Highlights of the Prior Week

NASDAQ 5000! Will It Stick This Time?

Macro

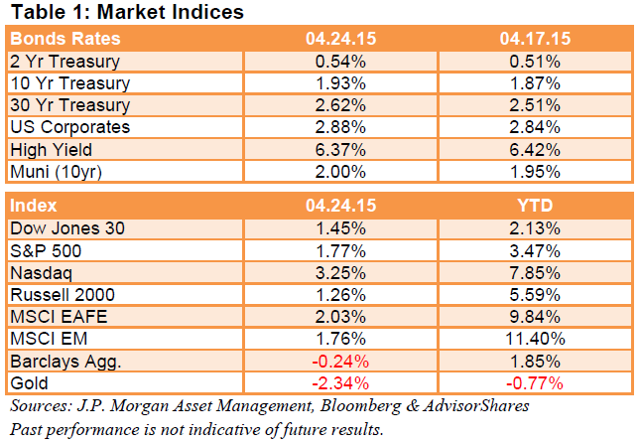

US equity markets were stronger across the board with little volatility except for the NASDAQ's upside volatility as it added 3.24% for the week and finished Friday at an all-time closing high of 5092. The Dow Jones Industrial Average gained 1.42% last week while the S&P 500 moved ahead 1.76% and the Russell 2000 was the laggard with a 1.25% lift.

Through Friday, Bespoke Investment Group noted that approximately 400 companies have reported earnings with 66.5% beating estimates for earnings compared to 52.3% beating revenue estimates. Last week we noted a similar number beating on earnings but revenue beats were only 42%.

Economic data was, what else, mixed most notably the durable goods report. The headline number was a positive 4.0% which would appear to be a good number but that may not have been the case. Excluding transportation the report was down 0.2%. The gain in the headline number was mostly from aircraft spending (defense and nondefense).New orders were down 1.91% compared to last year.

In other economic news, the Commerce Department reported a decline in business investment spending for the seventh month in a row. Reuters' coverage attributed this in part to a strong dollar and weak energy prices.

The seven major foreign markets we follow regularly in this report were all higher last week. The FTSE 100 gained 1.08%, France added 1.13% and the German DAX went up by 1.05%. Over in Asia the Shanghai gained 2.48%, the Hang Seng had a 1.52% lift while Nikkei was better by 1.88% and the ASX 200 tacked on 79 basis points.

Bond yields backed up last week including the US Ten Year Treasury Note which closed the week up six basis points to 1.91%. The German bund now yields 15 basis points, the French OAT moved up to 0.42%, Spain yields 1.39% and Italy pays 1.44%. Switzerland's ten year is still well into negative territory at -0.10%.

Speaking of commodities, West Texas Intermediate Crude traded lower by 1.46% to $57.24. Gold also traded lower last week giving up 2.0%. The dollar was weaker as well giving up a couple of basis points to the yen while the euro gained 0.53% against the dollar and the British pound added 1.47% against the greenback.

ETF News & Data

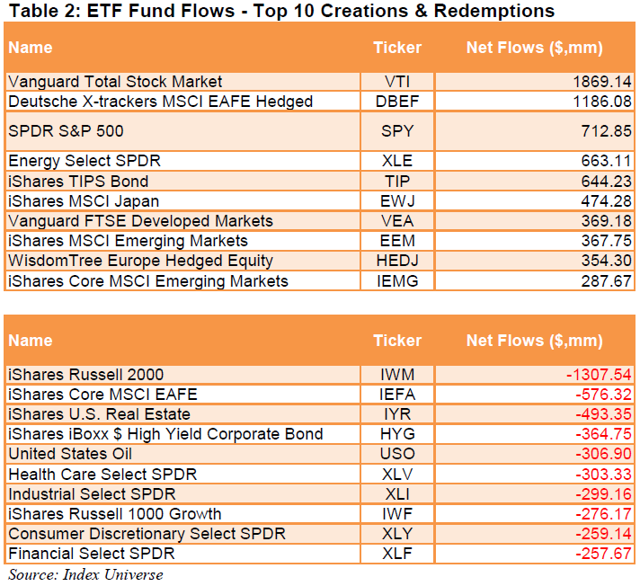

The fund flows data was again heavy in creations for currency hedged equity funds as well as TIPS funds and even energy. Outflow leaders included one biotech fund which is interesting in that for as well as the group has performed, their flows have rarely shown up on the leaderboard.

There were two new funds launched last week including a fund from Global X that tracks Pakistan. Like many frontier and smaller emerging market country funds, this new fund is heavy in financials, energy and materials stocks.

Interesting Reads

Jurassic Park was one of the highest grossing films of all time with over $1billion. IFLScience,com is reporting scientists may be on the verge of bringing back the wooly mammoth in what seems to be taken straight from the movie's script.

"This discovery means that recreating extinct species is a much more real possibility, one we could in theory realize within decades," says study author Hendrik Poinar. Alongside bringing scientists tantalizingly close to this goal, the research is also offering scientists an insight into the evolutionary history of this iconic species and the factors that contributed to its extinction."

We are unsure what to be hoping for on this one.

Sports

A few months ago we looked at the decision by the University of Alabama-Birmingham to shutter its FBS football program because of claims it was a money loser. It turns out it may not have lost money as ESPN reports that Study Concludes That Shuttered Football Program At UAB Made Money.

"We conclude that going forward, anticipated improvement in ticket sales from 2013-14 levels and new College Football Playoff revenues will outpace new expenses from Cost of Attendance stipends and unlimited food allowances."

Like the economics of other industries, the economics of college football are complicated.

Source: Google Finance, Yahoo Finance, Wall Street Journal, Bloomberg, Barrons, ETF.com, XTF.com, Bespoke Investment Group, Reuters, SISR Research, Reuters, IFLScience

Weekly ETF Flows

For April 20, 2015 to April 24, 2015

S&P Sector Analysis

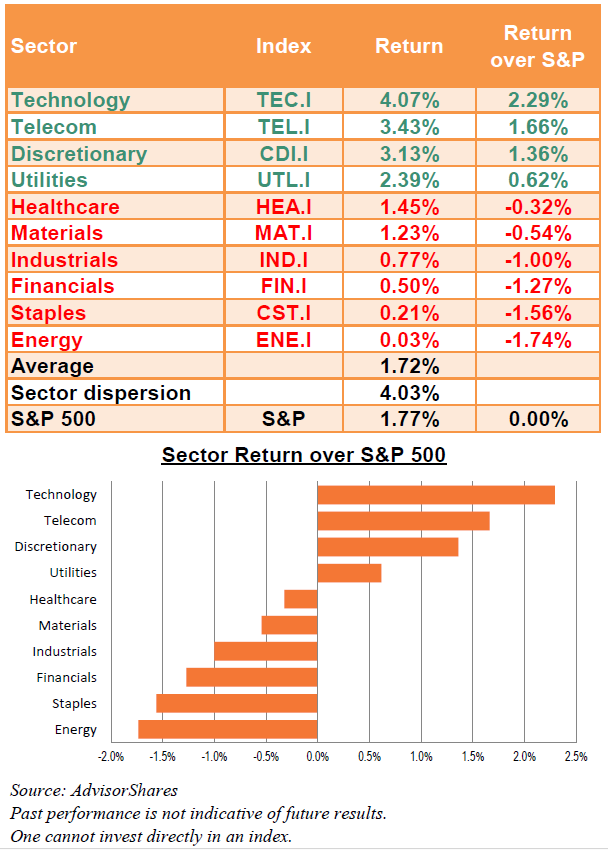

As for the sectors of the S&P 500, four outperformed the broad benchmark Technology, Telecom, Discretionary, and Utilities. The remaining six - Healthcare, Materials, Industrials, Financials, Staples, and Energy - each underperformed. The dispersion between the top-performing and bottom-performing sectors was roughly 4.03% this week, with Industrials outperforming all, and Technology coming in last.

For April 20, 2015 to April 24, 2015

As measured by the S&P 500 sector indices, respective performances were: