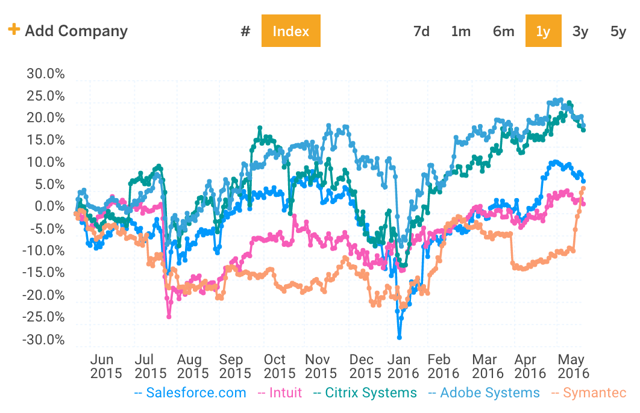

ADBE's stock price has outperformed comparable companies

salesforce.com (CRM), Intuit (INTU),Citrix (CTXS) and Symantec (SYMC) increasing almost 20% year-over-year.

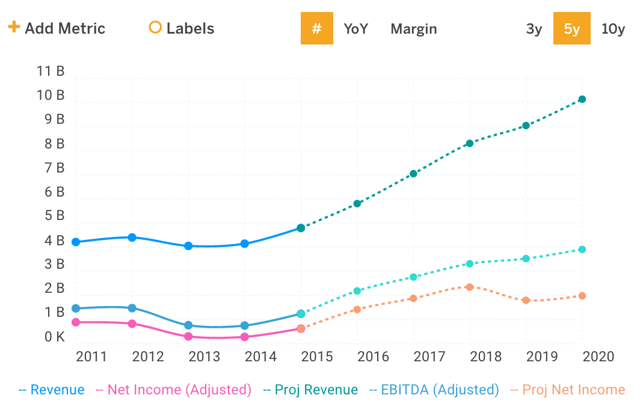

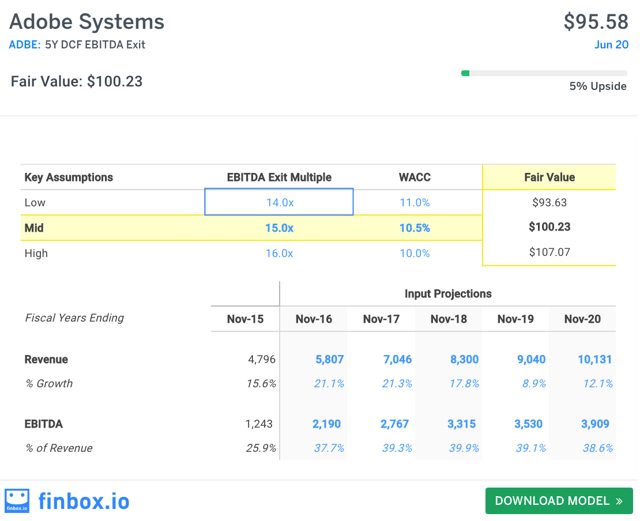

After last quarter's earnings beat, ADBE management raised FY'16 guidance and Wall Street quickly followed suit. Consensus estimates have ADBE's revenues reaching over $10.1 billion by 2020 representing a 16% compounded annual growth rate (OTC:CAGR).

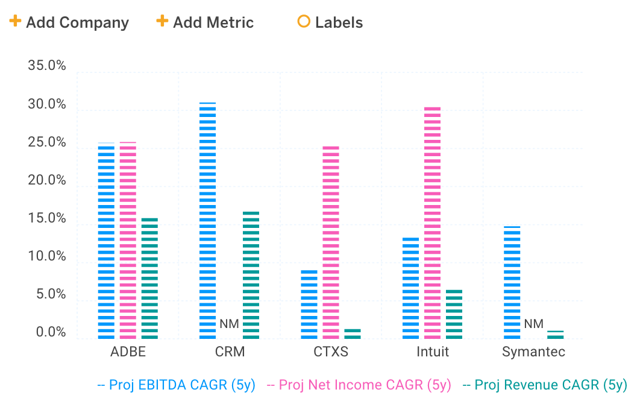

CRM is the only comparable company projected to enjoy a higher 5-year revenue CAGR.

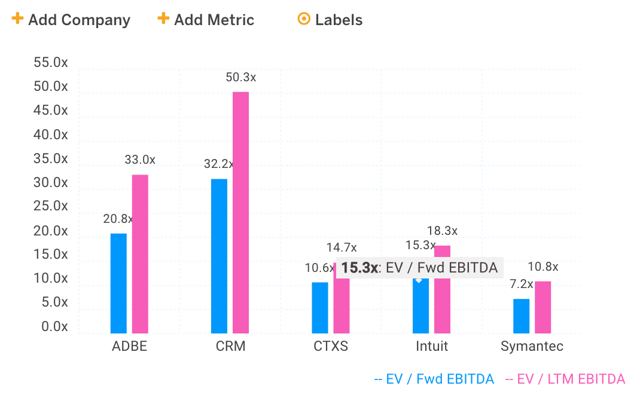

CRM is also the only comparable company trading at higher EBITDA multiples.

A fair value of ~$100 per share is calculated by applying a 15x EBITDA exit multiple along with Wall Street consensus projections in the DCF analysis below. This represents a 5% margin of safety compared to current prices. Let's see whether ADBE beats or misses on tomorrow's announcement and the resulting price movement.