Article Contents

- Overview of Noah (NOAH)

- Noah will benefit from market trends

- The Chinese private wealth management market is expanding

- Noah is targeting ultra high net worth individuals

- SHIBOR swap spread reveals need for shadow banking

- Noah has large real estate related lending rates exposure

- Chinese real estate fundamentals have upside

- Noah is expanding its asset management business

- Noah upside is driven by demand, supply, market and political factors

Overview of Noah

- Noah Holdings Limited provides private wealth management and insurance product marketing, brokerage and services in Mainland China and Hong Kong

- Non state-owned enterprise founded in 2003

- Market cap of USD 854 mm and price per share of USD 15.16 (as of Jan 13, 2014)

- Specializes in Chinese over-the-counter fixed income securities, private equity funds and insurance related funds for high net worth clients. The majority of capital from these asset classes make up the Chinese "shadow banking" market

- Main revenues generated by sales commissions and service fees from clients and securities providers (i.e. issuers and underwriters). Also has line of proprietary asset management funds in addition to third party offerings

- Includes over 40,000 clients and offices in 60 cities

- Ranked 16 on Forbes China's Top 100 Public Small Businesses for 2012

Noah will benefit from market trends

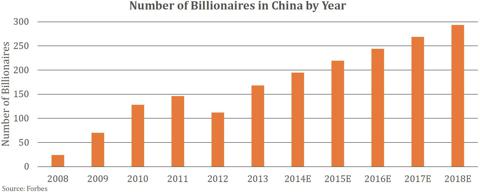

The Chinese private wealth management market is expanding

- The population of Chinese high net worth individuals is projected to be 2.7 million by the end of 2013

- The expanding private wealth management market is currently around USD 4 trillion

- USD 1.5 trillion of this sector represents ultra high net worth individuals. Specific wealth management expertise and services for this sector is still largely undeveloped

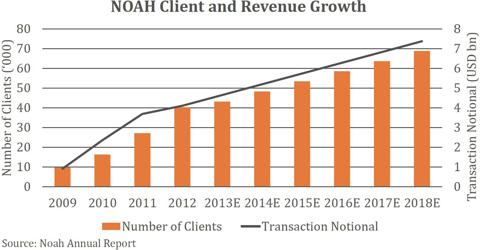

Noah is targeting ultra high net worth individuals

- Noah's new "family office" initiative has expanded the number of staff with specific knowledge of asset allocation, regulation and tax policy changes. Especially in areas such as estate and inheritance tax

- Noah has hundreds of local offices, a strong sales network and client base

- Noah is subject to less regulation than state-owned banks and "too big to fail" private conglomerates. Its three largest competitors (China Everbright Group, China Merchants Bank and China Minsheng Banking Co.) all fall into this category

- We expect assets under management to increase by USD 20 bn in the next 5 years, which translates to USD 200 mm in additional annual revenue

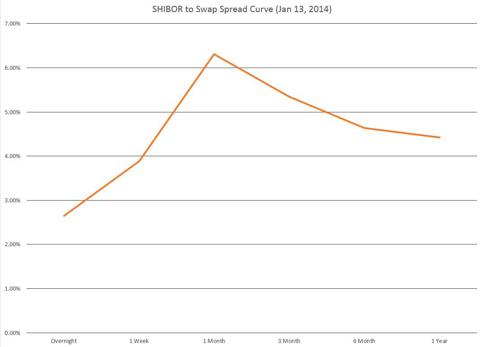

SHIBOR swap spread reveals need for shadow banking

- Shadow banking is driven by illiquid and overly-regulated fixed income markets

- The Chinese subprime credit market is not well developed and more illiquid than foreign equivalents

- The lack of a municipal and securitized credit market has pushed lenders to seek alternative access to capital

- The Chinese Academy of Social Sciences, a prominent government think tank, estimates the size of the shadow banking

- market at 40% of GDP (c. USD 3.3 trillion)

- There is a 400 - 500 bp "liquidity" spread between the Shanghai Interbank Offered Rate (SHIBOR) and LIBOR

- SHIBOR is a daily rate survey of 18 Chinese banks

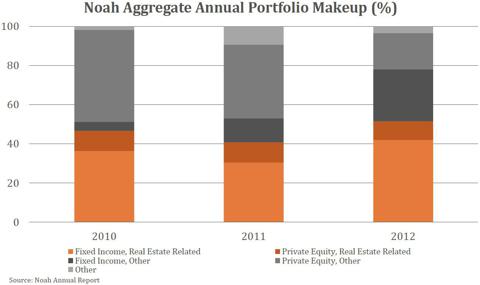

Noah has large real estate related lending rates exposure

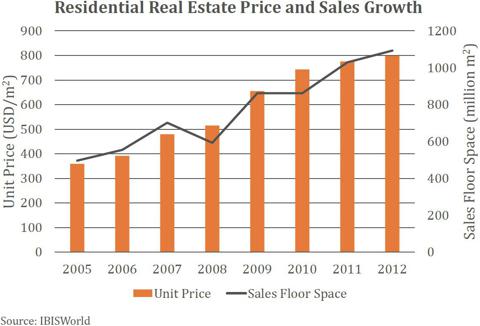

Chinese real estate fundamentals have upside

- An ongoing rise in residential real estate construction and mortgage loan demand is causing a rates and housing price short squeeze

- The Twelfth Five Year Plan (2011 - 2015) reveals central government plans to restrict loan rates and terms for low to medium income families

- An artificial cap on prices or rates will further drive the need for banks and lenders to allocate capital and offset risk

- Commercial and residential real estate are expected to expand, albeit at a slower pace

- Residential real estate had 16% CAGR from 2008 - 2013. We forecast a strong conservative 8.1% CAGR from 2013 - 2018

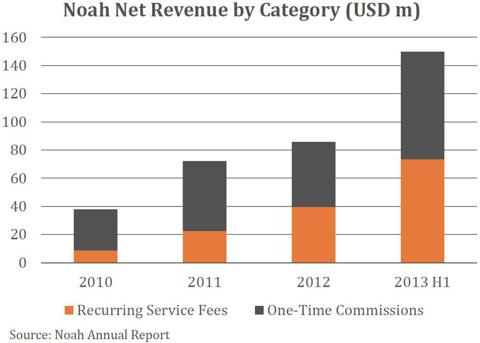

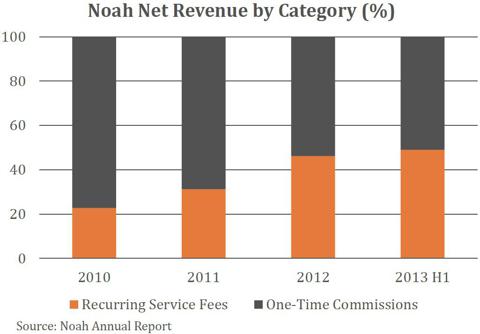

Noah is expanding its asset management business

- Over the past three years, NOAH has expanded its proprietary asset managing business. This vertical integration cuts out third party commissions and increases margins

Noah upside is driven by demand, supply, market and political factors

- The ongoing expansion of internal asset management will increase margins

- Underlying demand for high net worth private wealth management is increasing

- Noah's large unhedged real estate portfolio will benefit from the ongoing Chinese real estate market expansion and rates short squeeze

- A strengthening of regulations will exacerbate the rates short squeeze and increase demand for shadow banking

- Noah targets high net worth clients, while regulatory priority is to add more transparent disclosure requirements and protection for low to medium income citizens

- Noah is a private wealth management firm, while regulatory priority targets state owned and "too big to fail" banks

- Overly pessimistic views and misunderstandings of Chinese real estate fundamentals, lack of liquidity and allocation in fixed income markets, regulatory environment and the future of shadow banking has undervalued Noah

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.