Nobody loves miners any more - it could be the very good time to accumulate the best stories in the market place. And now it looks like that December was a really good time for it. Still under the radar screens of the mainstream investors best junior miners are turning around from historical oversold levels. Last week CITI went bullish on miners for the first time in three years, so the story will be getting out and new money will be coming into the sector now.

McEwen Mining has been breaking out with the very impressive run from retesting lows of 2013 at just above $1.65 level in mid December to this last Friday close of $2.49 on Volume of 5 million shares. TNR Gold is getting its bids as well now and closed at CAD0.055 last week. Los Azules copper is the key to valuation catalyst for both companies now. TNR Gold holds shares of McEwen Mining after the settlement on Los Azules. TNR Gold is selling its Back-In right with PI Financial engaged and Rob McEwen was relying on Los Azules sale to finance its ambitious expansion plans.

In the recent interview Rob has discussed Argentina situation, which is changing for the better now. Nothing is easy in these markets, but any developments with Los Azules will be the game changer for McEwen Mining and TNR Gold. Rob is talking about potential acquisitions for McEwen Mining, ongoing drilling in Nevada in Q1 and his conversation with "person from the ground in China." Not a lot of people are expecting it, but 5 dollar Copper could be in the cards, according to that source. Needless to say that it will make very happy shareholders of McEwen Mining and TNR Gold and Rob is still standing by his $5,000 price for Gold.

Recent impressive rally in McEwen Mining was fired by the huge short position of over 30 million shares as of December 2013 and should Gold continue its run to the upside shorts will be very nervous. The WSJ article is providing some confirmation of the potential change in the trend for Copper as well.

McEwen Mining And TNR Gold: Report - Argentina Is In The Mood For Change On Investment Policy TNR.v, MUX, LCC.v, SSRI, PAA

"Argentina mining landscape is changing for the better according to the report by BN Americas. Lumina Copper is trading above CAD 6.00, McEwen Mining is breaking out to the upside and TNR Gold has found some bids as well recently."

Los Azules Copper - McEwen Mining And TNR Gold: Yamana Gold to invest $450 million in Argentine mine MUX, TNR.v, LCC.v"It looks like the shift in Argentina for the better is happening for real this time. Rob McEwen has discussed it in his recent presentation and that in his opinion "we have seen the low in Argentina after a lot of disappointment". Shevron special Shale Oil deal, repayment to Repsol and now Yamana Gold investment are certainly the things we would like to see now after elections. Lumina copper is holding above CAD5.00 these days and McEwen Mining and TNR Gold should benefit from Los Azules copper revised valuation now."

The Wall Street Journal:

China Lights the Way for Copper COUNTRY'S APPETITE FOR THE METAL GROWS DESPITE SLOWING ECONOMY; HEDGE FUNDS HELP LIFT PRICESBy

MATT DAY and

TATYANA SHUMSKY

CONNECT

Updated Jan. 17, 2014 10:02 p.m. ET

Copper cathodes at a port near Shanghai. Reuters

Surprisingly strong Chinese copper demand is prompting investors to rethink their dour predictions for the metal.

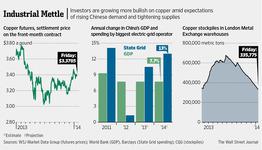

Copper consumption by the world's biggest user remains resilient even as China's economy cools and Beijing attempts to tighten access to credit, analysts say. Stockpiles of the metal in London Metal Exchange warehouses have fallen 50% since late June. Much of that copper has been moving to China, industry experts say.

Copper prices are up 7.1% from a three-month low reached in mid-November. On Friday, the most actively traded contract eked out a 0.1% gain to close at $3.3445 a pound on the Comex division of the New York Mercantile Exchange. The front-month contract fell 0.4% to $3.3785.

The increase has been partly driven by hedge funds and other money managers. Earlier this month, investors' bets on higher copper prices rose to their largest since mid-2011, according to the U.S. Commodity Futures Trading Commission, which regulates Nymex. Futures contracts outstanding on Nymex and LME are valued at $96.7 billion.

Jeremy Baker, portfolio manager at the $732 million Vontobel VONN.EB -0.95%Belvista Commodity Fund in Zurich, said he may buy copper futures in coming weeks. He believes Chinese manufacturers will keep expanding, buying up copper from warehouses and new mines opening this year.

"We're seeing a bit of a manufacturing revival" in China and elsewhere, Mr. Baker said. "The potential surplus in the [copper] market can easily be eradicated."

The gains come as many analysts and investors had expected prices to be falling. A year ago, there were widespread predictions that rising mine production and a slower-growing China would lead to a yawning surplus of metal in the global market. China, which accounts for more than 40% of global copper use, posted a 7.7% rise in gross domestic product last year, down from 9.3% in 2011, according to the World Bank.

But China's cooling economy hasn't sunk its demand for industrial metals. Deutsche BankDBK.XE -0.57% says China's copper appetite increased 11% last year as companies ranging from power-cable makers to home builders continued to use copper products at a brisk clip. These companies ramped up despite slower growth in the broader economy and the Chinese government's efforts to keep a lid on credit. Many of China's biggest copper users are state-controlled companies, which are less reliant on the loans types that are the focus of the government crackdown.

Vontobel's Mr. Baker said the outlook is bright for copper's most important sectors. He pointed to State Grid Corp. of China, which is responsible for the maintenance and expansion of high-voltage transmission lines across most of China. The company plans to increase spending by 13% this year.

State Grid of China plans to increase spending by 13% this year. One of its employees at work.Imaginechina/Associated Press

Most copper is used in electrical applications. Investors view changes in spending by State Grid as a proxy for how much wire the company will buy.

"The market has come to realize that physical demand is what matters," said Jean Marc Bonnefous, managing partner with London commodities hedge fund Tellurian Capital Management LLP. "The single-largest copper consumer in the world is the Chinese grid."

Analysts say copper's strength is further evidence that global manufacturing growth is on track despite investors' worries about the health of the global economy. Some economists see copper as a useful economic indicator because it is a component of many products essential to modern life, including plumbing and wiring in homes and appliances, automobiles and consumer electronics.

Deutsche Bank expects supply in the global copper market to exceed demand this year by 320,000 metric tons, less than half of the 750,000 ton surplus it expected at this time a year ago.

"The whole bearish story for copper last year was this wall of supply coming," said Mr. Bonnefous of Tellurian Capital. "That wall of supply has been met by higher demand from China." Tellurian began betting on higher copper prices in recent months.

Still, some aren't convinced copper demand is healthy enough to boost prices. Analysts say some of the metal making its way into China is bound for storage, not consumption, and mines starting production this year will send more of the metal into the market.

"There's still a lot of inventory out there," said John Pickart, chief investment officer at Pelagos Capital Management, which manages commodity-focused funds for investment manager Franklin Resources Inc. BEN +0.39% Mr. Pickart said his funds hold copper as part of a broad basket of commodities, but he isn't ready to add bets on higher prices until global metal stockpiles fall further and Chinese data confirm steady growth.

Write to Matt Day at matt.day@wsj.com and Tatyana Shumsky attatyana.shumsky@wsj.com"

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.