As 2013 winds to a close, investors should ponder whether their investments are proper for the start of 2014. The market has had a terrific run this year, which I expect to continue in the short-term, with no negative catalysts on the imminent horizon.

One of the paramount pieces of information in making investment decisions are to look at the catalysts of change. There is much overlap between asset prices, such as stocks, and physics (hence, the proliferation of physics based models for pricing options, application of statistical models for trading strategies, and the overrun of quants in the markets). As such, I will refer to Newton's laws that an object at rest remains at rest until another force acts upon it…and an object in motion remains in motion until another force acts upon it. Such is the world of asset prices - momentum strategies have proven to produce statistically significant alpha over time. To change the course of an asset price significantly requires some sort of catalyst, i.e. a piece of information that brings participants to the market to either buy or sell. When looking at broad views of the market instead of subcomponents, the catalyst must be systemic driving forces. This is beneficial for investors since systemic forces are largely visible, highly researched and reported on, generally transparent, and slow to change.

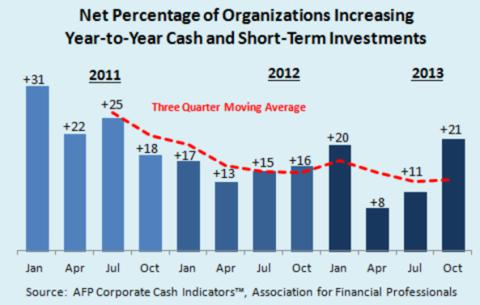

From my perspective, there are several tailwind forces pushing markets higher in the near-term and limited headwinds. Pushing markets higher you have continued heavy stimulus monetary policy, generally stimulus financial policy (restricted somewhat by sequestration), improving economic fundamentals domestically across nearly all economic indicators, strong economic performance from very large global partners far outweighing the slowdowns from smaller economics (China v. Brazil & Mexico), ample corporate cash, low asset price volatility, moderating unemployment, and the U.S. energy boom. Tailwinds consist of worldwide conflicts (always present, but no active and costly broad scale wars for the U.S.), political issues within the U.S., European austerity, and increasing regulatory oversight. While I am certain to be missing both significant positives and negatives, the fact is the global economy is chugging along with cheaper costs of funding due to government stimulus, but earning nice real returns through judicious capital investment expenditures financed by cushy corporate cash balances. Furthermore, technology has increased productivity output per unit of labor globally; therefore, businesses are able to spend less to produce more, which generates better profitability margins. With realization of improving margins, executives will be encouraged to invest greater amounts of cash for investment, pushing the book values of companies higher.

Country | GDP (trillions) | GDP Growth (2012) |

|---|---|---|

China | 8.227T | 7.80% |

Mexico | 1.177T | 3.90% |

Brazil | 2.253T | 0.90% |

In researching this topic, my initial belief was that stock prices had risen too much, too quickly. After analyzing returns of the S&P 500 over 5, 10, 20, 50, 100, and 200 day periods it became more and more obvious the market is not "on fire". Merely the market is going up more days than it is going down, but with moderated moves in both directions.

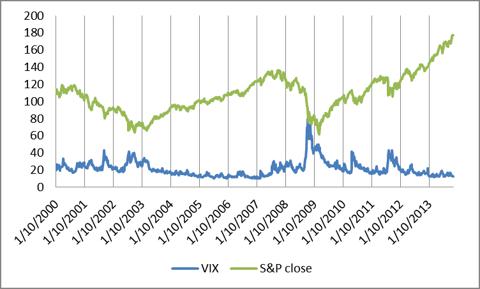

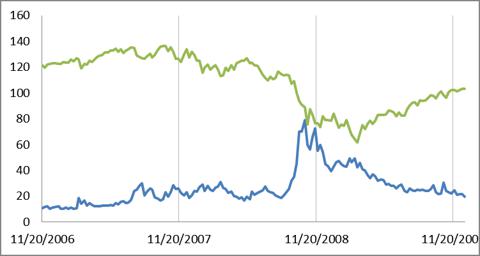

Statistically speaking, market returns are exhibiting low volatility on an ex-ante and ex-post basis. That is, current volatility calculated form recent price movements is low, and forecasted volatility is also low as presented by the VIX index. The VIX index is composite of implied volatilities for options. Implied volatility (implied vols) are backed out mathematically from market option prices. These volatilities represent how much compensation a seller is requiring for insurance on price movements in either direction. Said another way, implied vols, taken overall, are the markets expectation of future price movements. If you believe in some form of efficient markets, then it should be acceptable that the market believes forthcoming volatility is going to be subdued, given a snapshot of the VIX, which bodes well for a rising market environment.

Charts showing VIX spikes precede S&P collapses :

Is the market due for a correction? Yes. Markets will always go up and down, and something will come up in the near future that will lead to a 2% down day, the equivalent of a 300 point move in the DOW. We may even see a 4% or 5% weekly loss. However, do I think there are more catalysts propping this market higher that outweigh such risks? Yes. Barring a black swan event, which do occur in markets more often than they are discounted for, you should be invested now. Black swans on a systemic scale are easy to protect yourself from by purchasing deep OTM puts, which at today's implied levels are relatively cheap. Therefore, on a risk-adjusted basis, you are much better positioned to be long equities in this environment than short or in cash.

Macro-trade ideas: Long diversified indexes using ETFs. Attractive sectors are durables, industrials materials, technology, and maritime trade. Slightly overweight growth and small cap. Real estate is attractive at these funding levels. Overweight Asia, primarily China and Japan, underweight Europe and South America. Avoid most commodities, particularly gold!

William Sharpe (http://www.stanford.edu/~wfsharpe/art/active/active.htm) and Warren Buffet argue a diversified portfolio of passive investments will outperform active management for the majority of investors - if this is true, I believe it holds strongest under a strong bull market, such as the one we are in, and therefore the majority of your assets should be in assets such as ETF and broad index or sector funds. Also, further research shows 95%+ of returns are attributable to asset selection...food for thought for the average investor trying to pick winners and losers v. letting the markets lead the way.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.