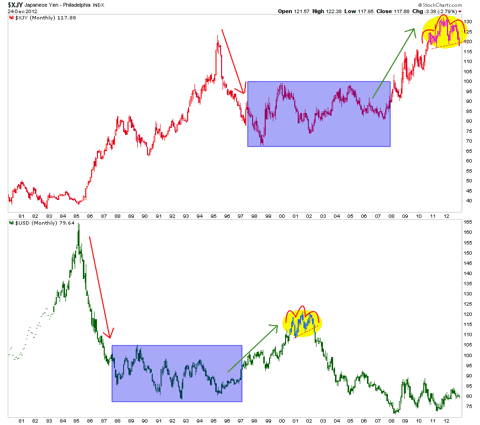

Japan is following in the footsteps of the man who laid the groundwork for the greatest global inflationary operation of the modern era. We see the Yen in the top panel of the chart below forming a similar pattern to that which USD made from 2000 to 2002 as an epic bubble in credit expansion was being fomented in the US.

The similarity in the charts (with a decade stagger) is striking and it is probably no coincidence that Japan has chosen to leverage its currency - which had been chronically strong since the 2007 beginnings of the US-triggered global financial meltdown - just as the US did with the once strong 'King' dollar in and around 2001.

According to now widely known macro fundamentals Japan is indicated to be following in the US' footsteps' as well. Mr. Shinzo Abe has taken power with a vow to pull Japan out of deflation through "bold economic measures", which is another way of saying "I have got a similar currency setup to that of Mr. Greenspan a decade ago and I am going to use it."

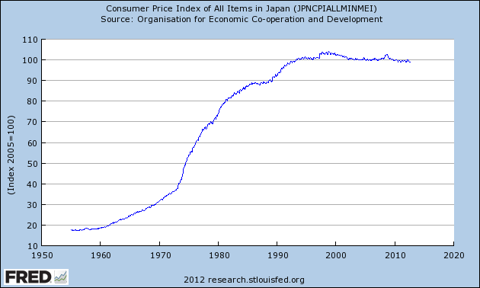

Of course pulling Japan out of deflation is likely to mean that this graph will break to the upside out of a 20+ year consolidation as Japan has apparently voted for higher prices of goods and services.

Ten years ago the Greenspan inflation was still fairly new and the US stock markets were mired in a cyclical bear. Greenspan and his scheming successor pulled and have kept the US out of what would have likely been a fierce and secular deflationary bear market by employing ever more stimulative money tricks to give us what we have now; diminishing returns and soaring debt loads. A massive bailout of the financially powerful at the expense of the nation's seed corn and its very future.

Now we have Japan, finally deciding the time is right to join the global party and devour some of its seed corn. But it can be argued that Japan, a country that has routinely been the top global net creditor year after year after year, has enough seed corn to do as it pleases. US citizens should cringe at the thought of what Japan might want to do with some of its massive hoard of Treasury bonds. But that is a story for another day.

The point here is that global policy makers are inflating against a deflationary force that seeks to unwind decades of excess in an over extended and global paper money system. While we wait for the shenanigans in the gold market to play out (as the prime inflationary barometer is put upon by natural and unnatural forces alike), it is worth looking out into the world for more conventional opportunities.

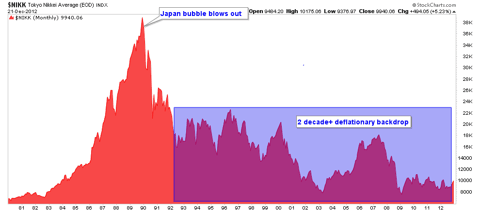

Japan has qualified for a termination to its secular bear market. It may also qualify for an inflationary growth cycle and attendant rising asset markets. The key to remember is the 'inflationary' part, because that is what this would be. Just like the thing Greenspan created over a decade ago.

A big difference between the two is that Japan would be initiating its major inflationary operations after a secular and deflationary bear market. In the US, we could not even endure a cyclical bear that followed a massive secular bull without panicking into full on inflation. A future article or NFTRH edition will seek to flesh out the meanings of any differences this could signal, but my gut tells me that Japan's two decades in the desert will bode well for it on a relative basis to the US.

NFTRH uses a model portfolio to try to illustrate and take advantage of some of these global themes, and the Japanese stock market may be part of a balanced plan. The currency swings in the Euro/USD battle and the potentially major turning point in the Yen are likely to provide short and longer term opportunities in 2013. Be ready for change.

http://www.biiwii.com, Twitter, Free eLetter

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: No stocks mentioned, but long EWJ.