Highlights of the Prior Week

Macro

The January jobs report came in at a strong 257,000 with the headline unemployment rate ticking up to 5.7%. The unemployment rate went up because of the slight increase in the labor force participation rate to 62.9%. The broader U6 measure of unemployment printed at 11.3% which was a slight uptick from last month's 11.2%. There was also underlying strength in the report from average hourly earnings which increased 0.5% although this may be attributable to an increased minimum wages is nine states. The November jobs report was revised up to a gain of 423,000 jobs and December was revised up to 329,000.

As wild as the ride was for West Texas Intermediate Crude in the last week of January, it went on an even wilder ride this past week rallying more than 11% on the week despite an approximate 8% decline on Wednesday. Bearish arguments seem to focus on supply while bullish arguments center on lack of viability if prices go too low (companies would go out of business and the price would rocket higher). While we will leave the predictions to other people we do believe the increased volatility is important to follow closely.

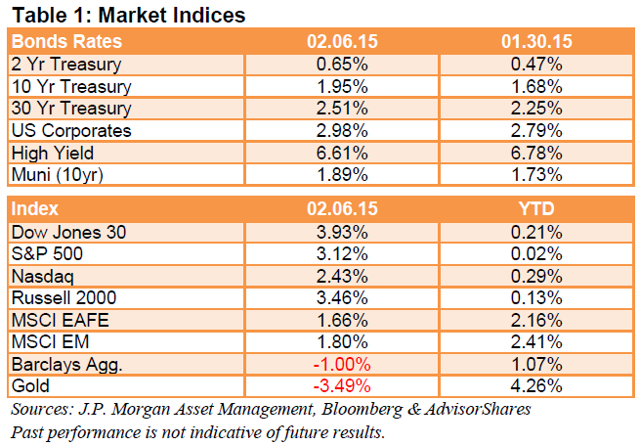

Domestic equities had a strong week, despite Friday's broad selloff, which mostly reversed January's decline. The Dow Jones Industrial Average was up 3.83%, the S&P 500 gained 3.04%, the NASDAQ was the weak sister with a 2.29% gain followed by the Russell 2000 which was better by 3.37%.

Foreign equities were mixed with generally smaller moves than the US. The Nikkei 225 was down 0.19%, the Hang Seng added 67 basis points, the Shanghai Composite fell 4.17% and Australia gained an impressive 4.15% on news of a rate cut by the Reserve Bank of Australia. Europe fared a little better with the FTSE 100 up 1.55%, the CAC 40 gained 1.87%, the DAX added 1.42% while the Swiss Market Index put in the strongest showing with a 2.53% lift. The Swiss market may have been helped by a slightly weaker franc against the euro.

In currency majors, the euro and British pound rallied against the US dollar while the dollar gained against the yen. Gold traded up by almost 9% in January but last week gave back more than 3.5% with most of the decline coming in the face of Friday's strong jobs report.

The yield on the Ten Year US Treasury Note popped higher on the jobs report, closing at 1.93% after closing at 1.67% last week. Where last week's conversation about the ten year centered around global macro events causing the Fed to delay its rate hikes, the jobs report seems to put the Fed back on schedule. No one should be surprised if this sentiment volleys back forth a few more times.

Global yields mostly went up as well but the moves were less dramatic than in the US. German bunds yield 0.37% but the German five year still has a negative yield, the French OAT ticked up to 0.61%, Spain comes in at 1.49%, Italy at 1.58% and the Swiss ten year is still negative; -0.06%.

ETF News & Data

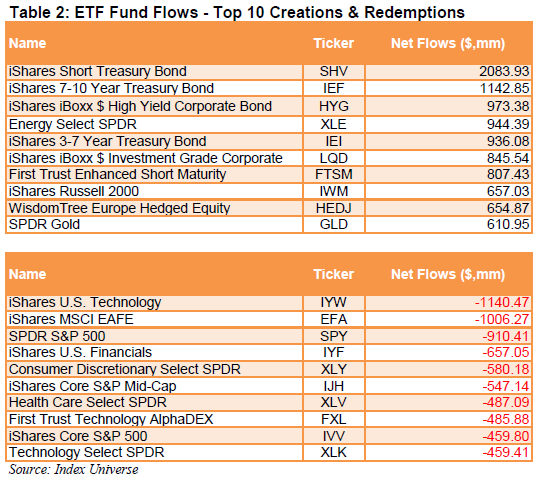

Last week was the first time this year that the SPDR S&P 500 did not show up in the top spot for outflows but it did see $900 million head for the exit. There were large outflows from the tech sector exceeding $2 billion as well as the EAFE Index.

There were large inflows into shorter dated and intermediate treasuries. Interestingly there was also $1 billion of flows into energy stocks as volatility in the price of crude increased last week.

Five new funds hit the market last week including two dividend oriented equity funds, a REIT focused funds and two factor (aka smart beta) funds.

Interesting Reads

Do you live in a big city but have thought about living in a small town? Bestchoicereviews.org looks at the 50 Best Small Town Downtowns In America and perhaps will inspire you to seek out small town life.

Small town Americana is alive and well across the entire United States. With thousands of sleep towns and beautiful villages, a new idea of an American downtown has emerged. Gone are the days of a downtown area with a post office, market and police department. What has taken the place of this outdated notion are unique and eclectic downtown areas full of energy, entertainment and accessibility for Americans of all ages.

Sports

We were saddened to hear of the passing of former University of North Carolina mens basketball coach Dean Smith at the age of 83. Smith coached the Tar Heels from 1961 until 1997 making it to 11 final fours and winning two championships, the first in 1982 with Michael Jordan, Sam Perkins and James Worthy and the second in 1993 when they beat the Fab Five with Eric Montross and George Lynch.

Smith was initially famous, beyond being a good coach, for the four corners offense which was a way to preserve a lead by passing the ball around without shooting, letting the clock wind down. He then was able to adapt to the shot clock, which effectively ended the four corners strategy, and have continued success.

Roger Nusbaum

AdvisorShares ETF Strategist

Source: Google Finance, Yahoo Finance, Wall Street Journal, Bloomberg, Barrons, ETF.com, XTF.com, Convergex, ESPN.com, Bestchoicereview.org

For February 2, 2014 to February 6, 2015

S&P Sector Analysis

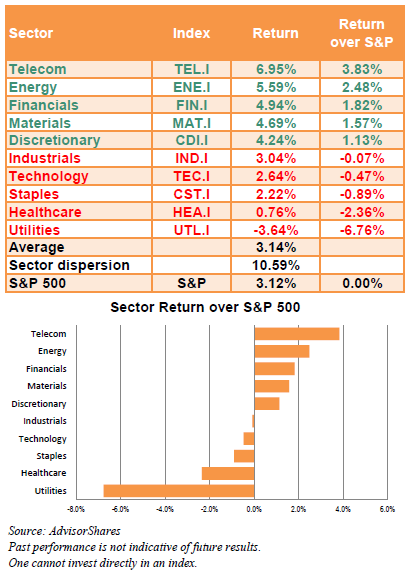

As for the sectors of the S&P 500, five outperformed the broad benchmark - Telecom, Energy, Financials, Materials and Discretionary. The remaining five - Industrials, Technology, Staples, Healthcare and Utilities - each underperformed. The dispersion between the top-performing and bottom-performing sectors was roughly 10.59% this week, with Telecom outperforming all, and Utilities coming in last.

For February 2, 2014 to February 6, 2015

As measured by the S&P 500 sector indices, respective performances were: