by Angel Clark, VectorVest, Inc.

Passive income. Sounds nice, doesn't it? Like you can just sit back in a sunny lounge chair while the money rolls in… That's essentially what it is - an income stream that doesn't require work. You may have even heard dividend income referred to as passive income.

I suppose it is, if you have someone managing your portfolio for you. But for those of us outside the billionaire club that may not be able to afford the best (money managers that is) and don't trust the rest, generating portfolio income-especially enough to live on-can sometimes be a mental and emotional feat worthy of an Olympic gold medal (or at least the bronze). It only makes sense that the resulting, sometimes-not-so-passive income you generate should be as profitable as possible. Here's a simple, but effective strategy you can use to get more bang for your buck, VectorVest calls it the Double Juicy strategy.

In a nutshell, it's a triple whammy - option premiums, dividends and a little capital appreciation. When aligned correctly, you'll keep the stock for long-term capital gains (more often than not), pocket the dividend check and collect nice, not-so-little bonus income from selling covered calls (often making you more money than the dividend. If you've never heard of covered calls or thought they weren't for you, go here for a quickie lesson, www.tradeking.com/education/options/5-ti...).

It's not just buying a stock that pays dividends and randomly selling calls though, this strategy is about the timing. When you do what you do. Two mistakes that beginners often make are; one, rely solely on dividends rather than incorporating option strategies and two, leaving the option open with little time value left until the ex-dividend date is declared. Either one of these mistakes can hit you right where it counts, your bottom line. Why?

If you are still short the call before the ex-dividend date, then it's often to the buyer's advantage to exercise the day before the ex-dividend date and be the owner on record to receive the dividend. (The exception would be when there's considerable time value left in the option. Time value is lost upon early exercise, so if the time value lost exceeds the dividend gained, the stock is much less likely to be called away.)

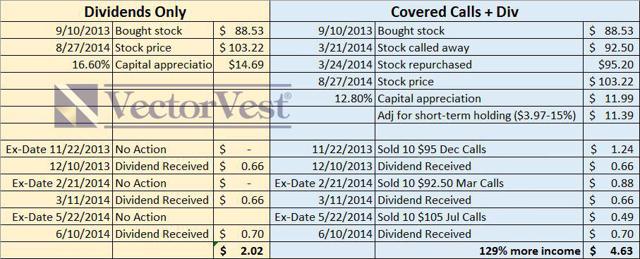

Let's take a one-year look at Johnson and Johnson ($JNJ), 8/27/13-8/27/14.

In order to collect the dividend, you must own the stock by the ex-dividend date. Within the one-year period listed, we would have missed the first ex-dividend date, but we could have picked up the stock anytime afterward. Let's say we picked it up after the payout that occurred on 9/10/13, the stock closed that day at $88.53. To keep the math simple, we'll say we bought 1,000 shares (allowing us to write 10 covered calls contracts).

The next ex-dividend date was 11/22/13, by which time the stock had risen to $95.25. On this same date, the $95 December call could have been sold for $1.24 per share. (Quick explanation if you are totally new, $95 is the strike price, $1.24 per share is the premium you would pay to buy or get paid to sell, this option would expire the third Friday in December. Options are traded in contracts that consist of 100 shares, so 10 contracts would control 1,000 shares of stock. $1.24*1,000=$1240.00 received.)

(Tip: Don't sell the calls at the open of the ex-dividend day. The price of the stock trades down at the open to compensate for the dividend being paid.)

The dividend of $0.66 per share was paid to you, the stock owner on record as of the ex-dividend date. This resulted in a dividend check for $660.00 issued 12/10/13. On this same date, the stock price had pulled back to $94.14 and the call premiums could have been purchased to close (if desired) for .41 per share, but the stock continued to pull back to $92.09 as of option expiration, allowing you to keep the full $1.24 per share premium, the stock and the dividend. By selling the covered call, you nearly tripled the cash that would have been generated by the dividends alone ($0.66 vs. $1.90 ($0.66+$1.24)).

Let's continue with our example.

JNJ's next ex-dividend date was 2/21/14, the stock was now at $91.52. The $92.50 calls, expiring in March, were .88 per share. The dividend payout was once again .66 and took place on 3/11/14, stock price $93.49. Since the calls continued to go up in value and were in-the-money (lower than the stock price), the buyer could exercise their right to buy and you could be assigned, which means your stock would be sold at the agreed upon strike price of $92.50 per share. Let's break that down.

That means that in the worst case scenario our stock was sold for a higher price than when we sold the calls, we still keep $880 (.88 per share) from the option premium and because we waited until the ex-dividend date to sell, we also collect $660 in dividends. We give up the capital appreciation beyond $92.50 and we are likely to buy back into the stock at a higher price (if we wish to continue with the same stock). Not really a big deal. What can be a big deal are taxes.

If you've owned the stock less than a year, you will pay a higher tax rate. More than a year qualifies for long-term capital gains rate of 15%, versus regular income tax if the stock is held less than a year. Providing this isn't a holding that you have enormous capital gains in, the increased cash flow should compensate for higher taxes that may be incurred. Let's continue, then we'll net everything together.

We get right back into JNJ after it's called away. Let's say it's on the Monday after our March calls expire, JNJ is $95.20 on 3/24/14. The next ex-dividend date is 5/22/14, the stock is now $100.96. I have a choice, I can sell the Jun 100 calls for $1.83 or the Jul $105 calls for $0.49. If I want to give myself some room to gain from a continued up move in the stock, as well as minimize the risk of the stock getting called away again, I'll take the July 105's ($0.49x1000=$490).

The dividend payout of $.70 per share occurs 6/10/14. As of option expiration, the stock is at $101.80 on 7/18/14. Since it is below the strike price sold, we keep the full option premium, the dividend and a negligible amount of appreciation.

Let's review and compare:

We incurred approximately a 15% higher tax rate (estimating 30% total) when we sold in March. We repurchased at a higher price. This resulted in 3.8% less capital appreciation, however, our income was increased by 129%. That's pretty significant.

By selling covered calls on the ex-dividend date, we had a high success of keeping the stock, keeping the dividend and of course, we keep the covered call premium whether the stock gets called or not. Had we ignored the timing of our calls though, we could have missed out on the dividends entirely.

At first try, this might seem complicated. It's a little like watching a kid try to step on the escalator for the first time - every time they go to take a step, they think they've missed their chance, but eventually they get the timing just right and enjoy the ride. You will too, and when you do, your passive income will be all the more worthwhile.

Note: JNJ was selected due to its high rating in the VectorVest System. If you'd like to know what your stock is worth, how safe it is and whether to buy, sell or hold, you can analyze any stock free at www.vectorvest.com/AnalyzeNow