From an earlier post by Biiwii.com guest Doug Noland:

Senator Dean Heller: "A quick question about quantitative easing: Do you see it causing an equity bubble in today's stock market?"

Yellen: "I mean, stock prices have risen pretty robustly. But I think that if you look at traditional valuation measures, the kind of things that we monitor, akin to price-equity ratios, you would not see stock prices in territory that suggests bubble-like conditions. When we look at a measure of what's called the equity risk premium, which is the differential between the expected return on stocks and safe assets like bonds, that premium is not - is somewhat elevated historically, which again suggests valuations that are not in bubble territory."

Thank you Ms. Yellen for testifying to my point. Equities are not in a bubble by "traditional valuation measures", just as I have been saying. If you are sincerely and actively bearish the market you had better be bearish because you either think monetary policy is about to fail (i.e. its efficacy is going to wane) or that policy makers are going to be forced to cease and desist, most likely by the Treasury bond market.

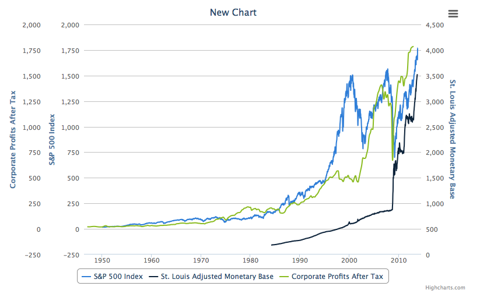

Yes folks, here is that chart once again (courtesy of SlopeCharts) telling its story of a broad US stock market rising in line with one of its "traditional valuation measures", general corporate profits (green line). Right there in parabolic accompaniment of stock prices and corporate profits is Janet Yellen herself, as represented by the black line, which is money supply growth courtesy of the Fed's ongoing ZIRP and QE operations.

She tells the truth. Stocks are in line with traditional valuation measures; and also with non-traditional policy measures. This week in NFTRH 265 we introduced another view into this dynamic…

Excerpted from NFTRH 265′s closing (Wrap Up) segment:

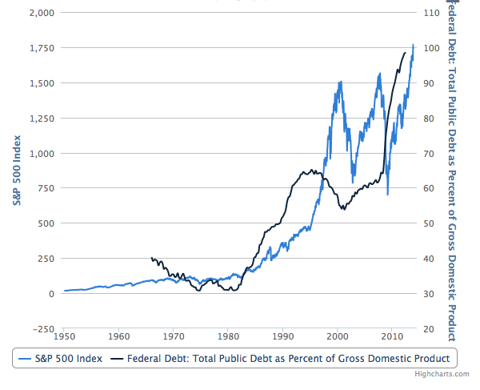

"Federal debt was used throughout the meat of the 20-year secular bull market as Alan Greenspan feasted upon the wellspring of monetary goodwill that was left by his predecessor Paul Volcker's inflation fighting policy (as interest rates approached the high teens).

Federal debt was then ramped down after it had done its job in instigating a bubble in stocks (S&P 500's Hump #1). As we have documented in other graphs, Hump #2 was instigated by the bubble in commercial credit that was promoted by official policy on the Fed Funds rate.

Now we have Hump #3. This one is rising in real time with a 'hockey stick' of debt accumulation by the Federal Government as well as the Federal Reserve. The racket will end. So if people want to view NFTRH as a fundamentally bearish newsletter, so be it. NFTRH is bullish on honesty and bearish on dishonesty on the biggest picture.

The stock market is honestly rising as far as credit accumulation, money printing and willful policy will take it. Right now, that appears to be pretty far. But I simply ask that people remain aware of the mechanics beneath the surface of the mania."

Biiwii.com | Notes From the Rabbit Hole | Free eLetter | Twitter