding the descending support down, but I really don't expect it to hold for long with what's going on. There's little change in the oscillators I watch - all weak and getting weaker.

In a normal trading environment I would judge the falling volume as possibly indicating consolidation, but as I've mentioned I think it means we'll break below that descending support into the $0.10xx area soon.

FYI: since 11/05's VWAP of $0.1340 we've seen it drop -16.04%.

Intra-day trading breakdown by arbitrary time-frames.

09:30-09:57: 177750 shrs, 30.49% of vol, VWAP $0.1122, 11.4% buys

10:11-10:40: 159000 shrs, 27.28% of vol, VWAP $0.1126, 24.1% buys

11:19-12:24: 126932 shrs, 21.78% of vol, VWAP $0.1131, 91.3% buys

12:46-15:13: 026000 shrs, 04.46% of vol, VWAP $0.1125, 80.2% buys

15:13-15:56: 093241 shrs, 16.00% of vol, VWAP $0.1121, 05.4% buys

Here's the intra-day trading breakdown by arbitrary price range.

$0.1111-$0.1125: 333526 shrs, 57.22% of vol, VWAP $0.1120, b:s 1:22.60, 4.2% buys

$0.1127-$0.1140: 249397 shrs, 42.78% of vol, VWAP $0.1132, b:s 2.95:1, 74.7% buys

Both my original and newer experimental inflection point calculations remain in a general weakening trend.

Yesterday I said "my newer version ... It doesn't mean bullishness is here because the pattern [that] guides me is a long way from appearing on the upside. However, the strong start to a pattern suggesting a down move is not out of play. If the positive action of today doesn't hold that negative pattern should begin very quickly to develop again". The 5 and 10-day inflection points are reflecting reduced rte of weakening, but this is countered by the longer-term calculations suggesting increased rate of weakening.

OTC markets down 11/07 until ~15:00 resulting in an aberrant day! Keep that in mind when looking at numbers below!

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

10/24 $0.1285 -02.80% 25.1%

10/25 $0.1254 -02.37% 27.8%

10/28 $0.1267 +01.00% 36.0%

10/29 $0.1274 +00.54% 55.6%

10/30 $0.1232 -03.25% 23.3%

10/31 $0.1222 -00.84% 21.2%

11/01 $0.1249 +02.20% 19.9%

11/04 $0.1289 +03.25% 33.5%

11/05 $0.1340 +03.94% 33.2%

11/06 $0.1272 -05.07% 24.3%

11/07 $0.1251 -01.68% 55.2%

11/08 $0.1229 -01.74% 38.9%

11/11 $0.1237 +00.62% 35.7%

11/12 $0.1201 -02.91% 28.3%

11/13 $0.1214 +01.07% 35.0%

11/14 $0.1139 -06.19% 31.7%

11/15 $0.1203 +05.69% 38.5%

11/18 $0.1206 +00.27% 43.5% MAN. ADJ'D. DATASET

11/19 $0.1155 -03.73% 23.6%

11/20 $0.1125 -02.57% 34.4%

This week's daily estimated values (older dailys in prior EOD posts in prior instablog) for next share issue:

11/18: 20 lowest intra-day VWAPs in 40 days avg, $0.1182, x 85%: $0.1004

11/19: 20 lowest intra-day VWAPs in 40 days avg, $0.1179, x 85%: $0.1002

11/20: 20 lowest intra-day VWAPs in 40 days avg, $0.1175, x 85%: $0.0999

Vol, in K, for above days: 1373.74, 1332.68 and 582.92.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

11/19/2013: EOD stuff partially copied to the concentrator.

# Trds: 125, MinTrSz: 500, MaxTrSz: 95332, Vol: 1332681, AvTrSz: 10661

Min. Pr: 0.1111, Max Pr: 0.1239, VW Avg. Tr. Pr: 0.1155

# Buys, Shares: 35 314432, VW Avg Buy Pr: 0.1158

# Sells, Shares: 89 1007249, VW Avg Sell Pr: 0.1154

# Unkn, Shares: 1 11000, VW Avg Unk. Pr: 0.1160

Buy:Sell 1:3.20 (23.6% buys"), DlyShts 72610 (5.45%), Dly Sht % of 'sells' 7.21%

VWAP, trade volume and daily short sales volumes were down -3.73%, -2.99% and -75.32% respectively. The daily short sales percentage says no upside here. Likely down on the VWAP for at least several more days. Some support may exist at $0.11 if CANT maintains their 421K bid and others join in, but the "sells" percentage, which has averaged ~67.3% since 10/30, suggests that this potential support volume will be easily overwhelmed.

The maximum cumulative buy percentage seen today, 29.69%, occurred at 12:10. It was generally "flat" throughout the day as price drifted lower (see the trading breakdowns below).

The usual: started strong on price and buy percentage with reasonable volume. ARCA made an early brief appearance on the bid again. They didn't have to hang around though as the bids were supported, early on, by NITE, ATDF and BNCH. Didn't do much good as bid was down from $0.12 at 9:45 (ATDF, BNCH) to $0.115 at 10:46 (ATDF, CDEL). Bids stayed in the $0.115-$0.116 range through 15:38. At 15:44 bid was $0.1111.

On the ask side, we started at $0.124 at 09:33 and dropped continuously through 11:24 when we hit $0.1155. Offers stayed in the $0.115x-$0.116x area through 15:38. At 15:44 it was $0.1115. Although ATDF participated in the usual fashion, they were outclassed by ARCA and NITE, which provided most of the downward pressure. However, ATDF did provided some large-volume offers at various times.

Larger bid sizes were also seen from ATDF and NITE. This gave the sellers a nice sink-hole in which to dump and we ended with the average trade size on the high side again.